Question: PLEASE DO ALL QUESTIONS BECAUSE IT'S NOT MUTILPLE QUESTIONS IT'S JUST 1. top picture: Picture of actual problem bottom picture: solution to similar problem please

PLEASE DO ALL QUESTIONS BECAUSE IT'S NOT MUTILPLE QUESTIONS IT'S JUST 1.

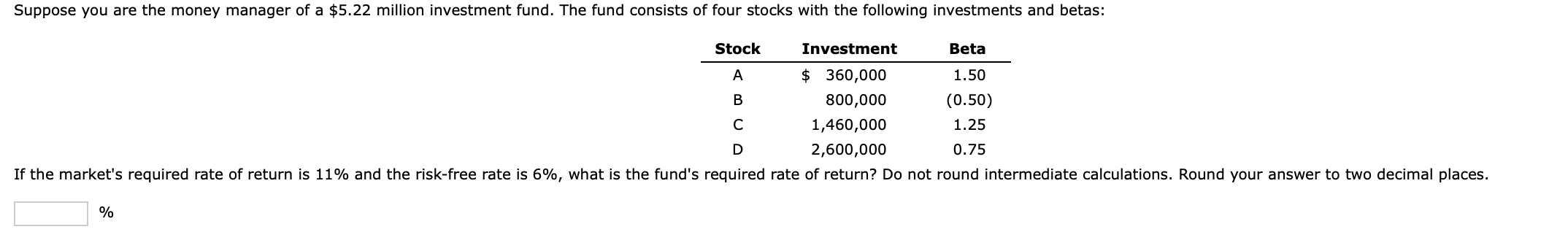

top picture: Picture of actual problem

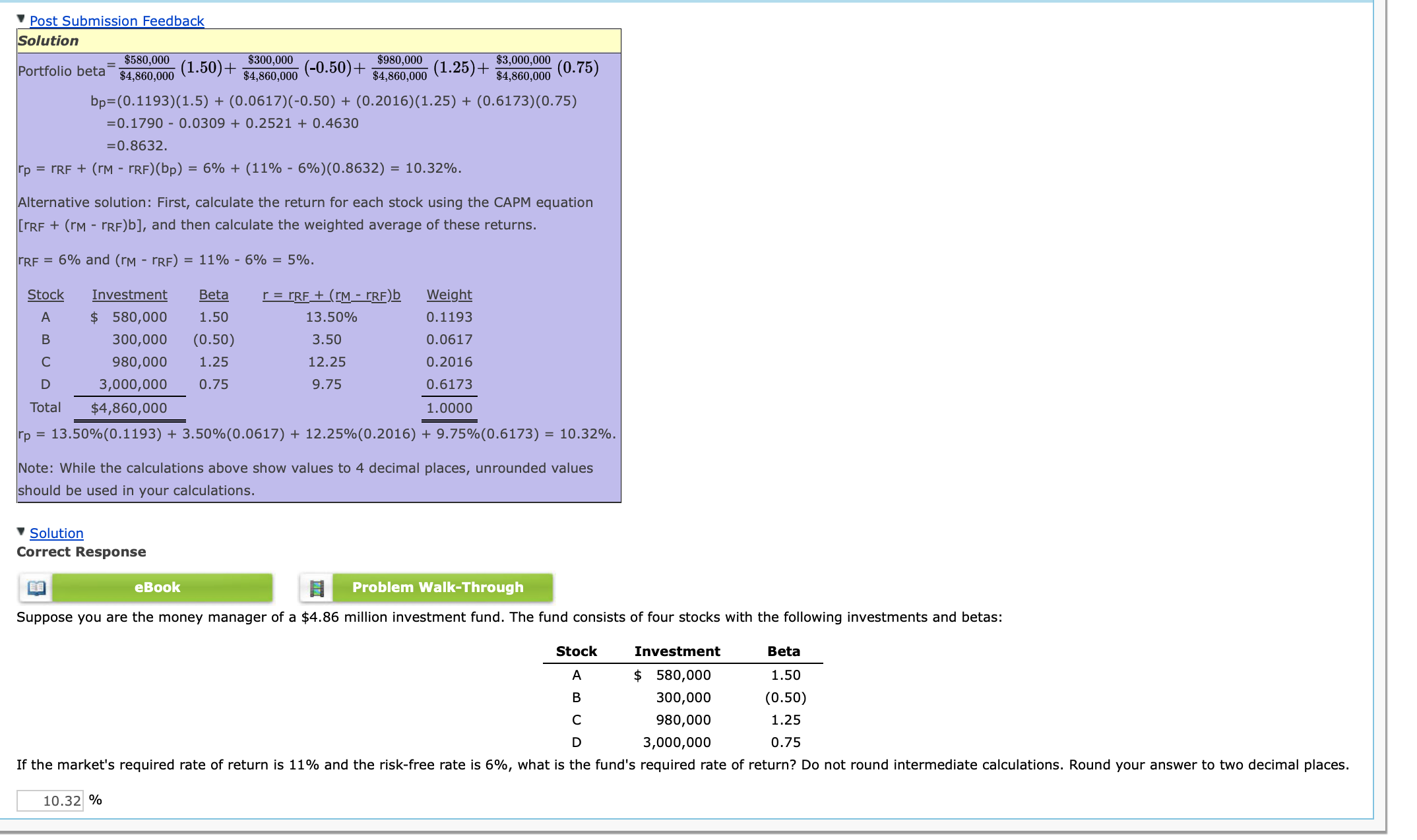

bottom picture: solution to similar problem please follow formula

Suppose you are the money manager of a $5.22 million investment fund. The fund consists of four stocks with the following investments and betas: \begin{tabular}{ccc} Stock & Investment & Beta \\ \hline A & $360,000 & 1.50 \\ B & 800,000 & (0.50) \\ C & 1,460,000 & 1.25 \\ D & 2,600,000 & 0.75 \end{tabular} % Solution Portfoliobetabp=$4,860,000$580,000(1.50)+$4,860,000$300,000(0.50)+$4,860,000$980,000(1.25)+$4,860,000$3,000,000(0.75)=(0.1193)(1.5)+(0.0617)(0.50)+(0.2016)(1.25)+(0.6173)(0.75)=0.17900.0309+0.2521+0.4630=0.8632 Alternative solution: First, calculate the return for each stock using the CAPM equation [rRF+(rMrRF)b], and then calculate the weighted average of these returns. rRFR=6%and(rMrRF)=11%6%=5% Note: While the calculations above show values to 4 decimal places, unrounded values should be used in your calculations. Solution Correct Response Suppose you are the money manager of a $4.86 million investment fund. The fund consists of four stocks with the following investments and betas: %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts