Question: PLEASE ANSWER QUESTION SHOWING ALL WORK AND CORRECT ANSWER COMPLETELY!!! QUESTIONS 11 THROUGH 13!! Patti Company owns 80% of the common stock of Shannon, Inc.

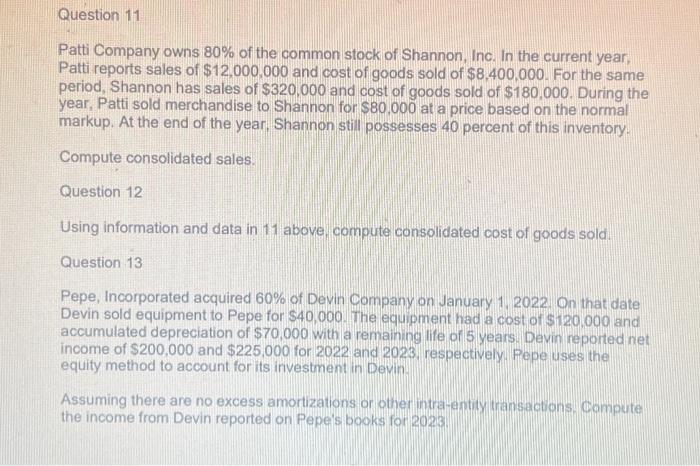

Patti Company owns 80% of the common stock of Shannon, Inc. In the current year, Patti reports sales of $12,000,000 and cost of goods sold of $8,400,000. For the same period, Shannon has sales of $320,000 and cost of goods sold of $180,000. During the year, Patti sold merchandise to Shannon for $80,000 at a price based on the normal markup. At the end of the year, Shannon still possesses 40 percent of this inventory. Compute consolidated sales. Question 12 Using information and data in 11 above, compute consolidated cost of goods sold. Question 13 Pepe, Incorporated acquired 60% of Devin Company on January 1, 2022. On that date Devin sold equipment to Pepe for $40,000. The equipment had a cost of $120,000 and accumulated depreciation of $70,000 with a remaining life of 5 years. Devin reported net. income of $200,000 and $225,000 for 2022 and 2023, respectively. Pepe uses the equity method to account for its investment in Devin. Assuming there are no excess amortizations or other intra-entity transactions, Compute the income from Devin reported on Pepe's books for 2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts