Question: PLEASE ANSWER QUESTION SHOWING ALL WORK AND CORRECT ANSWER COMPLETELY!!! BOTH QUESTIONS 14 AND 15!! Question 14 Prater Inc. owned 75% of the voting common

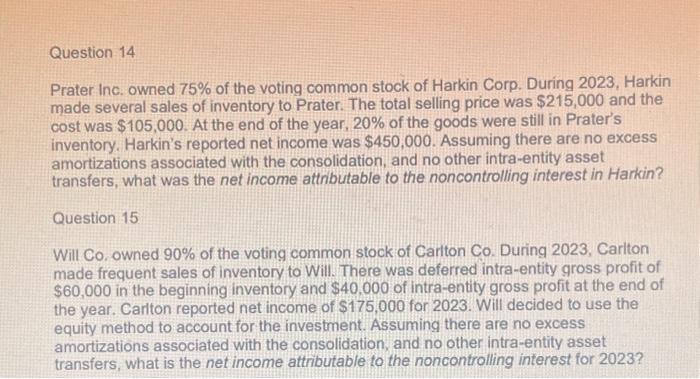

Question 14 Prater Inc. owned 75% of the voting common stock of Harkin Corp. During 2023, Harkin made several sales of inventory to Prater. The total selling price was $215,000 and the cost was $105,000. At the end of the year, 20% of the goods were still in Prater's inventory. Harkin's reported net income was $450,000. Assuming there are no excess amortizations associated with the consolidation, and no other intra-entity asset transfers, what was the net income attnbutable to the noncontrolling interest in Harkin? Question 15 Will Co. owned 90% of the voting common stock of Cariton Co. During 2023, Carlton made frequent sales of inventory to Will. There was deferred intra-entity gross profit of $60,000 in the beginning inventory and $40,000 of intra-entity gross profit at the end of the year. Cariton reported net income of $175,000 for 2023. Will decided to use the equity method to account for the investment. Assuming there are no excess amortizations associated with the consolidation, and no other intra-entity asset transfers, what is the net income attributable to the noncontrolling interest for 2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts