Question: please help it is visible, thanks 5. Consider the two (excess return) index model regression results for A and B: RA = 1% + 1.2RM

please help it is visible, thanks

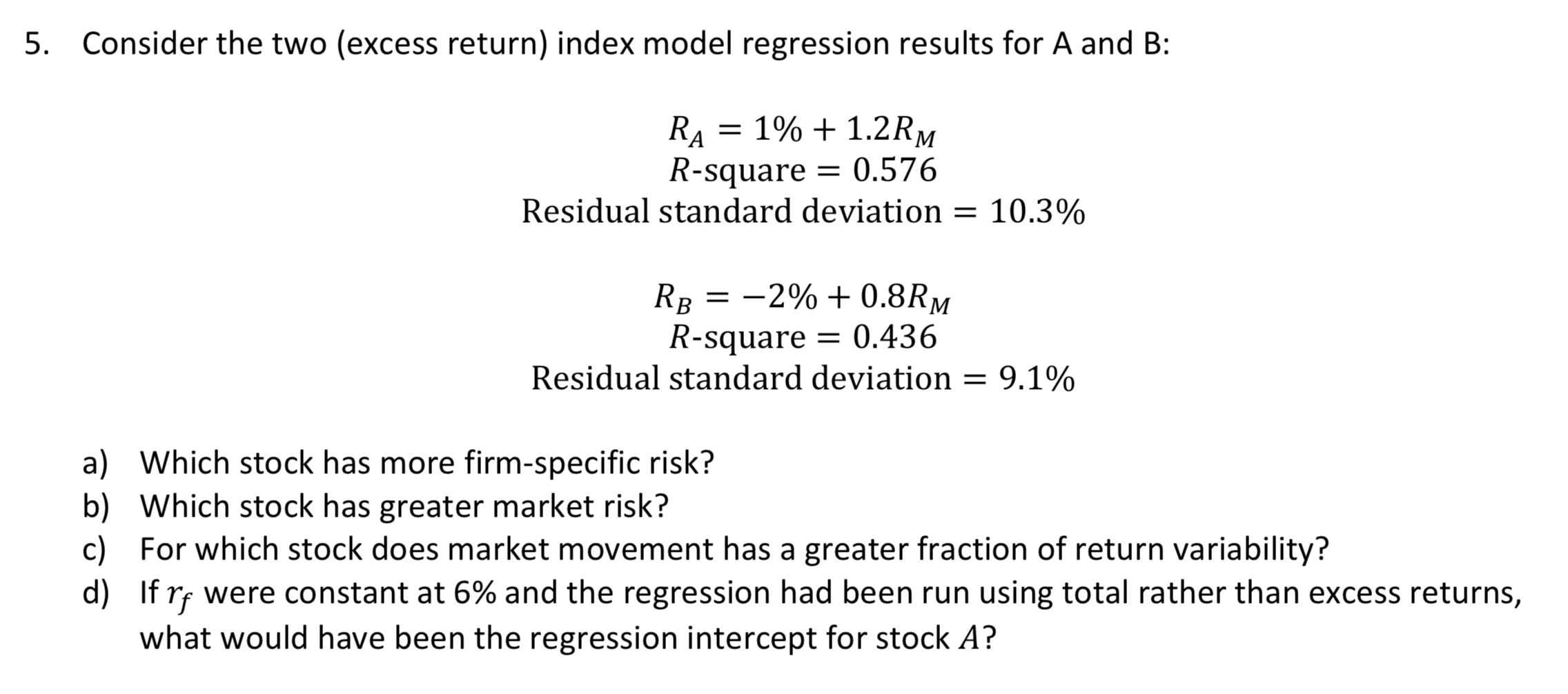

5. Consider the two (excess return) index model regression results for A and B: RA = 1% + 1.2RM R-square = 0.576 Residual standard deviation = 10.3% RB = -2% + 0.8RM | R-square = 0.436 Residual standard deviation = 9.1% a) Which stock has more firm-specific risk? b) Which stock has greater market risk? c) For which stock does market movement has a greater fraction of return variability? d) If re were constant at 6% and the regression had been run using total rather than excess returns, what would have been the regression intercept for stock A? 5. Consider the two (excess return) index model regression results for A and B: RA = 1% + 1.2RM R-square = 0.576 Residual standard deviation = 10.3% RB = -2% + 0.8RM | R-square = 0.436 Residual standard deviation = 9.1% a) Which stock has more firm-specific risk? b) Which stock has greater market risk? c) For which stock does market movement has a greater fraction of return variability? d) If re were constant at 6% and the regression had been run using total rather than excess returns, what would have been the regression intercept for stock A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts