Question: The ECC District is preparing to sell bonds to improve their campus. The cost of the project is $ 9 0 0 , 0 0

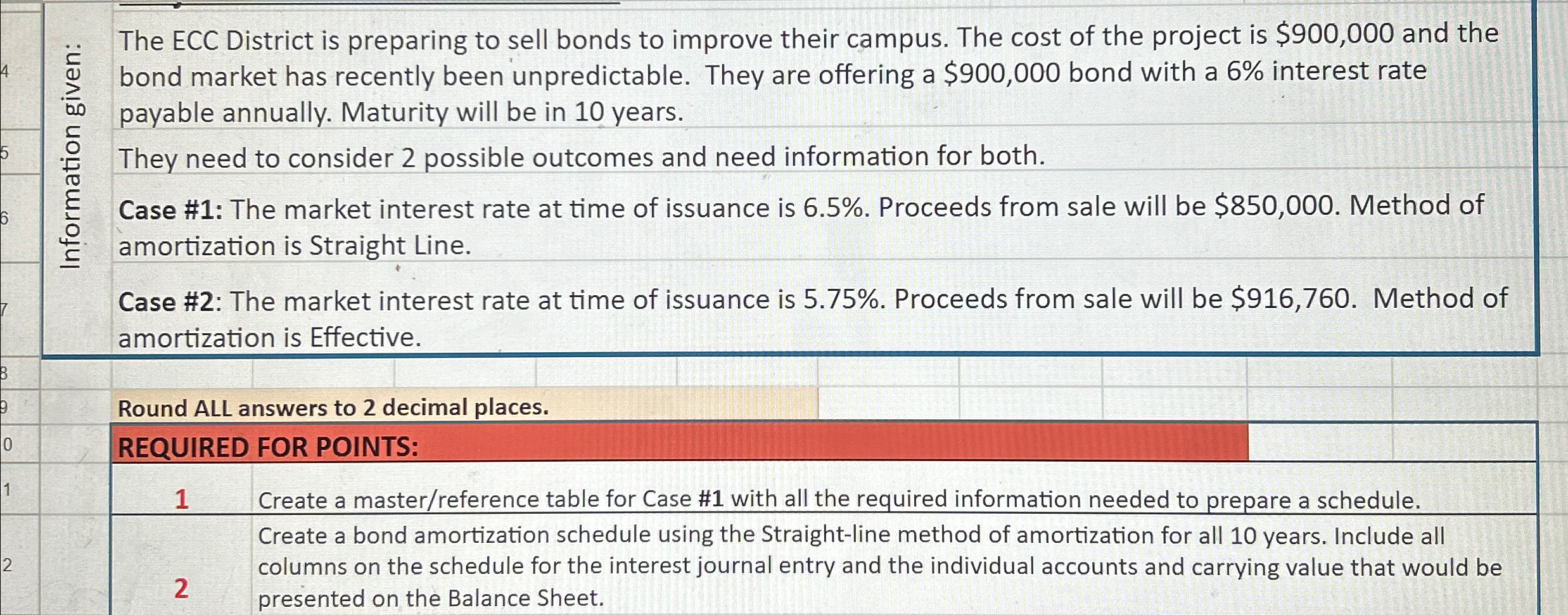

The ECC District is preparing to sell bonds to improve their campus. The cost of the project is $ and the bond market has recently been unpredictable. They are offering a $ bond with a interest rate payable annually. Maturity will be in years.

They need to consider possible outcomes and need information for both.

Case #: The market interest rate at time of issuance is Proceeds from sale will be $ Method of amortization is Straight Line.

Case #: The market interest rate at time of issuance is Proceeds from sale will be $ Method of amortization is Effective.

Round ALL answers to decimal places.

REQUIRED FOR POINTS:

Create a masterreference table for Case # with all the required information needed to prepare a schedule.

Create a bond amortization schedule using the Straightline method of amortization for all years. Include all

columns on the schedule for the interest journal entry and the individual accounts and carrying value that would be presented on the Balance Sheet.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock