Question: please answer question 2 you see to e for any tunities for repom tions revealed on to do to accomplish this consistency? c. In general,

please answer question 2

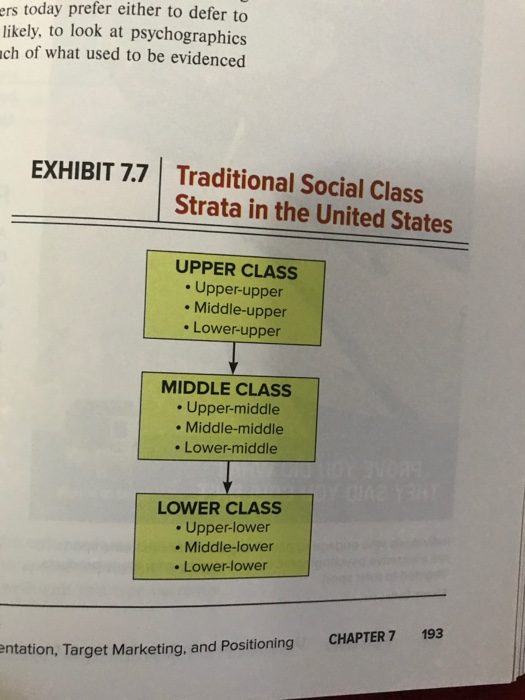

you see to e for any tunities for repom tions revealed on to do to accomplish this consistency? c. In general, what opportunities for pe of the brands to take advantage of current the perceptual map? What would they have to do repositioning? MANAGEMENT DECISION CASE Crafty Credit Card Competitor Chases" Amex for Share of Millennials' Wallets Amex, founded in 1850 as an express mail servid American Express (Amex for short) is one of the most venerable brands in all of financial services. didn't offer its first charge card-which was technically Unfortunately, Amex and its stockholders recently not a credit card, since the balance had to be paid off saw profits in the credit card business fall by nearly each month-until 1958. Over its history, the firm cre. 20 percent, with an accompanying revenue plunge of ated the once popular "Traveler's Cheques" business $2 billion! How is it that a successful firm like Amex (1891-1990s), founded and spun off an investment can hit such a rough patch? One key reason is chang- bank to Lehman Brothers (1981-1994), and formed a ing customer demographic trends, Amex's aging and joint venture with Warner Communications that leo somewhat pompous brand image (which makes it the creation of television channels MIV and appear out of touch with younger up-and-coming odeon (1979-1984). Today. Amex has over market segments), and a wily competitor in the form of Chase Bank (more on Chase later). cardholders worldwide, some of whom se value in their cards to pay a $7,500 initial fee and some of whom see enough 206 PART TWO Use Information to Drive Marketing Decisions 400 annual fee to obtain the ran adaka their black card WOW ON understatement, as it ra provides a lot of nose from Generation cant pricing power with m However Amex recent customers and key merch whose holding come ON the recent vulnerability as boldly taken advantage mending, targeting and to craft and present a new image ble and hard-to-reach millennials. lass. Den rarefied Centurion buy Using basic demographic segment d deepening the insights with psychographics of the e lla band would be a carcal Ame Amex a venerable brand would be a millennial tarne millennial target segment, Chase discovered r anks as one of the top younger consumers typically shunned the valued by Card because as one consumer stated, using the ends in the world and has been valued by billion Amex's branding power Amex card felt "braggy (an ant i ng the brand o c het with customers-especially millennials Out Chase's Sapphire card esa and older and it has so blue and mode of metal, feels more with merchants worldwide. younger consumer. It says. "I have this then Amex recently has been steadily losing interesting - merchants, including dropped to be sure, the Sapphire Reserved Costco and JetBlue-losses that plenty deals with Costco and Jets ve de of benefits, especially for n ts of revenue. Warren Buf- 100.000-mile reward sign-up bonus crede Anexm a ny Berkshire Hathaway TSA Prev enrollment, an automatic extended percent of Amex, has said that ranty on purchases, trip insurance, and s e more th a ck" But why under attack airport lounges. But Chase's main brand me brand is the brand most responsible for that these rewards are designed to get you to the particular? The brand most responsible for th sow, in part i lity at Amex is Chase. Chase has snowboard slopes and the after parties at the hot advantage of an opportunity by seg- test local venues, rather than to an exclusive used ting, and positioning in Amex's market wine tasting in the Loire Valley. To say that Chases present a new image to the highly desir- Sapphire Reserve card has been a slam dunk would be an understatement. In the first seven months aher in Chase's approach, we must first under its release, Chase signed up more than 1 million Amex has traditionally positioned itself as a cardholders, half of whom were under ane 15:12 ering, providing a posh credit card for the But don't count Amex totally out of the millennia wccessful and (typically older professional ballgame they are working hard for a come he decided to take a different approach. Fol. but how well they do is "all in the cards lowing demographic trends, Chase saw that market growth potential was much greater for millennials Generation Y) than any other generational segment. Questions for Consideration According to the US Census Bureau, millennials 1. Why is the millennial generation, in particular, so now outnumber every other generational cohort important to Amex? and will hold this position for at least two decades Millennial consumers behave differently from those 2. This case focuses primarily on the battle between Chase and Amex over millennial consumers. But, from previous generations. They are known to ignore as the content in this chapter points out, lumping much traditional advertising, and often postpone mar- all older consumers into a generalized segment riage and home purchases--but they may not hesi- overlooks some important variables. Looking at tate to jump right into car and travel purchases. They check blogs and social media for product reviews, the generational groups and their representative values (see Exhibit 77). where would you suggest and also tend to be more brand loyal than other gen- Amex focus its marketing efforts, and why? erational segments. The value that millennials place on brand authenticity and brand involvement with 3. As noted in the chapter, an external positioning social causes, as well as their desire to participate statement is not just about being able to describe in product creation processes and dialogues (usually how your product benefits the customer-it also virtualy provide strong clues to marketing manag needs to explain how your product is different ers about how to win them over, it seems that Amex from the competition. Chase's "It's not your largely missed these cues, and Chase was only too father's credit card" external positioning state- happy to cash in on the oversight. ment sums up in six words the idea that Chase So Chase developed and marketed a card rich is young while its competitors are old. The state- rewards, designed to appeal to millennials ment leads millennial consumers to consider we seeking behavior and attitudes. They posi- what this card could do for them, beyond what oned the Sapphire Reserve card as "not your their father's card could. Amex's positioning has er's credit card," directly opposite to Amex's positioning. Chase smartly set out to provide a differ always been that its card is for the successful pro- fessional-what would happen if Amex changed it value proposition by offering up a brand image sed on experiences rather than conspicuous con- that positioning? (As a bonus, try to create a short external positioning phrase for Amex to use with on meaning "showing off" one's ability to millennials.) - you see ions p according hare 55 mm to be Segmentation, Target Marketing and Positioning CHAPTER 7 207 ers today prefer either to defer to likely, to look at psychographics ach of what used to be evidenced EXHIBIT 7.7 | Traditional Social Class Strata in the United States UPPER CLASS Upper-upper Middle-upper Lower-upper MIDDLE CLASS Upper-middle Middle-middle Lower-middle LOWER CLASS Upper-lower Middle-lower Lower-lower CHAPTER 7 193 entation, Target Marketing, and Positioning

please answer question 2

please answer question 2