Question: please answer this step by step, thank you :)) lestion 5 a) A firm is considering a future investment. Describe which types of cashflows the

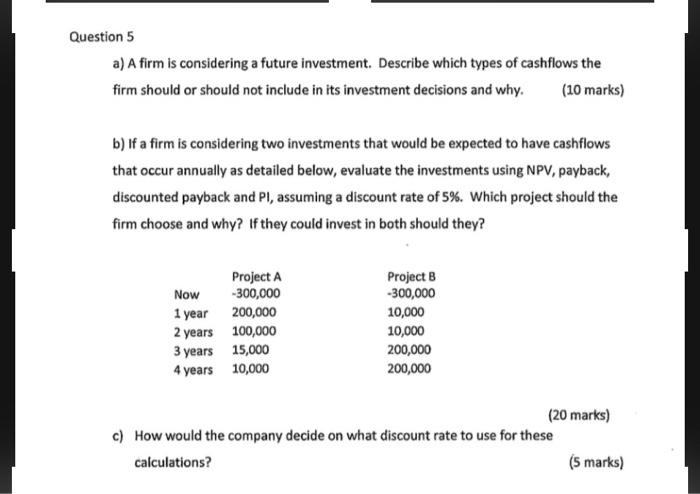

lestion 5 a) A firm is considering a future investment. Describe which types of cashflows the firm should or should not include in its investment decisions and why. (10 marks) b) If a firm is considering two investments that would be expected to have cashflows that occur annually as detailed below, evaluate the investments using NPV, payback, discounted payback and PI, assuming a discount rate of 5%. Which project should the firm choose and why? If they could invest in both should they? (20 marks) c) How would the company decide on what discount rate to use for these calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts