Question: please help, and please show calculations so I can study for my final! thank you! You are in charge of the investment decisions of a

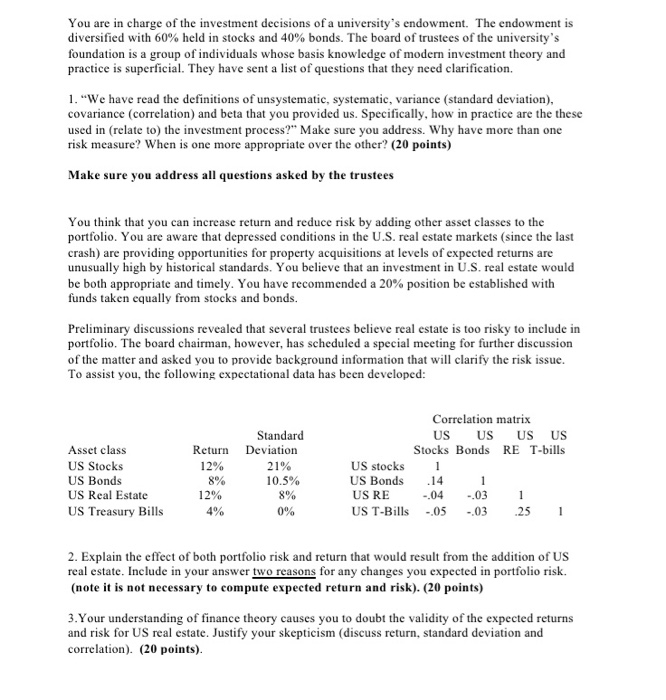

You are in charge of the investment decisions of a university's endowment. The endowment is diversified with 60% held in stocks and 40% bonds. The board of trustees of the university's foundation is a group of individuals whose basis knowledge of modern investment theory and practice is superficial. They have sent a list of questions that they need clarification. ad the definitions of unsystematic, systematic, variance (standard deviation), covariance (correlation) and beta that you provided us. Specifically, how in practice are the these used in (relate to the investment process?" Make sure you address. Why have more than one risk measure? When is one more appropriate over the other? (20 points) Make sure you address all questions asked by the trustees You think that you can increase return and reduce risk by adding other asset classes to the portfolio. You are aware that depressed conditions in the U.S. real estate markets (since the last crash) are providing opportunities for property acquisitions at levels of expected returns are unusually high by historical standards. You believe that an investment in U.S. real estate would be both appropriate and timely. You have recommended a 20% position be established with funds taken equally from stocks and bonds. Preliminary discussions revealed that several trustees believe real estate is too risky to include in portfolio. The board chairman, however, has scheduled a special meeting for further discussion of the matter and asked you to provide background information that will clarify the risk issue. To assist you, the following expectational data has been developed: Asset class US Stocks US Bonds US Real Estate US Treasury Bills Return 12% 8% 12% 4% Standard Deviation 21% 10.5% 8% 0% Correlation matrix US US US US Stocks Bonds RE T-bills US stocks 1 US Bonds .14 1 US RE -.04 03 1 US T-Bills -05 -03 25 1 2. Explain the effect of both portfolio risk and return that would result from the addition of US real estate. Include in your answer two reasons for any changes you expected in portfolio risk. (note it is not necessary to compute expected return and risk). (20 points) 3. Your understanding of finance theory causes you to doubt the validity of the expected returns and risk for US real estate. Justify your skepticism (discuss return, standard deviation and correlation). (20 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts