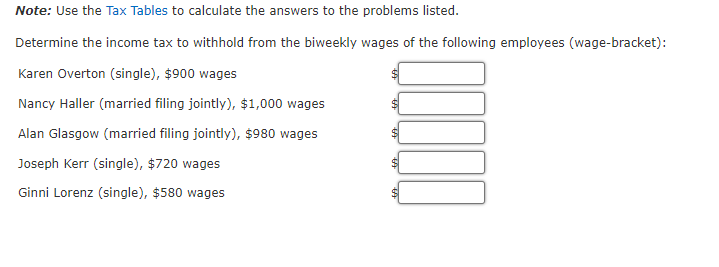

Question: please help, i am stuck on this question. thanks Note: Use the Tax Tables to calculate the answers to the problems listed. Determine the income

please help, i am stuck on this question. thanks

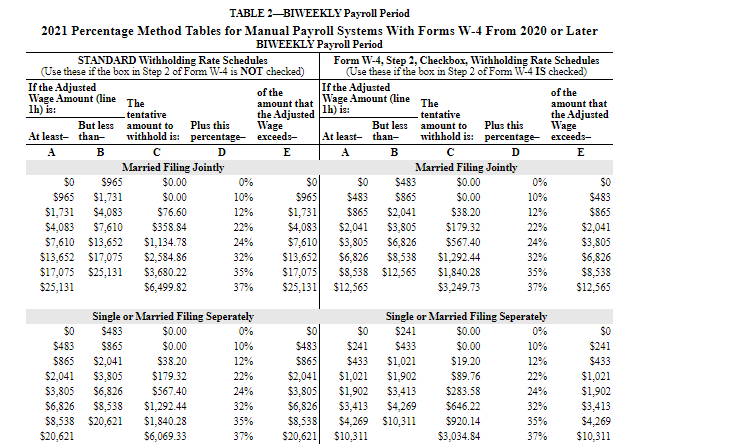

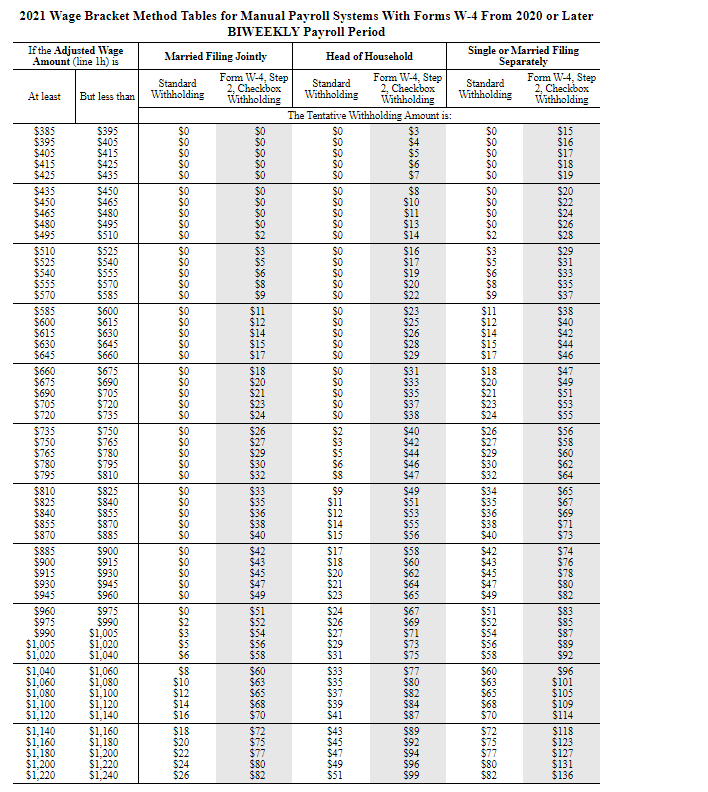

Note: Use the Tax Tables to calculate the answers to the problems listed. Determine the income tax to withhold from the biweekly wages of the following employees (wage-bracket): TABLE 2-BIWEEKLY Payroll Period 2021 Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later BIWEEKLY Payroll Period \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{\begin{tabular}{l} STANDARD Withholding Rate Schedules \\ (Use these if the box in Step 2 of Form W-4 is NOT checked) \end{tabular}} & \multicolumn{5}{|c|}{\begin{tabular}{c} Form W-4, Step 2, Checkbox, Withholding Rate Schedules \\ (Use these if the box in Step 2 of Form W-4 IS checked) \end{tabular}} \\ \hline \multicolumn{2}{|c|}{\begin{tabular}{l} If the Adjusted \\ Wage Amount (line \\ lh) is: \end{tabular}} & \multirow{2}{*}{\begin{tabular}{l} The \\ -tentative \\ amount to \\ withhold is: \end{tabular}} & \multirow[b]{2}{*}{\begin{tabular}{l} Plus this \\ percentage- \end{tabular}} & \multirow{2}{*}{\begin{tabular}{l} of the \\ amount that \\ the Adjusted \\ Wage \\ exceeds- \end{tabular}} & \multicolumn{2}{|c|}{\begin{tabular}{l} If the Adjusted \\ Wage Amount (line \\ lh) is: \end{tabular}} & \multirow{2}{*}{\begin{tabular}{l} The \\ - tentative \\ amount to \\ withhold is: \end{tabular}} & \multirow[b]{2}{*}{\begin{tabular}{l} Plus this \\ percentage- \end{tabular}} & \multirow{2}{*}{\begin{tabular}{l} of the \\ amount that \\ the Adjusted \\ Wage \\ exceeds- \end{tabular}} \\ \hline At least- & \begin{tabular}{l} But less \\ than- \end{tabular} & & & & At least- & \begin{tabular}{l} But less \\ than- \end{tabular} & & & \\ \hline A & B & C & D & E & A & B & C & D & E \\ \hline \multicolumn{5}{|c|}{ Married Filing Jointly } & \multicolumn{5}{|c|}{ Married Filing Jointly } \\ \hline$0 & $965 & $0.00 & 0% & \$o & $0 & $483 & $0.00 & 0% & so \\ \hline$965 & $1,731 & $0.00 & 10% & $965 & $483 & $865 & $0.00 & 10% & $483 \\ \hline$1,731 & $4.083 & $76.60 & 12% & $1,731 & $865 & $2,041 & $38.20 & 12% & $86j \\ \hline$4,083 & $7,610 & $358.84 & 22% & $4,083 & $2,041 & $3,805 & $179.32 & 22% & $2,041 \\ \hline$7,610 & $13,652 & $1,134.78 & 24% & $7,610 & $3,805 & $6,826 & $567.40 & 24% & $3,805 \\ \hline$13,652 & $17,075 & $2,584.86 & 32% & $13,652 & $6,826 & $8,538 & $1,292.44 & 32% & $6,826 \\ \hline$17,075 & $25,131 & $3,680.22 & 35% & $17,075 & $8,538 & $12,565 & $1,840.28 & 35% & $8,538 \\ \hline$25,131 & & $6,499.82 & 37% & $25,131 & $12,565 & & $3,249.73 & 37% & $12,563 \\ \hline \multicolumn{5}{|c|}{ Single or Married Filing Seperately } & \multicolumn{5}{|c|}{ Single or Married Filing Seperately } \\ \hline$0 & $483 & $0.00 & 0% & \$o & $0 & $241 & $0.00 & 0% & so \\ \hline$483 & $865 & $0.00 & 10% & $483 & $241 & $433 & $0.00 & 10% & $241 \\ \hline$865 & $2,041 & $38.20 & 12% & $865 & $433 & $1,021 & $19.20 & 12% & $433 \\ \hline$2,041 & $3,805 & $179.32 & 22% & $2,041 & $1,021 & $1,902 & $89.76 & 22% & $1,021 \\ \hline$3,805 & $6,826 & $567.40 & 24% & $3,805 & $1,902 & $3,413 & $283.58 & 24% & $1,902 \\ \hline$6,826 & $8,538 & $1,292.44 & 32% & $6,826 & $3,413 & $4,269 & $646.22 & 32% & $3,413 \\ \hline$8,538 & $20,621 & $1,840.28 & 35% & $8,538 & $4,269 & $10,311 & $970.22 & 35% & $4,269 \\ \hline$20,621 & & $6,069.33 & 37% & $20,621 & $10,311 & & $3,034.84 & 37% & $10,311 \\ \hline \end{tabular} 2021 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later BIWEEKLY Payroll Period \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multicolumn{2}{|c|}{\begin{tabular}{l} If the Adjusted Wage \\ Amount (line lh) is \end{tabular}} & \multicolumn{2}{|c|}{ Married Filing Jointly } & \multicolumn{2}{|c|}{ Head of Household } & \multicolumn{2}{|c|}{\begin{tabular}{l} Single or Married Filing \\ Separately \end{tabular}} \\ \hline \multirow[t]{2}{*}{ At least } & \multirow[t]{2}{*}{ But less than } & \begin{tabular}{c} Standard \\ Withholding \end{tabular} & \begin{tabular}{c} Form W-4, Step \\ 2, Checkbox \\ Withholding \end{tabular} & \begin{tabular}{l} Standard \\ Withholding \end{tabular} & \begin{tabular}{c} Form W-4, Step \\ 2, Checkbox \\ Withholding \end{tabular} & \begin{tabular}{l} Standard \\ Withholding \end{tabular} & \begin{tabular}{c} Form W-4, Step \\ 2, Checkbox \\ Withholding \end{tabular} \\ \hline & & \multicolumn{6}{|c|}{ The Tentative Withholding Amount is: } \\ \hline \begin{tabular}{l} $385 \\ $395 \\ $405 \\ $415 \\ $425 \\ \end{tabular} & \begin{tabular}{l} $395 \\ $405 \\ $415 \\ $425 \\ $435 \\ \end{tabular} & \begin{tabular}{l} 0 \\ $0 \\ $0 \\ $0 \\ $0 \\ \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \\ \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $33 \\ $4 \\ $5 \\ $6 \\ $7 \\ \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $15 \\ $16 \\ $17 \\ $18 \\ $19 \\ \end{tabular} \\ \hline \begin{tabular}{l} $435 \\ $450 \\ $465 \\ $480 \\ $495 \end{tabular} & \begin{tabular}{l} $450 \\ $465 \\ $480 \\ $495 \\ $510 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $2 \end{tabular} & \begin{tabular}{l} \$0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{r} $8 \\ $10 \\ $11 \\ $13 \\ $14 \\ \end{tabular} & \begin{tabular}{l} \$0 \\ $0 \\ $0 \\ $0 \\ $2 \end{tabular} & \begin{tabular}{l} $20 \\ $22 \\ $24 \\ $26 \\ $28 \end{tabular} \\ \hline \begin{tabular}{l} $510 \\ $525 \\ $540 \\ $555 \\ $570 \\ \end{tabular} & \begin{tabular}{l} $525 \\ $540 \\ $555 \\ $570 \\ $585 \end{tabular} & \begin{tabular}{l} 0 \\ $0 \\ $0 \\ $0 \\ $0 \\ \end{tabular} & \begin{tabular}{l} $3 \\ $5 \\ $6 \\ $8 \\ $9 \\ \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $16 \\ $17 \\ $19 \\ $20 \\ $22 \\ \end{tabular} & \begin{tabular}{l} $33 \\ $5 \\ $6 \\ $8 \\ $9 \end{tabular} & \begin{tabular}{l} $29 \\ $31 \\ $33 \\ $35 \\ $37 \\ \end{tabular} \\ \hline \begin{tabular}{l} $585 \\ $600 \\ $615 \\ $630 \\ $645 \end{tabular} & \begin{tabular}{l} $600 \\ $615 \\ $630 \\ $645 \\ $660 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $11 \\ $12 \\ $14 \\ $15 \\ $17 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $23 \\ $25 \\ $26 \\ $28 \\ $29 \end{tabular} & \begin{tabular}{l} $11 \\ $12 \\ $14 \\ $15 \\ $17 \end{tabular} & \begin{tabular}{l} $38 \\ $40 \\ $42 \\ $44 \\ $46 \end{tabular} \\ \hline \begin{tabular}{l} $660 \\ $675 \\ $690 \\ $705 \\ $720 \\ \end{tabular} & \begin{tabular}{l} $675 \\ $690 \\ $705 \\ $720 \\ $735 \\ \end{tabular} & \begin{tabular}{l} 0 \\ $0 \\ $0 \\ $0 \\ $0 \\ \end{tabular} & \begin{tabular}{l} $18 \\ $20 \\ $21 \\ $23 \\ $24 \\ \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $31 \\ $33 \\ $35 \\ $37 \\ $38 \\ \end{tabular} & \begin{tabular}{l} $18 \\ $20 \\ $21 \\ $23 \\ $24 \\ \end{tabular} & \begin{tabular}{l} $47 \\ $49 \\ $51 \\ $53 \\ $55 \\ \end{tabular} \\ \hline \begin{tabular}{l} $735 \\ $750 \\ $765 \\ $780 \\ $795 \end{tabular} & \begin{tabular}{l} $750 \\ $765 \\ $780 \\ $795 \\ $810 \end{tabular} & \begin{tabular}{l} $0 \\ $0 \\ $0 \\ $0 \\ $0 \end{tabular} & \begin{tabular}{l} $26 \\ $27 \\ $29 \\ $30 \\ $32 \end{tabular} & \begin{tabular}{l} $2 \\ $3 \\ $5 \\ $6 \\ $8 \end{tabular} & \begin{tabular}{l} $40 \\ $42 \\ $44 \\ $46 \\ $47 \end{tabular} & \begin{tabular}{l} $26 \\ $27 \\ $29 \\ $30 \\ $32 \end{tabular} & \begin{tabular}{l} $56 \\ $58 \\ $60 \\ $62 \\ $64 \\ \end{tabular} \\ \hline \begin{tabular}{l} $810 \\ $825 \\ $840 \\ $855 \\ $870 \\ \end{tabular} & \begin{tabular}{l} $825 \\ $840 \\ $855 \\ $870 \\ $885 \end{tabular} & \begin{tabular}{l} 0 \\ $0 \\ $0 \\ $0 \\ $0 \\ \end{tabular} & \begin{tabular}{l} $33 \\ $35 \\ $36 \\ $38 \\ $40 \\ \end{tabular} & \begin{tabular}{r} $99 \\ $11 \\ $12 \\ $14 \\ $15 \\ \end{tabular} & \begin{tabular}{l} $49 \\ $51 \\ $53 \\ $55 \\ $56 \\ \end{tabular} & \begin{tabular}{l} $34 \\ $35 \\ $36 \\ $38 \\ $40 \\ \end{tabular} & \begin{tabular}{l} $65 \\ $67 \\ $69 \\ $71 \\ $73 \\ \end{tabular} \\ \hline \begin{tabular}{l} $885 \\ $900 \\ $915 \\ $930 \\ $945 \\ \end{tabular} & \begin{tabular}{l} $900 \\ $915 \\ $930 \\ $945 \\ $960 \end{tabular} & \begin{tabular}{l} 0 \\ $0 \\ $0 \\ $0 \\ $0 \\ \end{tabular} & \begin{tabular}{l} $42 \\ $43 \\ $45 \\ $47 \\ $49 \\ \end{tabular} & \begin{tabular}{l} $17 \\ $18 \\ $20 \\ $21 \\ $23 \end{tabular} & \begin{tabular}{l} $58 \\ $60 \\ $62 \\ $64 \\ $65 \\ \end{tabular} & \begin{tabular}{l} $42 \\ $43 \\ $45 \\ $47 \\ $49 \end{tabular} & \begin{tabular}{l} $74 \\ $76 \\ $78 \\ $80 \\ $82 \\ \end{tabular} \\ \hline \begin{tabular}{r} $960 \\ $975 \\ $990 \\ $1,005 \\ $1,020 \\ \end{tabular} & \begin{tabular}{r} $975 \\ $990 \\ $1,005 \\ $1,020 \\ $1,040 \\ \end{tabular} & \begin{tabular}{l} $0 \\ $2 \\ $3 \\ $5 \\ $6 \\ \end{tabular} & \begin{tabular}{l} $51 \\ $52 \\ $54 \\ $56 \\ $58 \\ \end{tabular} & \begin{tabular}{l} $24 \\ $26 \\ $27 \\ $29 \\ $31 \end{tabular} & \begin{tabular}{l} $67 \\ $69 \\ $71 \\ $73 \\ $75 \\ \end{tabular} & \begin{tabular}{l} $51 \\ $52 \\ $54 \\ $56 \\ $58 \\ \end{tabular} & \begin{tabular}{l} $83 \\ $85 \\ $87 \\ $89 \\ $92 \\ \end{tabular} \\ \hline \begin{tabular}{l} $1,040 \\ $1,060 \\ $1,080 \\ $1,100 \\ $1,120 \\ \end{tabular} & \begin{tabular}{l} $1,060 \\ $1,080 \\ $1,100 \\ $1,120 \\ $1,140 \\ \end{tabular} & \begin{tabular}{r} $8 \\ $10 \\ $12 \\ $14 \\ $16 \\ \end{tabular} & \begin{tabular}{l} $60 \\ $63 \\ $65 \\ $68 \\ $70 \\ \end{tabular} & \begin{tabular}{l} $33 \\ $35 \\ $37 \\ $39 \\ $41 \end{tabular} & \begin{tabular}{l} $77 \\ $80 \\ $82 \\ $84 \\ $87 \\ \end{tabular} & \begin{tabular}{l} $60 \\ $63 \\ $65 \\ $68 \\ $70 \\ \end{tabular} & \begin{tabular}{r} $96 \\ $101 \\ $105 \\ $109 \\ $114 \\ \end{tabular} \\ \hline \begin{tabular}{l} $1,140 \\ $1,160 \\ $1,180 \\ $1,200 \\ $1,220 \end{tabular} & \begin{tabular}{l} $1,160 \\ $1,180 \\ $1,200 \\ $1,220 \\ $1,240 \end{tabular} & \begin{tabular}{l} $18 \\ $20 \\ $22 \\ $24 \\ $26 \end{tabular} & \begin{tabular}{l} $72 \\ $75 \\ $77 \\ $80 \\ $82 \end{tabular} & \begin{tabular}{l} $43 \\ $45 \\ $47 \\ $49 \\ $51 \end{tabular} & \begin{tabular}{l} $99 \\ $92 \\ $94 \\ $96 \\ $99 \end{tabular} & \begin{tabular}{l} $72 \\ $75 \\ $77 \\ $80 \\ $82 \end{tabular} & \begin{tabular}{l} $118 \\ $123 \\ $127 \\ $131 \\ $136 \end{tabular} \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts