Question: Please answer question 1; A,B, and C Question 1 (1 point) Investors should be compensated (in the form of return) for the risk that a

Please answer question 1; A,B, and C

Please answer question 1; A,B, and C

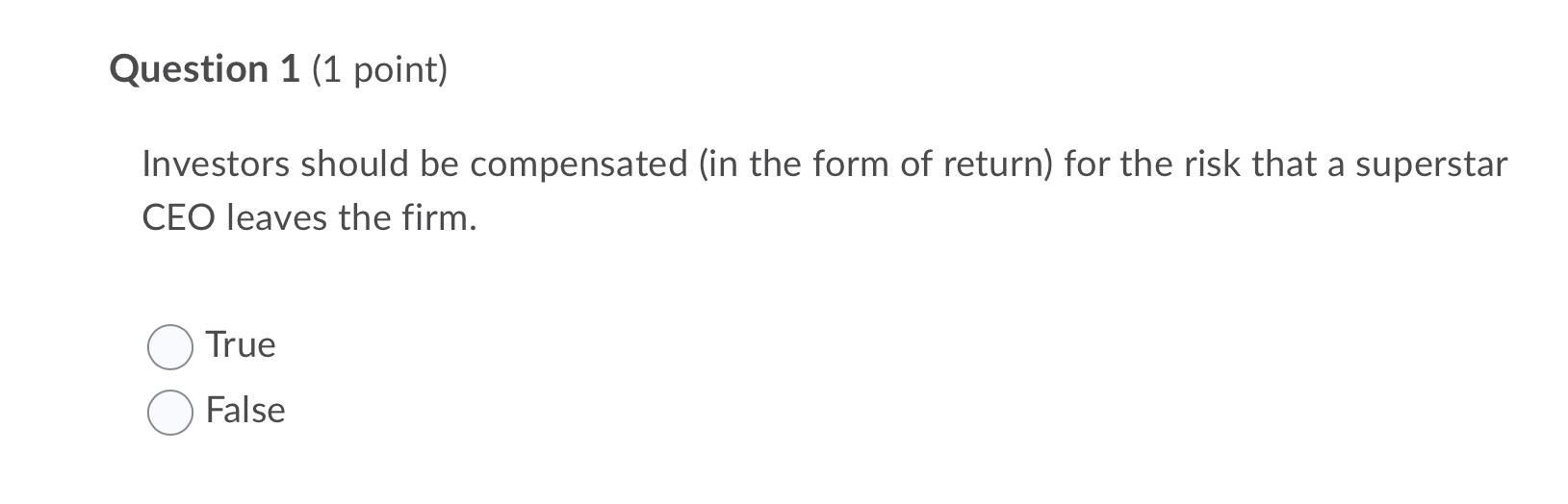

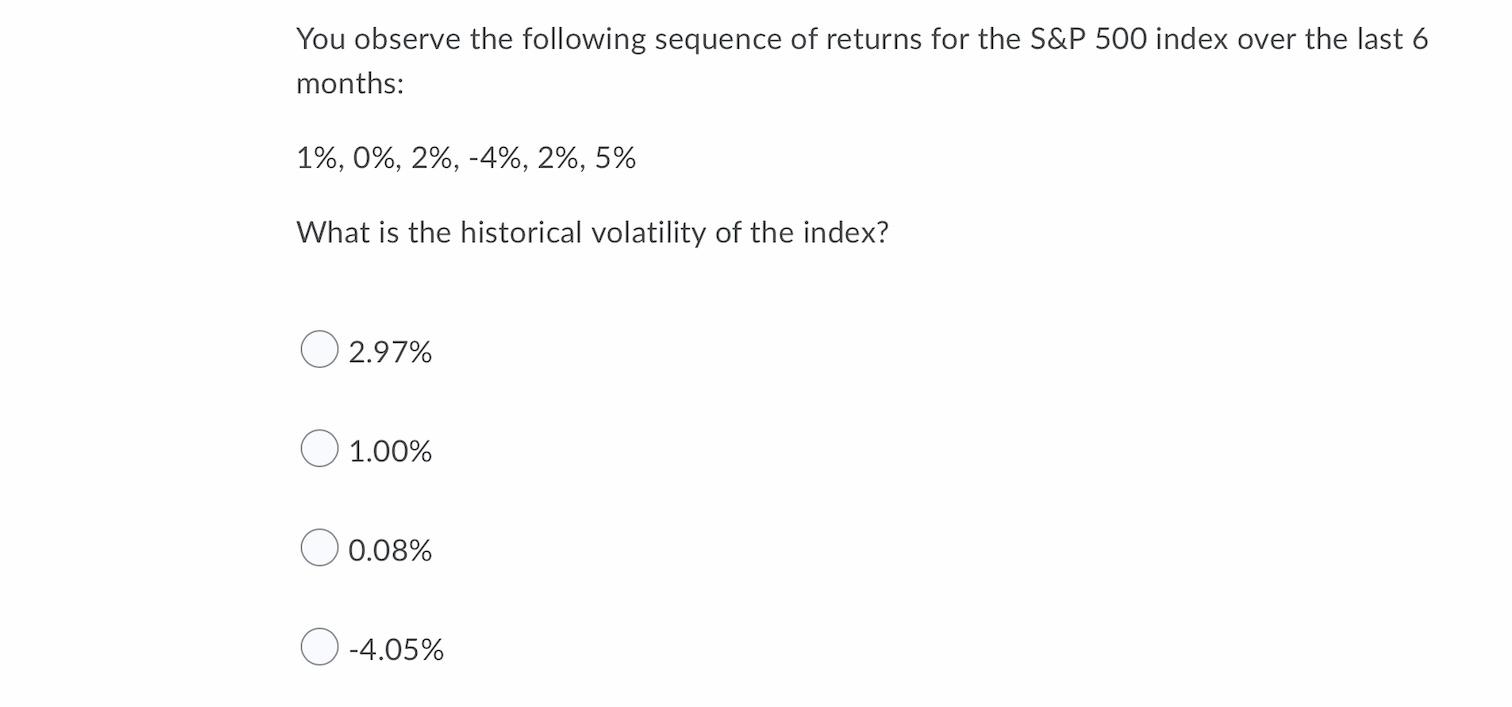

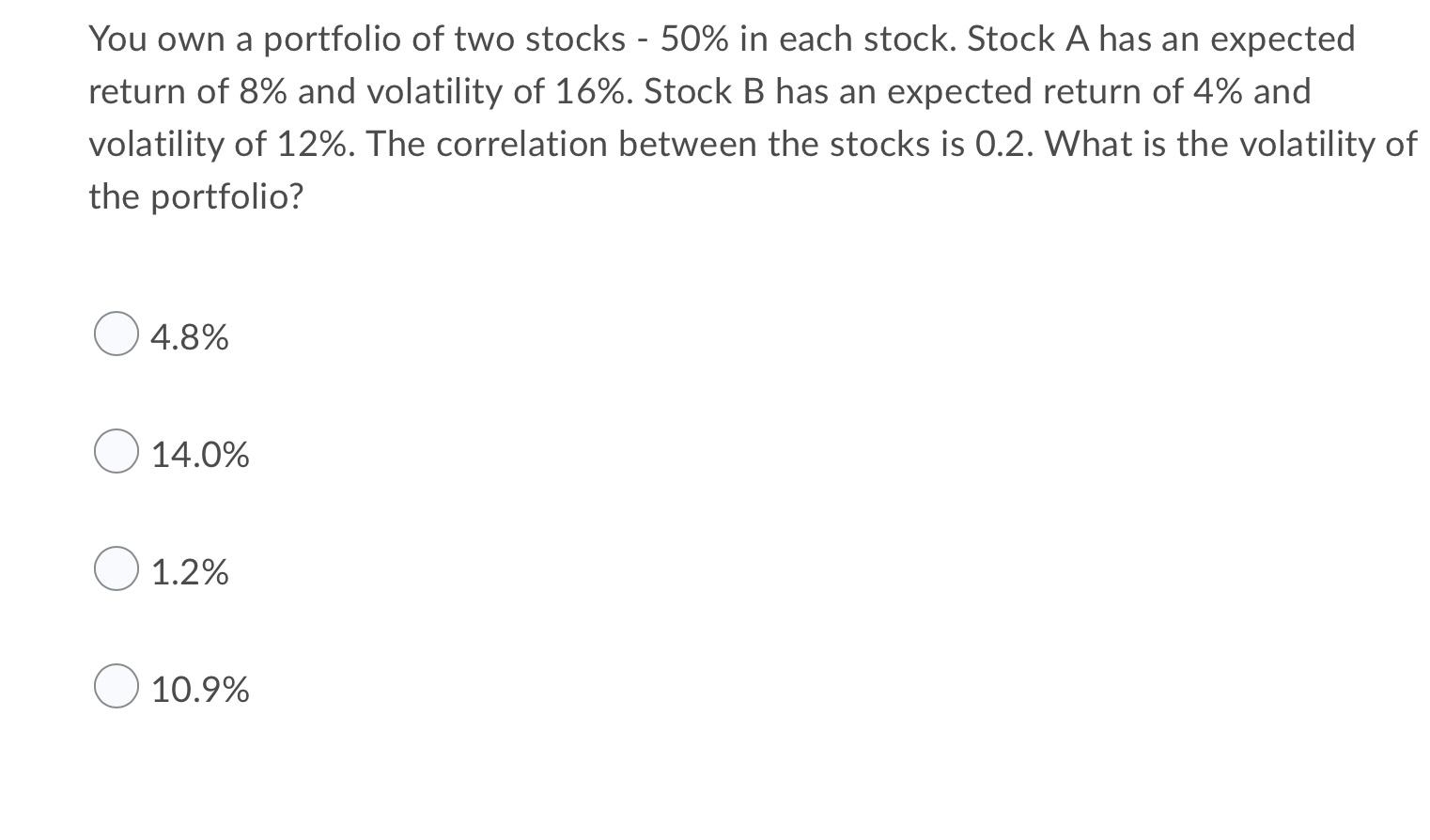

Question 1 (1 point) Investors should be compensated (in the form of return) for the risk that a superstar CEO leaves the firm. True False You observe the following sequence of returns for the S&P 500 index over the last 6 months: 1%, 0%, 2%, -4%, 2%, 5% What is the historical volatility of the index? O 2.97% 1.00% 0.08% -4.05% You own a portfolio of two stocks - 50% in each stock. Stock A has an expected return of 8% and volatility of 16%. Stock B has an expected return of 4% and volatility of 12%. The correlation between the stocks is 0.2. What is the volatility of the portfolio? 4.8% 14.0% 1.2% 10.9% Question 1 (1 point) Investors should be compensated (in the form of return) for the risk that a superstar CEO leaves the firm. True False You observe the following sequence of returns for the S&P 500 index over the last 6 months: 1%, 0%, 2%, -4%, 2%, 5% What is the historical volatility of the index? O 2.97% 1.00% 0.08% -4.05% You own a portfolio of two stocks - 50% in each stock. Stock A has an expected return of 8% and volatility of 16%. Stock B has an expected return of 4% and volatility of 12%. The correlation between the stocks is 0.2. What is the volatility of the portfolio? 4.8% 14.0% 1.2% 10.9%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts