Question: PLEASE ANSWER THE ENTIRE QUESTION. It is not helpful if you only answer part of it! 3. Introduction to option pricing models A put option

PLEASE ANSWER THE ENTIRE QUESTION. It is not helpful if you only answer part of it!

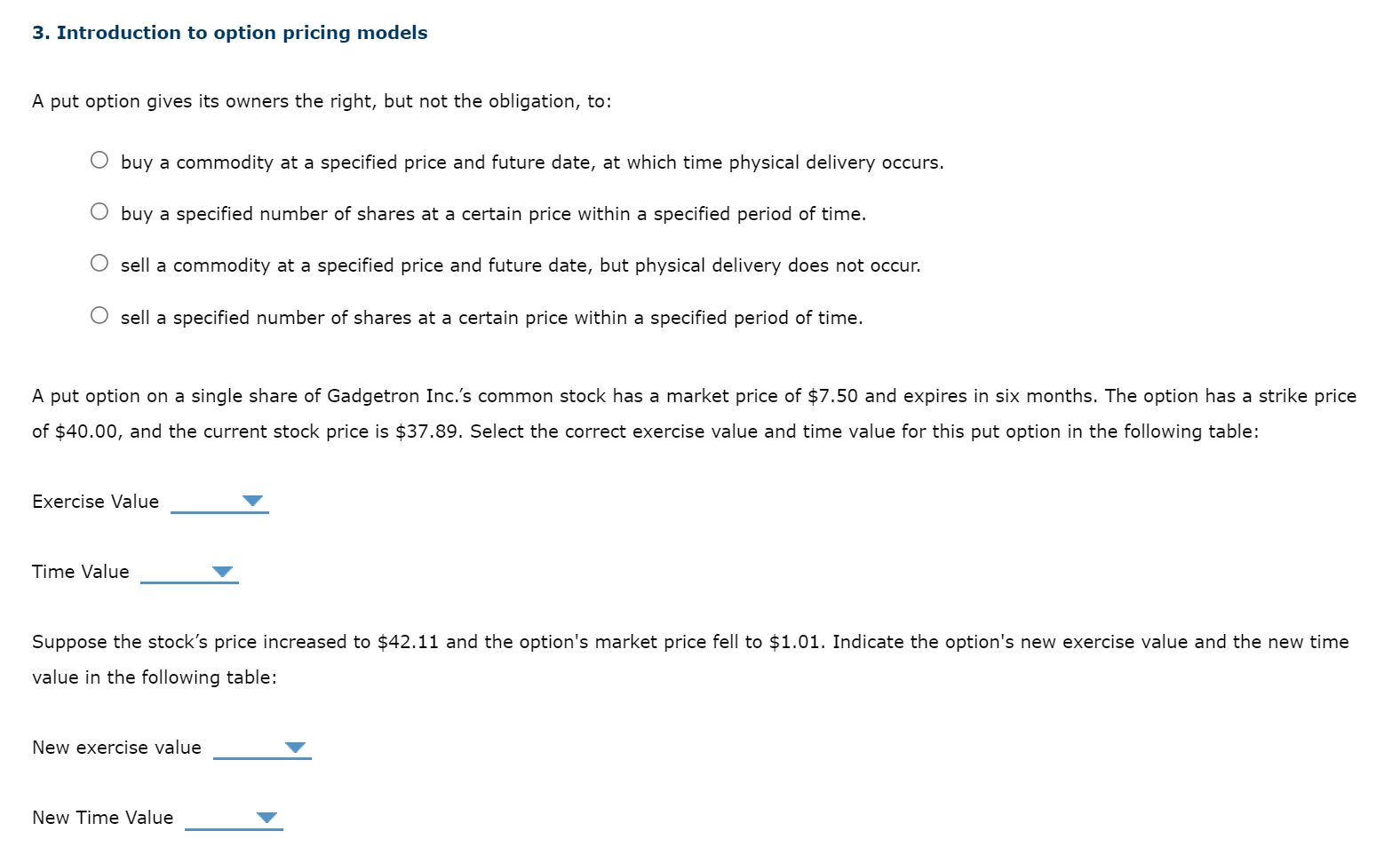

3. Introduction to option pricing models A put option gives its owners the right, but not the obligation, to: O buy a commodity at a specified price and future date, at which time physical delivery occurs. buy a specified number of shares at a certain price within a specified period of time. sell a commodity at a specified price and future date, but physical delivery does not occur. sell a specified number of shares at a certain price within a specified period of time. A put option on a single share of Gadgetron Inc.'s common stock has a market price of $7.50 and expires in six months. The option has a strike price of $40.00, and the current stock price is $37.89. Select the correct exercise value and time value for this put option in the following table: Exercise Value Time Value Suppose the stock's price increased to $42.11 and the option's market price fell to $1.01. Indicate the option's new exercise value and the new time value in the following table: New exercise value New Time Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts