Question: PLEASE, DO NOT COPY AND PASTE ANY ANSWER FROM OTHER CHEGG POSTS Please show me all work so I can learn. Thanks! Prices for American

PLEASE, DO NOT COPY AND PASTE ANY ANSWER FROM OTHER CHEGG POSTS

Please show me all work so I can learn. Thanks!

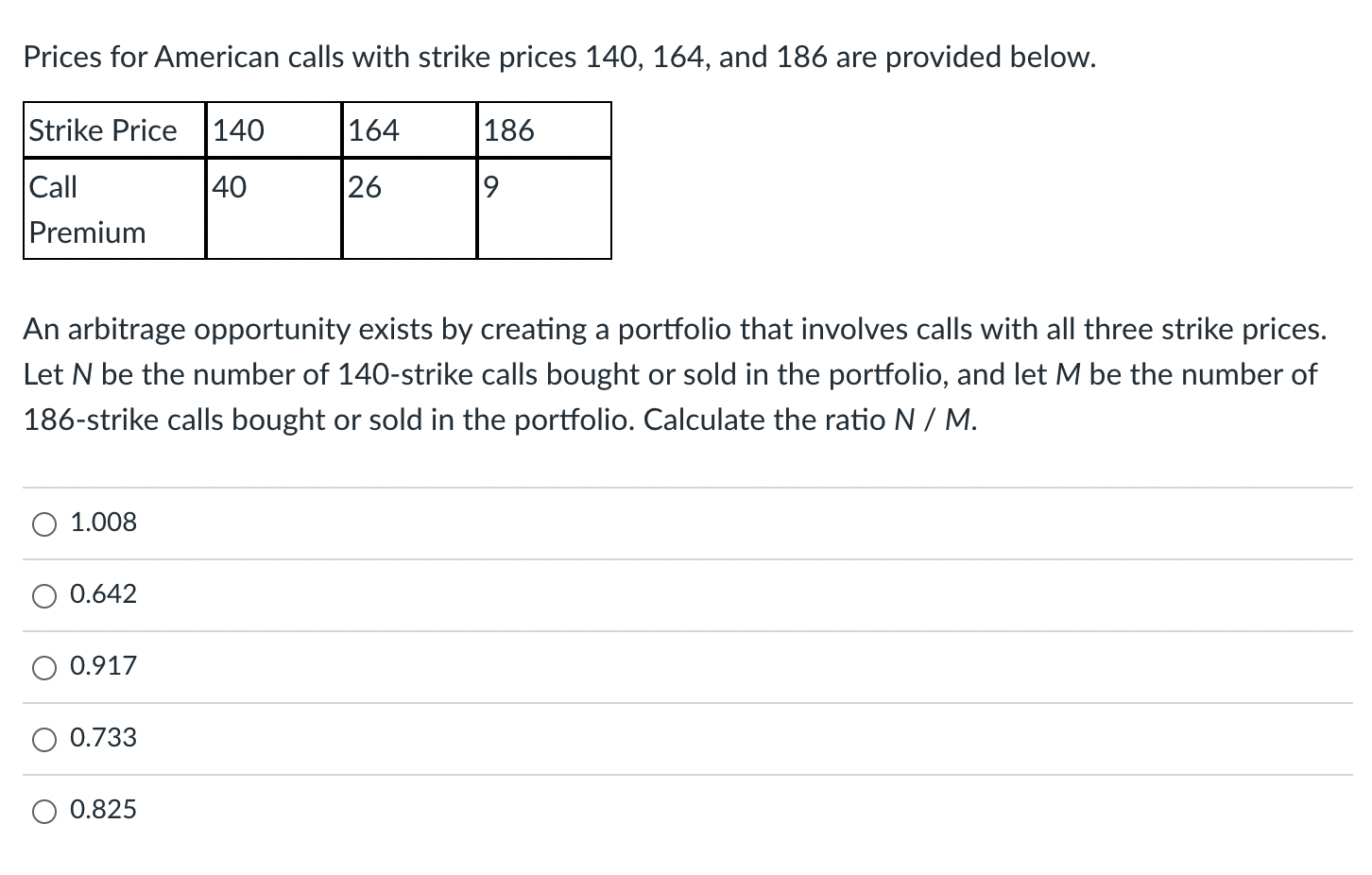

Prices for American calls with strike prices 140, 164, and 186 are provided below. Strike Price 140 164 186 40 26 9 Call Premium An arbitrage opportunity exists by creating a portfolio that involves calls with all three strike prices. Let N be the number of 140-strike calls bought or sold in the portfolio, and let M be the number of 186-strike calls bought or sold in the portfolio. Calculate the ratio N / M. 1.008 0.642 O 0.917 0.733 O 0.825 Prices for American calls with strike prices 140, 164, and 186 are provided below. Strike Price 140 164 186 40 26 9 Call Premium An arbitrage opportunity exists by creating a portfolio that involves calls with all three strike prices. Let N be the number of 140-strike calls bought or sold in the portfolio, and let M be the number of 186-strike calls bought or sold in the portfolio. Calculate the ratio N / M. 1.008 0.642 O 0.917 0.733 O 0.825

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts