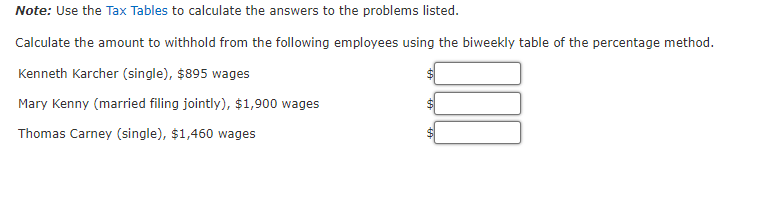

Question: please help, i am stuck on this problem. thanks Note: Use the Tax Tables to calculate the answers to the problems listed. Calculate the amount

please help, i am stuck on this problem. thanks

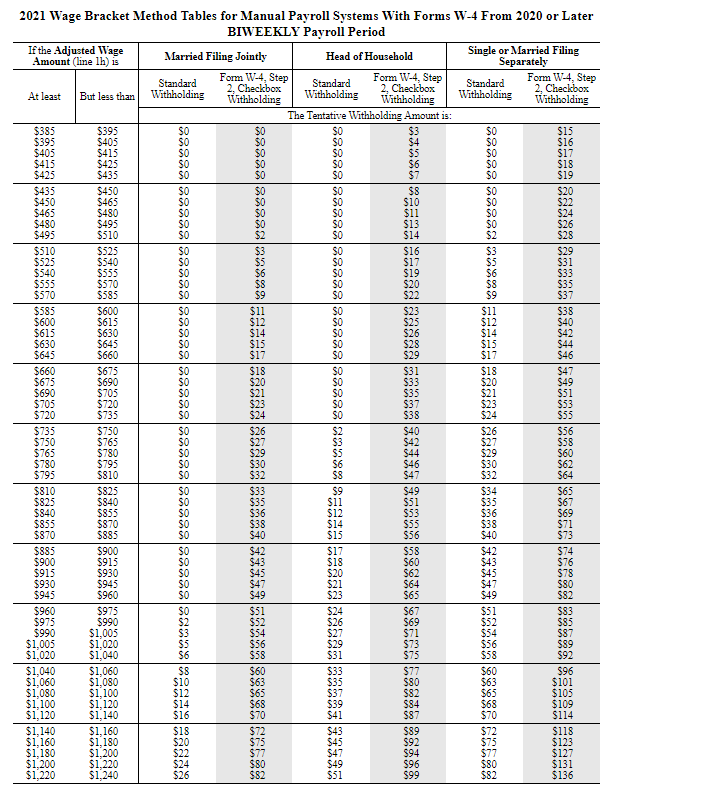

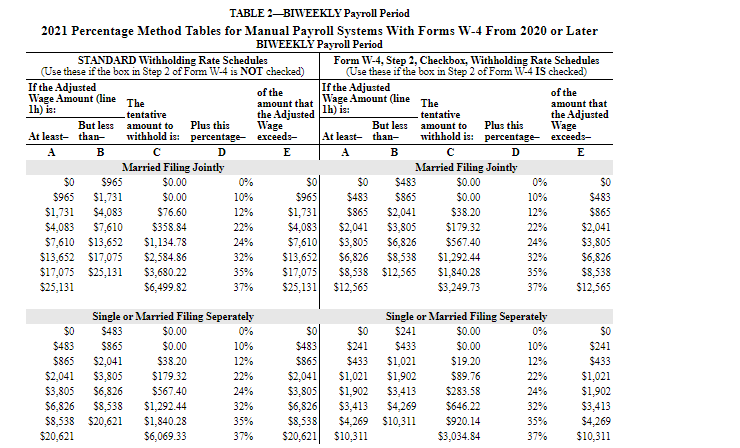

Note: Use the Tax Tables to calculate the answers to the problems listed. Calculate the amount to withhold from the following employees using the biweekly table of the percentage method. 2021 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later BIWEEKLY Payroll Period \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multicolumn{2}{|c|}{\begin{tabular}{l} If the Adjusted Wage \\ Amount (line lh) is \end{tabular}} & \multicolumn{2}{|c|}{ Married Filing Jointly } & \multicolumn{2}{|c|}{ Head of Household } & \multicolumn{2}{|c|}{\begin{tabular}{l} Single or Married Filing \\ Separately \end{tabular}} \\ \hline \multirow[t]{2}{*}{ At least } & \multirow[t]{2}{*}{ But less than } & \begin{tabular}{c} Standard \\ Withholding \end{tabular} & \begin{tabular}{c} Form W-4, Step \\ 2, Checkbox \\ Withholding \end{tabular} & \begin{tabular}{l} Standard \\ Withholding \end{tabular} & \begin{tabular}{c} Form W-4, Step \\ 2, Checkbox \\ Withholding \end{tabular} & \begin{tabular}{l} Standard \\ Withholding \end{tabular} & \begin{tabular}{c} Form W-4, Step \\ 2, Checkbox \\ Withholding \end{tabular} \\ \hline & & \multicolumn{6}{|c|}{ The Tentative Withholding Amount is: } \\ \hline \begin{tabular}{l} $385 \\ $395 \\ $405 \\ $415 \\ $425 \\ \end{tabular} & \begin{tabular}{l} $395 \\ $405 \\ $415 \\ $425 \\ $435 \\ \end{tabular} & \begin{tabular}{l} 0 \\ $0 \\ $0 \\ $0 \\ $0 \\ \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \\ \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $33 \\ $4 \\ $5 \\ $6 \\ $7 \\ \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $15 \\ $16 \\ $17 \\ $18 \\ $19 \\ \end{tabular} \\ \hline \begin{tabular}{l} $435 \\ $450 \\ $465 \\ $480 \\ $495 \end{tabular} & \begin{tabular}{l} $450 \\ $465 \\ $480 \\ $495 \\ $510 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $2 \end{tabular} & \begin{tabular}{l} \$0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{r} $8 \\ $10 \\ $11 \\ $13 \\ $14 \\ \end{tabular} & \begin{tabular}{l} \$0 \\ $0 \\ $0 \\ $0 \\ $2 \end{tabular} & \begin{tabular}{l} $20 \\ $22 \\ $24 \\ $26 \\ $28 \end{tabular} \\ \hline \begin{tabular}{l} $510 \\ $525 \\ $540 \\ $555 \\ $570 \\ \end{tabular} & \begin{tabular}{l} $525 \\ $540 \\ $555 \\ $570 \\ $585 \end{tabular} & \begin{tabular}{l} 0 \\ $0 \\ $0 \\ $0 \\ $0 \\ \end{tabular} & \begin{tabular}{l} $3 \\ $5 \\ $6 \\ $8 \\ $9 \\ \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $16 \\ $17 \\ $19 \\ $20 \\ $22 \\ \end{tabular} & \begin{tabular}{l} $33 \\ $5 \\ $6 \\ $8 \\ $9 \end{tabular} & \begin{tabular}{l} $29 \\ $31 \\ $33 \\ $35 \\ $37 \\ \end{tabular} \\ \hline \begin{tabular}{l} $585 \\ $600 \\ $615 \\ $630 \\ $645 \end{tabular} & \begin{tabular}{l} $600 \\ $615 \\ $630 \\ $645 \\ $660 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $11 \\ $12 \\ $14 \\ $15 \\ $17 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $23 \\ $25 \\ $26 \\ $28 \\ $29 \end{tabular} & \begin{tabular}{l} $11 \\ $12 \\ $14 \\ $15 \\ $17 \end{tabular} & \begin{tabular}{l} $38 \\ $40 \\ $42 \\ $44 \\ $46 \end{tabular} \\ \hline \begin{tabular}{l} $660 \\ $675 \\ $690 \\ $705 \\ $720 \\ \end{tabular} & \begin{tabular}{l} $675 \\ $690 \\ $705 \\ $720 \\ $735 \\ \end{tabular} & \begin{tabular}{l} 0 \\ $0 \\ $0 \\ $0 \\ $0 \\ \end{tabular} & \begin{tabular}{l} $18 \\ $20 \\ $21 \\ $23 \\ $24 \\ \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $31 \\ $33 \\ $35 \\ $37 \\ $38 \\ \end{tabular} & \begin{tabular}{l} $18 \\ $20 \\ $21 \\ $23 \\ $24 \\ \end{tabular} & \begin{tabular}{l} $47 \\ $49 \\ $51 \\ $53 \\ $55 \\ \end{tabular} \\ \hline \begin{tabular}{l} $735 \\ $750 \\ $765 \\ $780 \\ $795 \end{tabular} & \begin{tabular}{l} $750 \\ $765 \\ $780 \\ $795 \\ $810 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $26 \\ $27 \\ $29 \\ $30 \\ $32 \end{tabular} & \begin{tabular}{l} $2 \\ $3 \\ $5 \\ $6 \\ $8 \end{tabular} & \begin{tabular}{l} $40 \\ $42 \\ $44 \\ $46 \\ $47 \end{tabular} & \begin{tabular}{l} $26 \\ $27 \\ $29 \\ $30 \\ $32 \end{tabular} & \begin{tabular}{l} $56 \\ $58 \\ $60 \\ $62 \\ $64 \\ \end{tabular} \\ \hline \begin{tabular}{l} $810 \\ $825 \\ $840 \\ $855 \\ $870 \\ \end{tabular} & \begin{tabular}{l} $825 \\ $840 \\ $855 \\ $870 \\ $885 \end{tabular} & \begin{tabular}{l} 0 \\ $0 \\ $0 \\ $0 \\ $0 \\ \end{tabular} & \begin{tabular}{l} $33 \\ $35 \\ $36 \\ $38 \\ $40 \\ \end{tabular} & \begin{tabular}{r} $99 \\ $11 \\ $12 \\ $14 \\ $15 \\ \end{tabular} & \begin{tabular}{l} $49 \\ $51 \\ $53 \\ $55 \\ $56 \\ \end{tabular} & \begin{tabular}{l} $34 \\ $35 \\ $36 \\ $38 \\ $40 \\ \end{tabular} & \begin{tabular}{l} $65 \\ $67 \\ $69 \\ $71 \\ $73 \\ \end{tabular} \\ \hline \begin{tabular}{l} $885 \\ $900 \\ $915 \\ $930 \\ $945 \\ \end{tabular} & \begin{tabular}{l} $900 \\ $915 \\ $930 \\ $945 \\ $960 \end{tabular} & \begin{tabular}{l} 0 \\ $0 \\ $0 \\ $0 \\ $0 \\ \end{tabular} & \begin{tabular}{l} $42 \\ $43 \\ $45 \\ $47 \\ $49 \\ \end{tabular} & \begin{tabular}{l} $17 \\ $18 \\ $20 \\ $21 \\ $23 \end{tabular} & \begin{tabular}{l} $58 \\ $60 \\ $62 \\ $64 \\ $65 \\ \end{tabular} & \begin{tabular}{l} $42 \\ $43 \\ $45 \\ $47 \\ $49 \end{tabular} & \begin{tabular}{l} $74 \\ $76 \\ $78 \\ $80 \\ $82 \\ \end{tabular} \\ \hline \begin{tabular}{r} $960 \\ $975 \\ $990 \\ $1,005 \\ $1,020 \\ \end{tabular} & \begin{tabular}{r} $975 \\ $990 \\ $1,005 \\ $1,020 \\ $1,040 \\ \end{tabular} & \begin{tabular}{l} $0 \\ $2 \\ $3 \\ $5 \\ $6 \\ \end{tabular} & \begin{tabular}{l} $51 \\ $52 \\ $54 \\ $56 \\ $58 \\ \end{tabular} & \begin{tabular}{l} $24 \\ $26 \\ $27 \\ $29 \\ $31 \end{tabular} & \begin{tabular}{l} $67 \\ $69 \\ $71 \\ $73 \\ $75 \\ \end{tabular} & \begin{tabular}{l} $51 \\ $52 \\ $54 \\ $56 \\ $58 \\ \end{tabular} & \begin{tabular}{l} $83 \\ $85 \\ $87 \\ $89 \\ $92 \\ \end{tabular} \\ \hline \begin{tabular}{l} $1,040 \\ $1,060 \\ $1,080 \\ $1,100 \\ $1,120 \\ \end{tabular} & \begin{tabular}{l} $1,060 \\ $1,080 \\ $1,100 \\ $1,120 \\ $1,140 \\ \end{tabular} & \begin{tabular}{r} $8 \\ $10 \\ $12 \\ $14 \\ $16 \\ \end{tabular} & \begin{tabular}{l} $60 \\ $63 \\ $65 \\ $68 \\ $70 \\ \end{tabular} & \begin{tabular}{l} $33 \\ $35 \\ $37 \\ $39 \\ $41 \end{tabular} & \begin{tabular}{l} $77 \\ $80 \\ $82 \\ $84 \\ $87 \\ \end{tabular} & \begin{tabular}{l} $60 \\ $63 \\ $65 \\ $68 \\ $70 \\ \end{tabular} & \begin{tabular}{r} $96 \\ $101 \\ $105 \\ $109 \\ $114 \\ \end{tabular} \\ \hline \begin{tabular}{l} $1,140 \\ $1,160 \\ $1,180 \\ $1,200 \\ $1,220 \end{tabular} & \begin{tabular}{l} $1,160 \\ $1,180 \\ $1,200 \\ $1,220 \\ $1,240 \end{tabular} & \begin{tabular}{l} $18 \\ $20 \\ $22 \\ $24 \\ $26 \end{tabular} & \begin{tabular}{l} $72 \\ $75 \\ $77 \\ $80 \\ $82 \end{tabular} & \begin{tabular}{l} $43 \\ $45 \\ $47 \\ $49 \\ $51 \end{tabular} & \begin{tabular}{l} $99 \\ $92 \\ $94 \\ $96 \\ $99 \end{tabular} & \begin{tabular}{l} $72 \\ $75 \\ $77 \\ $80 \\ $82 \end{tabular} & \begin{tabular}{l} $118 \\ $123 \\ $127 \\ $131 \\ $136 \end{tabular} \\ \hline \end{tabular} TABLE 2-BIWEEKLY Payroll Period 2021 Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later BIWEEKLY Payroll Period \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{\begin{tabular}{l} STANDARD Withholding Rate Schedules \\ (Use these if the box in Step 2 of Form W-4 is NOT checked) \end{tabular}} & \multicolumn{5}{|c|}{\begin{tabular}{c} Form W-4, Step 2, Checkbox, Withholding Rate Schedules \\ (Use these if the box in Step 2 of Form W-4 IS checked) \end{tabular}} \\ \hline \multicolumn{2}{|c|}{\begin{tabular}{l} If the Adjusted \\ Wage Amount (line \\ lh) is: \end{tabular}} & \multirow{2}{*}{\begin{tabular}{l} The \\ -tentative \\ amount to \\ withhold is: \end{tabular}} & \multirow[b]{2}{*}{\begin{tabular}{l} Plus this \\ percentage- \end{tabular}} & \multirow{2}{*}{\begin{tabular}{l} of the \\ amount that \\ the Adjusted \\ Wage \\ exceeds- \end{tabular}} & \multicolumn{2}{|c|}{\begin{tabular}{l} If the Adjusted \\ Wage Amount (line \\ lh) is: \end{tabular}} & \multirow{2}{*}{\begin{tabular}{l} The \\ - tentative \\ amount to \\ withhold is: \end{tabular}} & \multirow[b]{2}{*}{\begin{tabular}{l} Plus this \\ percentage- \end{tabular}} & \multirow{2}{*}{\begin{tabular}{l} of the \\ amount that \\ the Adjusted \\ Wage \\ exceeds- \end{tabular}} \\ \hline At least- & \begin{tabular}{l} But less \\ than- \end{tabular} & & & & At least- & \begin{tabular}{l} But less \\ than- \end{tabular} & & & \\ \hline A & B & C & D & E & A & B & C & D & E \\ \hline \multicolumn{5}{|c|}{ Married Filing Jointly } & \multicolumn{5}{|c|}{ Married Filing Jointly } \\ \hline$0 & $965 & $0.00 & 0% & \$o & $0 & $483 & $0.00 & 0% & so \\ \hline$965 & $1,731 & $0.00 & 10% & $965 & $483 & $865 & $0.00 & 10% & $483 \\ \hline$1,731 & $4.083 & $76.60 & 12% & $1,731 & $865 & $2,041 & $38.20 & 12% & $86j \\ \hline$4,083 & $7,610 & $358.84 & 22% & $4,083 & $2,041 & $3,805 & $179.32 & 22% & $2,041 \\ \hline$7,610 & $13,652 & $1,134.78 & 24% & $7,610 & $3,805 & $6,826 & $567.40 & 24% & $3,805 \\ \hline$13,652 & $17,075 & $2,584.86 & 32% & $13,652 & $6,826 & $8,538 & $1,292.44 & 32% & $6,826 \\ \hline$17,075 & $25,131 & $3,680.22 & 35% & $17,075 & $8,538 & $12,565 & $1,840.28 & 35% & $8,538 \\ \hline$25,131 & & $6,499.82 & 37% & $25,131 & $12,565 & & $3,249.73 & 37% & $12,563 \\ \hline \multicolumn{5}{|c|}{ Single or Married Filing Seperately } & \multicolumn{5}{|c|}{ Single or Married Filing Seperately } \\ \hline$0 & $483 & $0.00 & 0% & \$o & $0 & $241 & $0.00 & 0% & so \\ \hline$483 & $865 & $0.00 & 10% & $483 & $241 & $433 & $0.00 & 10% & $241 \\ \hline$865 & $2,041 & $38.20 & 12% & $865 & $433 & $1,021 & $19.20 & 12% & $433 \\ \hline$2,041 & $3,805 & $179.32 & 22% & $2,041 & $1,021 & $1,902 & $89.76 & 22% & $1,021 \\ \hline$3,805 & $6,826 & $567.40 & 24% & $3,805 & $1,902 & $3,413 & $283.58 & 24% & $1,902 \\ \hline$6,826 & $8,538 & $1,292.44 & 32% & $6,826 & $3,413 & $4,269 & $646.22 & 32% & $3,413 \\ \hline$8,538 & $20,621 & $1,840.28 & 35% & $8,538 & $4,269 & $10,311 & $970.22 & 35% & $4,269 \\ \hline$20,621 & & $6,069.33 & 37% & $20,621 & $10,311 & & $3,034.84 & 37% & $10,311 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts