Question: Please answer question 1 and 2. HR means: Human Resources. HR How To Using Temporary Employees and Contractors When a company lands a big order,

Please answer question 1 and 2.

HR means: Human Resources.

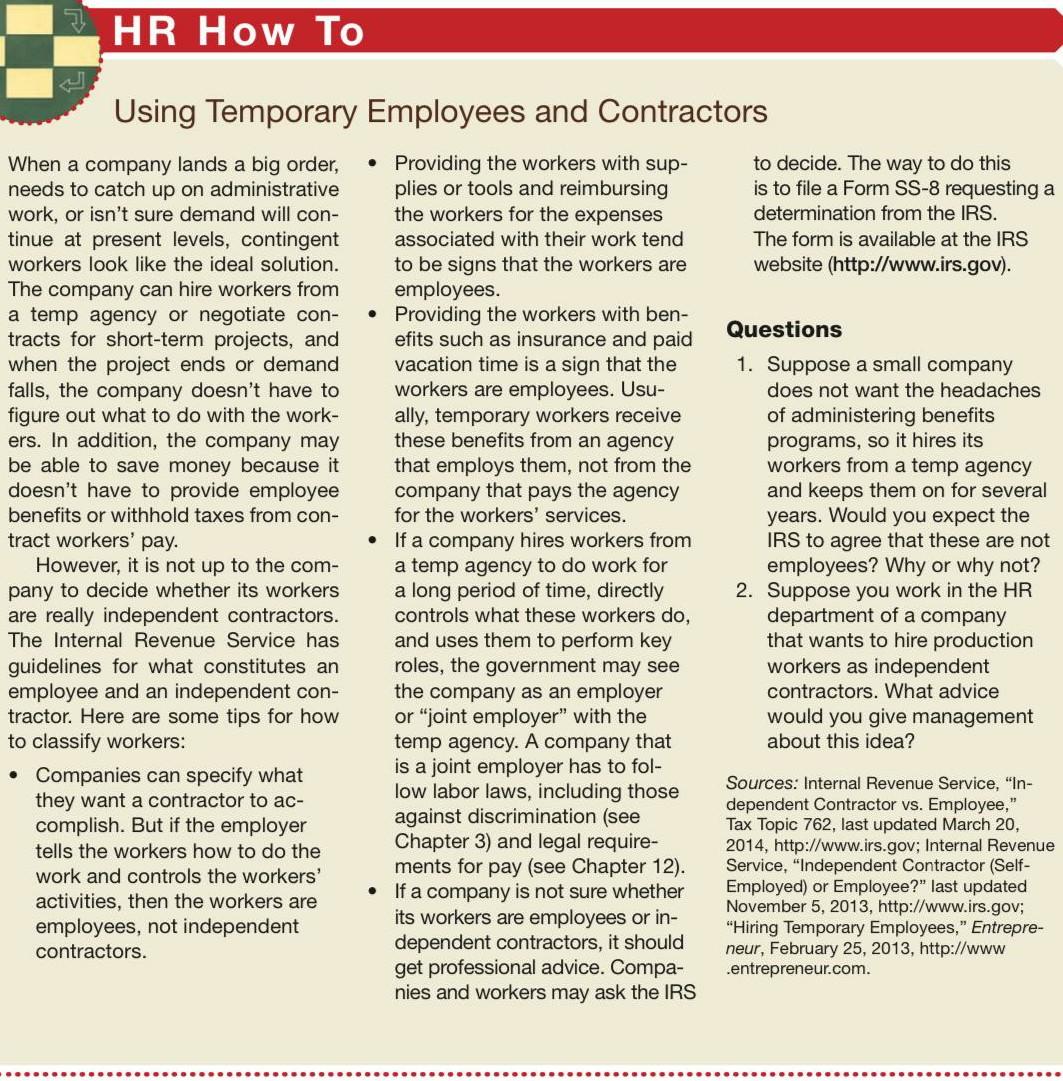

HR How To Using Temporary Employees and Contractors When a company lands a big order, Providing the workers with sup- to decide. The way to do this needs to catch up on administrative plies or tools and reimbursing is to file a Form SS-8 requesting a work, or isn't sure demand will con- the workers for the expenses determination from the IRS. tinue at present levels, contingent associated with their work tend The form is available at the IRS workers look like the ideal solution. to be signs that the workers are website (http://www.irs.gov). The company can hire workers from employees. a temp agency or negotiate con- Providing the workers with ben- tracts for short-term projects, and efits such as insurance and paid Questions when the project ends or demand vacation time is a sign that the 1. Suppose a small company falls, the company doesn't have to workers are employees. Usu- does not want the headaches figure out what to do with the work- ally, temporary workers receive of administering benefits ers. In addition, the company may these benefits from an agency programs, so it hires its be able to save money because it that employs them, not from the workers from a temp agency doesn't have to provide employee company that pays the agency and keeps them on for several benefits or withhold taxes from con- for the workers' services. years. Would you expect the tract workers' pay. If a company hires workers from IRS to agree that these are not However, it is not up to the com- a temp agency to do work for employees? Why or why not? pany to decide whether its workers a long period of time, directly 2. Suppose you work in the HR are really independent contractors. controls what these workers do, department of a company The Internal Revenue Service has and uses them to perform key that wants to hire production guidelines for what constitutes an roles, the government may see workers as independent employee and an independent con- the company as an employer contractors. What advice tractor. Here are some tips for how or "joint employer" with the would you give management to classify workers: temp agency. A company that about this idea? Companies can specify what is a joint employer has to fol- Sources: Internal Revenue Service, "In- they want a contractor to ac- low labor laws, including those dependent Contractor vs. Employee," complish. But if the employer against discrimination (see Tax Topic 762, last updated March 20, tells the workers how to do the Chapter 3) and legal require- 2014, http://www.irs.gov; Internal Revenue work and controls the workers' ments for pay (see Chapter 12). Service, "Independent Contractor (Self- activities, then the workers are If a company is not sure whether Employed) or Employee?" last updated November 5, 2013, http://www.irs.gov; employees, not independent its workers are employees or in- "Hiring Temporary Employees," Entrepre- contractors. dependent contractors, it should neur, February 25, 2013, http://www get professional advice. Compa- .entrepreneur.com. nies and workers may ask the IRS

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock