Question: Please Answer the following HW question. The excel file link is the following: https://docs.google.com/spreadsheets/d/e/2PACX-1vS7T2aUA1CsSDju0UWWV7-cF1hHeipYfgQlG9j0cwCgIV_KmBRcbqh_p8ZjoZZkwglhy13FwIPXtIDm/pubhtml In this question we are going to backtest the time series

Please Answer the following HW question. The excel file link is the following:

https://docs.google.com/spreadsheets/d/e/2PACX-1vS7T2aUA1CsSDju0UWWV7-cF1hHeipYfgQlG9j0cwCgIV_KmBRcbqh_p8ZjoZZkwglhy13FwIPXtIDm/pubhtml

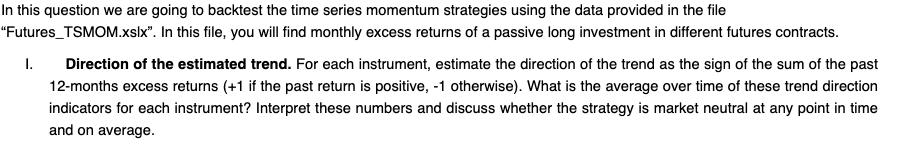

In this question we are going to backtest the time series momentum strategies using the data provided in the file "Futures_TSMOM.xsix". In this file, you will find monthly excess returns of a passive long investment in different futures contracts. 1. Direction of the estimated trend. For each instrument, estimate the direction of the trend as the sign of the sum of the past 12-months excess returns (+1 if the past return is positive, -1 otherwise). What is the average over time of these trend direction indicators for each instrument? Interpret these numbers and discuss whether the strategy is market neutral at any point in time and on average

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts