Question: Please calculate using excel and show ALL work and formulas. If the question is hard to read or information is missing please comment and I

Please calculate using excel and show ALL work and formulas. If the question is hard to read or information is missing please comment and I will Re-upload. Thank you.

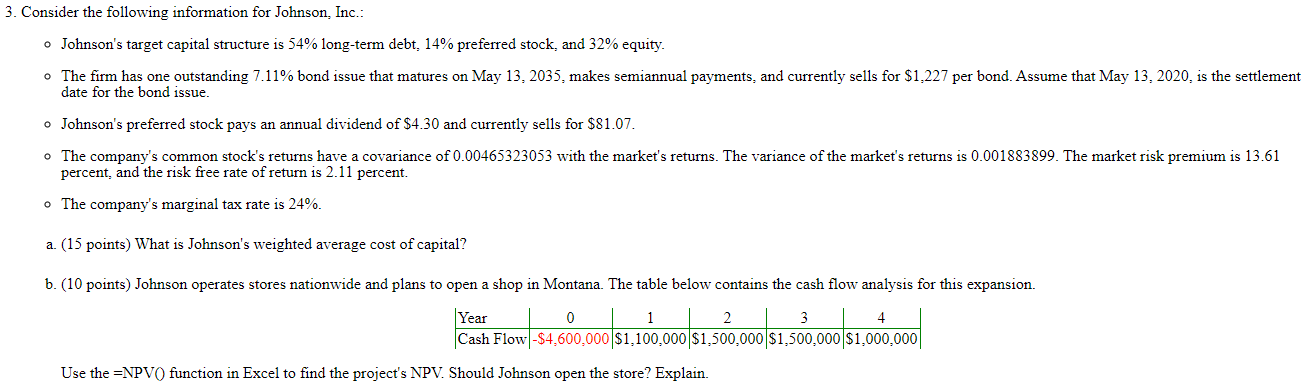

3. Consider the following information for Johnson, Inc.: o Johnson's target capital structure is 54% long-term debt, 14% preferred stock, and 32% equity. The firm has one outstanding 7.11% bond issue that matures on May 13, 2035, makes semiannual payments, and currently sells for $1.227 per bond. Assume that May 13, 2020. is the settlement date for the bond issue. Johnson's preferred stock pays an annual dividend of $4.30 and currently sells for $81.07. . The company's common stock's returns have a covariance of 0.00465323053 with the market's returns. The variance of the market's returns is 0.001883899. The market risk premium is 13.61 percent, and the risk free rate of return is 2.11 percent. The company's marginal tax rate is 24%. a. (15 points) What is Johnson's weighted average cost of capital? b.(10 points) Johnson operates stores nationwide and plans to open a shop in Montana. The table below contains the cash flow analysis for this expansion. Year 0 1 2 3 4 Cash Flow - $4,600,000 $1,100,000 $1,500,000 $1,500,000 $1,000,000 Use the NPVO function in Excel to find the project's NPV. Should Johnson open the store? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts