Question: PLEASE HELP ................. ITS URGENT ........................ PLEASE .................... DO (b) PLEASE ...................... Q2. Consider an at-the-money 6-month American call option on a non dividend paying

PLEASE HELP ................. ITS URGENT ........................ PLEASE ....................

DO (b) PLEASE ......................

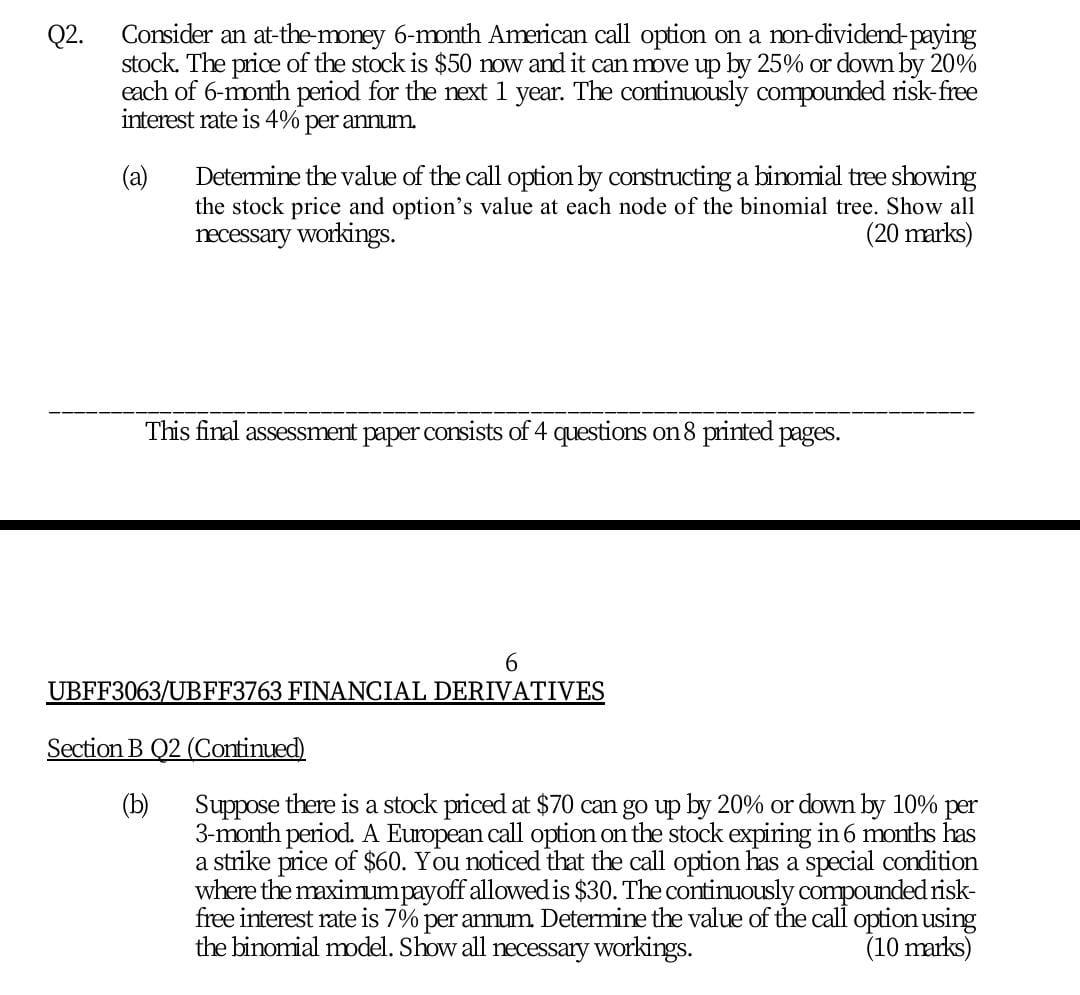

Q2. Consider an at-the-money 6-month American call option on a non dividend paying stock. The price of the stock is $50 now and it can move up by 25% or down by 20% each of 6-month period for the next 1 year. The continuously compounded risk-free interest rate is 4% per annum (a) Determine the value of the call option by constructing a binomial tree showing the stock price and option's value at each node of the binomial tree. Show all necessary workings. (20 marks) This final assessment paper consists of 4 questions on 8 printed pages. 6 UBFF3063/UBFF3763 FINANCIAL DERIVATIVES Section B 02 (Continued) Suppose there is a stock priced at $70 can go up by 20% or down by 10% per 3-month period. A European call option on the stock expiring in 6 months has a strike price of $60. You noticed that the call option has a special condition where the maximumpayoff allowedis $30. The continuously compounded risk- free interest rate is 7% per annum Determine the value of the call option using the binomial model. Show all necessary workings. (10 marks) Q2. Consider an at-the-money 6-month American call option on a non dividend paying stock. The price of the stock is $50 now and it can move up by 25% or down by 20% each of 6-month period for the next 1 year. The continuously compounded risk-free interest rate is 4% per annum (a) Determine the value of the call option by constructing a binomial tree showing the stock price and option's value at each node of the binomial tree. Show all necessary workings. (20 marks) This final assessment paper consists of 4 questions on 8 printed pages. 6 UBFF3063/UBFF3763 FINANCIAL DERIVATIVES Section B 02 (Continued) Suppose there is a stock priced at $70 can go up by 20% or down by 10% per 3-month period. A European call option on the stock expiring in 6 months has a strike price of $60. You noticed that the call option has a special condition where the maximumpayoff allowedis $30. The continuously compounded risk- free interest rate is 7% per annum Determine the value of the call option using the binomial model. Show all necessary workings. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts