Question: PLEASE DO ALL QUESTIONS BECAUSE IT'S NOT MUTILPLE QUESTIONS IT'S JUST 1. top picture: Picture of actual problem bottom picture: solution to similar problem please

PLEASE DO ALL QUESTIONS BECAUSE IT'S NOT MUTILPLE QUESTIONS IT'S JUST 1.

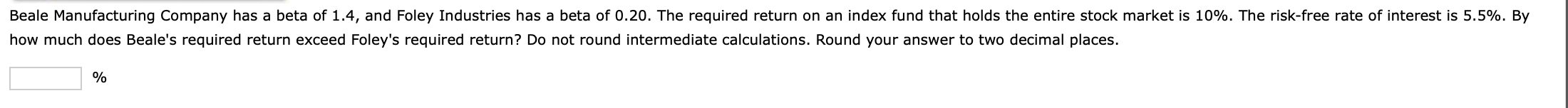

top picture: Picture of actual problem

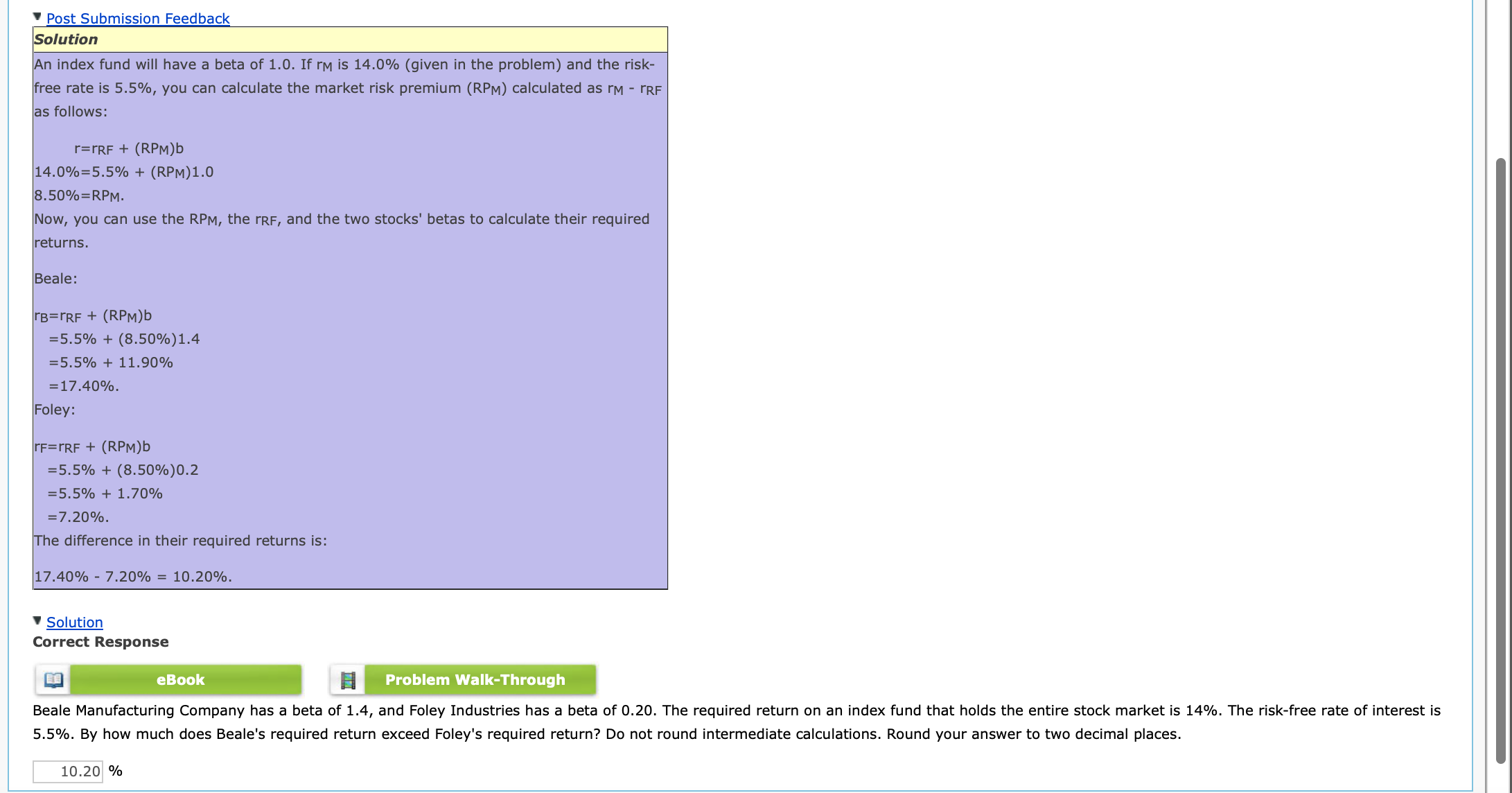

bottom picture: solution to similar problem please follow formula

how much does Beale's required return exceed Foley's required return? Do not round intermediate calculations. Round your answer to two decimal places. % An index fund will have a beta of 1.0 . If rm is 14.0% (given in the problem) and the riskfree rate is 5.5%, you can calculate the market risk premium (RPM) calculated as rmrRFR as follows: r14.0%8.50%=rRF+(RPM)b=5.5%+(RPM)1.0=RPM. Now, you can use the RPM, the rRF, and the two stocks' betas to calculate their required returns. Beale: rB=rRF+(RM)b=5.5%+(8.50%)1.4=5.5%+11.90%=17.40% Foley: rF=rRF+(RPM)b=5.5%+(8.50%)0.2=5.5%+1.70%=7.20%. The difference in their required returns is: 17.40%7.20%=10.20% Solution Correct Response 5.5\%. By how much does Beale's required return exceed Foley's required return? Do not round intermediate calculations. Round your answer to two decimal places. % how much does Beale's required return exceed Foley's required return? Do not round intermediate calculations. Round your answer to two decimal places. % An index fund will have a beta of 1.0 . If rm is 14.0% (given in the problem) and the riskfree rate is 5.5%, you can calculate the market risk premium (RPM) calculated as rmrRFR as follows: r14.0%8.50%=rRF+(RPM)b=5.5%+(RPM)1.0=RPM. Now, you can use the RPM, the rRF, and the two stocks' betas to calculate their required returns. Beale: rB=rRF+(RM)b=5.5%+(8.50%)1.4=5.5%+11.90%=17.40% Foley: rF=rRF+(RPM)b=5.5%+(8.50%)0.2=5.5%+1.70%=7.20%. The difference in their required returns is: 17.40%7.20%=10.20% Solution Correct Response 5.5\%. By how much does Beale's required return exceed Foley's required return? Do not round intermediate calculations. Round your answer to two decimal places. %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts