Question: Please assist with attached question. REQUIRED Study the information given below and answer the following questions: 5.1 Calculate the profit or loss on the disposal

Please assist with attached question.

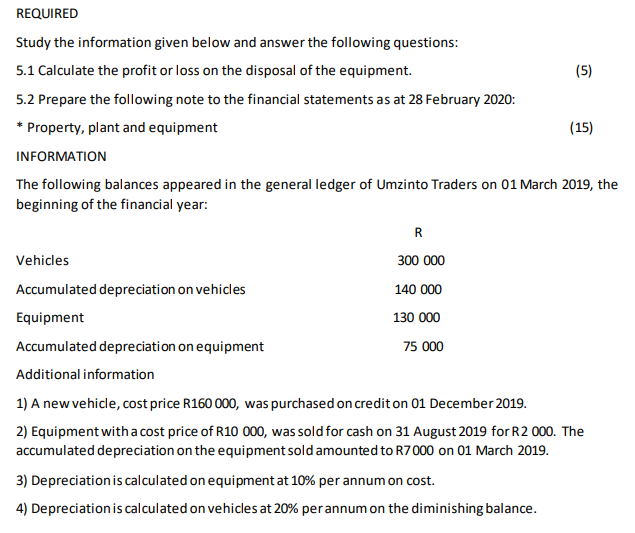

REQUIRED Study the information given below and answer the following questions: 5.1 Calculate the profit or loss on the disposal of the equipment. (5) 5.2 Prepare the following note to the financial statements as at 28 February 2020: * Property, plant and equipment (15) INFORMATION The following balances appeared in the general ledger of Umzinto Traders on 01 March 2019, the beginning of the financial year: R Vehicles 300 000 Accumulated depreciation on vehicles 140 000 Equipment 130 000 Accumulated depreciation on equipment 75 000 Additional information 1) A new vehicle, cost price R160 000, was purchased on credit on 01 December 2019. 2) Equipment with a cost price of R10 000, was sold for cash on 31 August 2019 for R2 000. The accumulated depreciation on the equipment sold amounted to R7000 on 01 March 2019. 3) Depreciation is calculated on equipment at 10% per annum on cost. 4) Depreciation is calculated on vehicles at 20% per annum on the diminishing balance

REQUIRED Study the information given below and answer the following questions: 5.1 Calculate the profit or loss on the disposal of the equipment. (5) 5.2 Prepare the following note to the financial statements as at 28 February 2020: * Property, plant and equipment (15) INFORMATION The following balances appeared in the general ledger of Umzinto Traders on 01 March 2019, the beginning of the financial year: R Vehicles 300 000 Accumulated depreciation on vehicles 140 000 Equipment 130 000 Accumulated depreciation on equipment 75 000 Additional information 1) A new vehicle, cost price R160 000, was purchased on credit on 01 December 2019. 2) Equipment with a cost price of R10 000, was sold for cash on 31 August 2019 for R2 000. The accumulated depreciation on the equipment sold amounted to R7000 on 01 March 2019. 3) Depreciation is calculated on equipment at 10% per annum on cost. 4) Depreciation is calculated on vehicles at 20% per annum on the diminishing balance Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock