Question: please help create a master/reference table for Option #1 and #2 with all the required information needed to prepare a schedule. The ECC District is

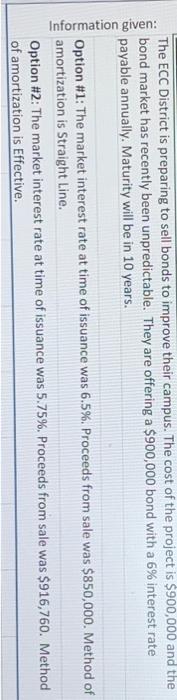

The ECC District is preparing to sell bonds to improve their campus. The cost of the project is $900,000 and the bond market has recently been unpredictable. They are offering a $900,000 bond with a 6% interest rate payable annually. Maturity will be in 10 years. Option \#1: The market interest rate at time of issuance was 6.5\%. Proceeds from sale was $850,000. Method of amortization is Straight Line. Option \#2: The market interest rate at time of issuance was 5.75\%. Proceeds from sale was $916,760. Method of amortization is Effective

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts