Question: PLEASE CODE IN SAP!!!!!! (ABAP OBJECTS) You will be creating a program which will complete a short income statement for a business person. The user

PLEASE CODE IN SAP!!!!!! (ABAP OBJECTS)

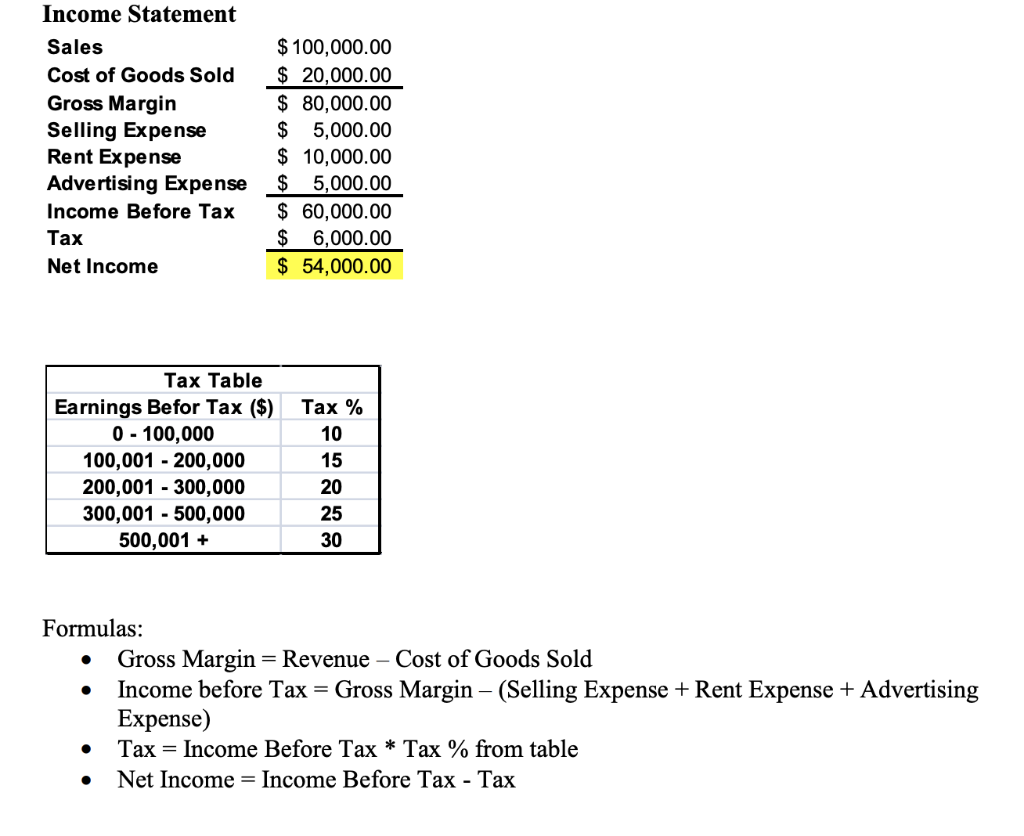

You will be creating a program which will complete a short income statement for a business person. The user of your program will enter numbers for Revenue, Cost of Goods Sold, Selling Expense, Rent Expense, and Advertising Expense. When run, your program will use the numbers provided by the user to calculate Gross Margin, Income Before Tax, the proper Tax, and Net Income according to the formulas below. Your program MUST use a GLOBAL structure for your variable type declarations. The initial screen for user input should, of course, include selection texts for easy understanding of what to enter where. Finally, your program will need to determine the proper tax % to apply to the Earnings Before Tax amount according to the table below. When run, your generated income statement should look similar to the following (please note that this is not SAP output, so just get it as close as you can)

Income Statement Sales Cost of Goods Sold Gross Margin Selling Expense Rent Expense Advertising Expense Income Before Tax Tax Net Income $100,000.00 $ 20,000.00 $ 80,000.00 $ 5,000.00 $ 10,000.00 $ 5,000.00 $ 60,000.00 $ 6,000.00 $ 54,000.00 Tax Table Earnings Befor Tax ($) 0 - 100,000 100,001 - 200,000 200,001 - 300,000 300,001 - 500,000 500,001 + Tax % 10 15 20 25 30 O Formulas: Gross Margin = Revenue - Cost of Goods Sold Income before Tax = Gross Margin (Selling Expense + Rent Expense + Advertising Expense) Tax = Income Before Tax * Tax % from table Net Income = Income Before Tax - Tax Income Statement Sales Cost of Goods Sold Gross Margin Selling Expense Rent Expense Advertising Expense Income Before Tax Tax Net Income $100,000.00 $ 20,000.00 $ 80,000.00 $ 5,000.00 $ 10,000.00 $ 5,000.00 $ 60,000.00 $ 6,000.00 $ 54,000.00 Tax Table Earnings Befor Tax ($) 0 - 100,000 100,001 - 200,000 200,001 - 300,000 300,001 - 500,000 500,001 + Tax % 10 15 20 25 30 O Formulas: Gross Margin = Revenue - Cost of Goods Sold Income before Tax = Gross Margin (Selling Expense + Rent Expense + Advertising Expense) Tax = Income Before Tax * Tax % from table Net Income = Income Before Tax - Tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts