Question: please answer both 2 15 Question 31 (3.03 points) Freddie Smith does not believe that the international Fisher effect (IFE) holds. Current one-year interest rates

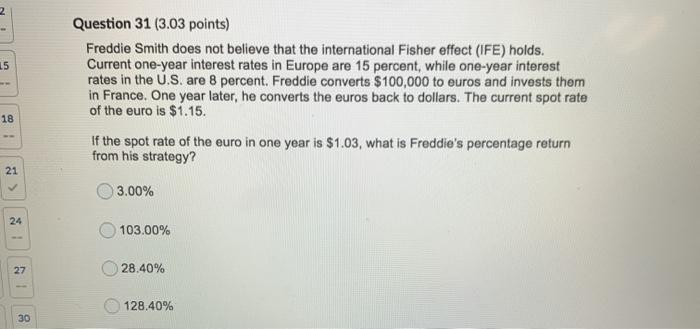

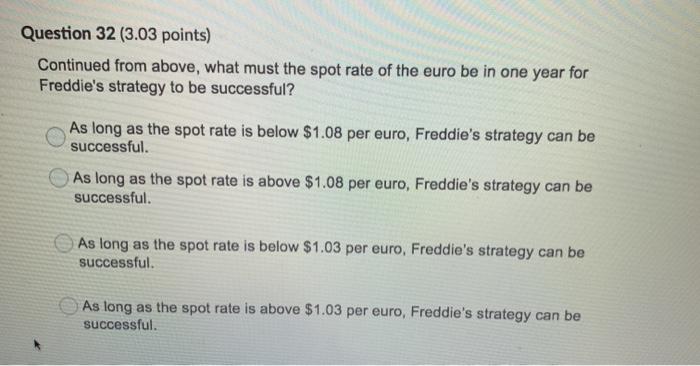

2 15 Question 31 (3.03 points) Freddie Smith does not believe that the international Fisher effect (IFE) holds. Current one-year interest rates in Europe are 15 percent, while one-year interest rates in the U.S. are 8 percent. Freddie converts $100,000 to euros and invests them in France. One year later, he converts the euros back to dollars. The current spot rate of the euro is $1.15. If the spot rate of the euro in one year is $1.03, what is Freddie's percentage return from his strategy? 18 21 3.00% 24 103.00% 27 28.40% 128,40% 30 Question 32 (3.03 points) Continued from above, what must the spot rate of the euro be in one year for Freddie's strategy to be successful? As long as the spot rate is below $1.08 per euro, Freddie's strategy can be successful. As long as the spot rate is above $1.08 per euro, Freddie's strategy can be successful. As long as the spot rate is below $1.03 per euro, Freddie's strategy can be successful. As long as the spot rate is above $1.03 per euro, Freddie's strategy can be successful

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts