Question: Please answer questions 1 through 6. Thank you. Instructions: What we do not see in the videos is that Kevin O'Leary asked Traci and Dani

Please answer questions 1 through 6. Thank you.

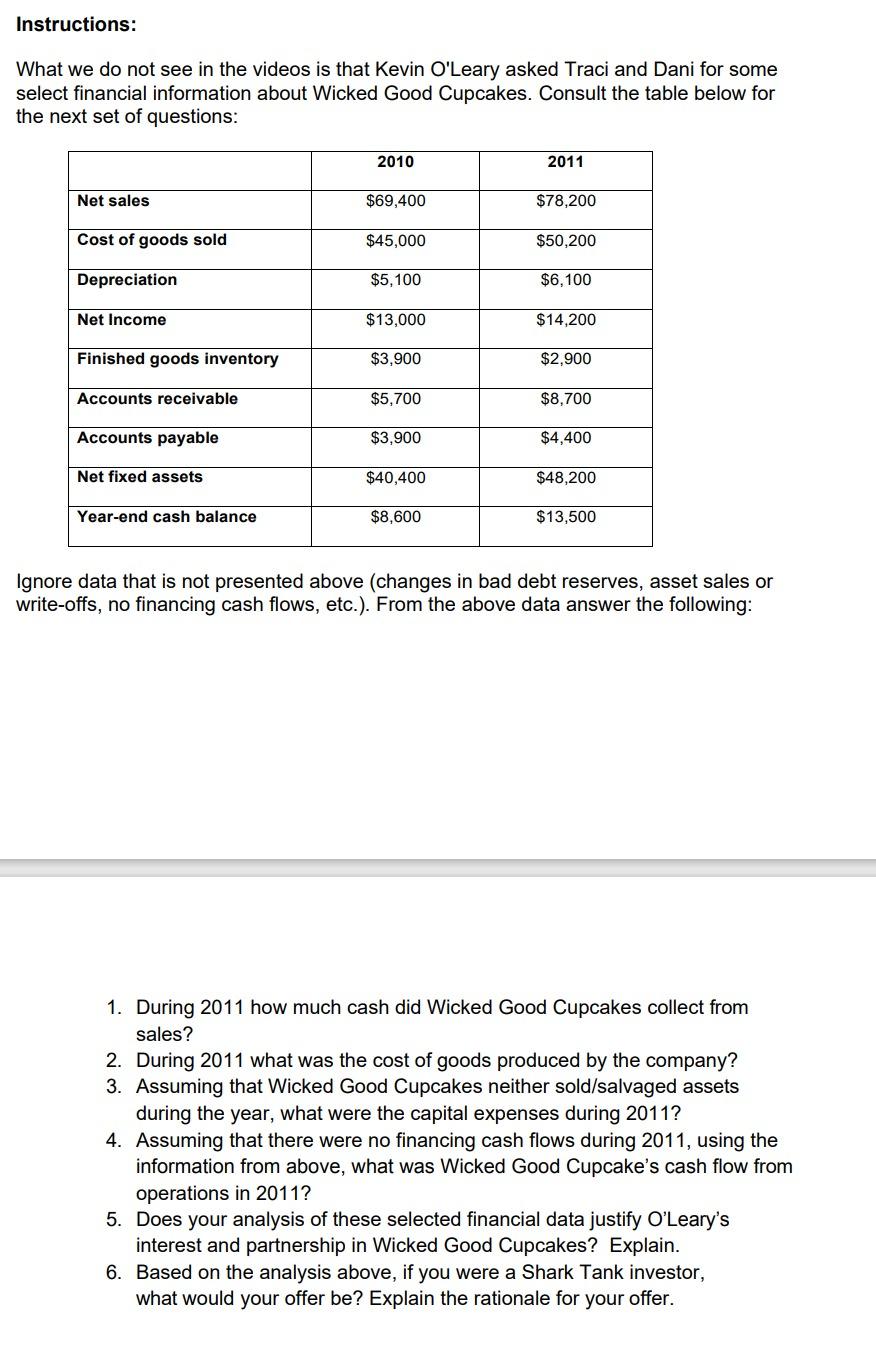

Instructions: What we do not see in the videos is that Kevin O'Leary asked Traci and Dani for some select financial information about Wicked Good Cupcakes. Consult the table below for the next set of questions: Ignore data that is not presented above (changes in bad debt reserves, asset sales or write-offs, no financing cash flows, etc.). From the above data answer the following: 1. During 2011 how much cash did Wicked Good Cupcakes collect from sales? 2. During 2011 what was the cost of goods produced by the company? 3. Assuming that Wicked Good Cupcakes neither sold/salvaged assets during the year, what were the capital expenses during 2011? 4. Assuming that there were no financing cash flows during 2011, using the information from above, what was Wicked Good Cupcake's cash flow from operations in 2011? 5. Does your analysis of these selected financial data justify O'Leary's interest and partnership in Wicked Good Cupcakes? Explain. 6. Based on the analysis above, if you were a Shark Tank investor, what would your offer be? Explain the rationale for your offerStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock