Question: Please help me answer the blue cells. The other expert answers have been incorrect, thank you. Shrieves Hospital Ltd. is considering adding a new line

Please help me answer the blue cells. The other expert answers have been incorrect, thank you.

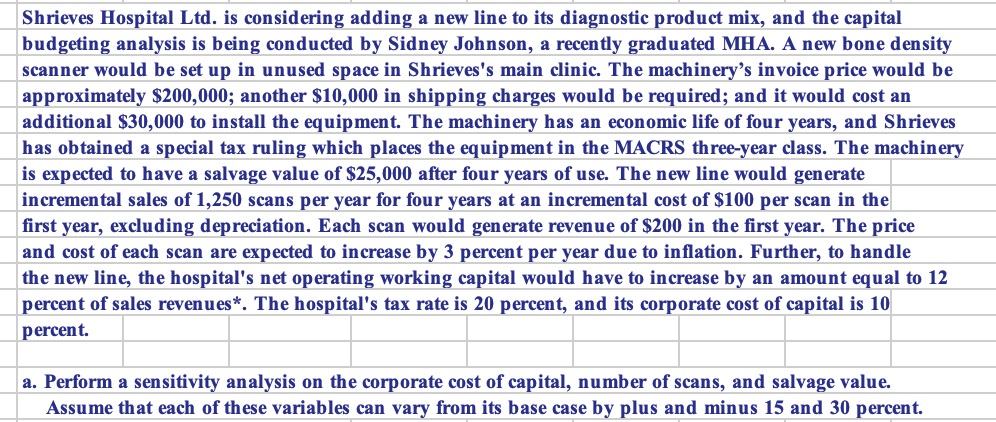

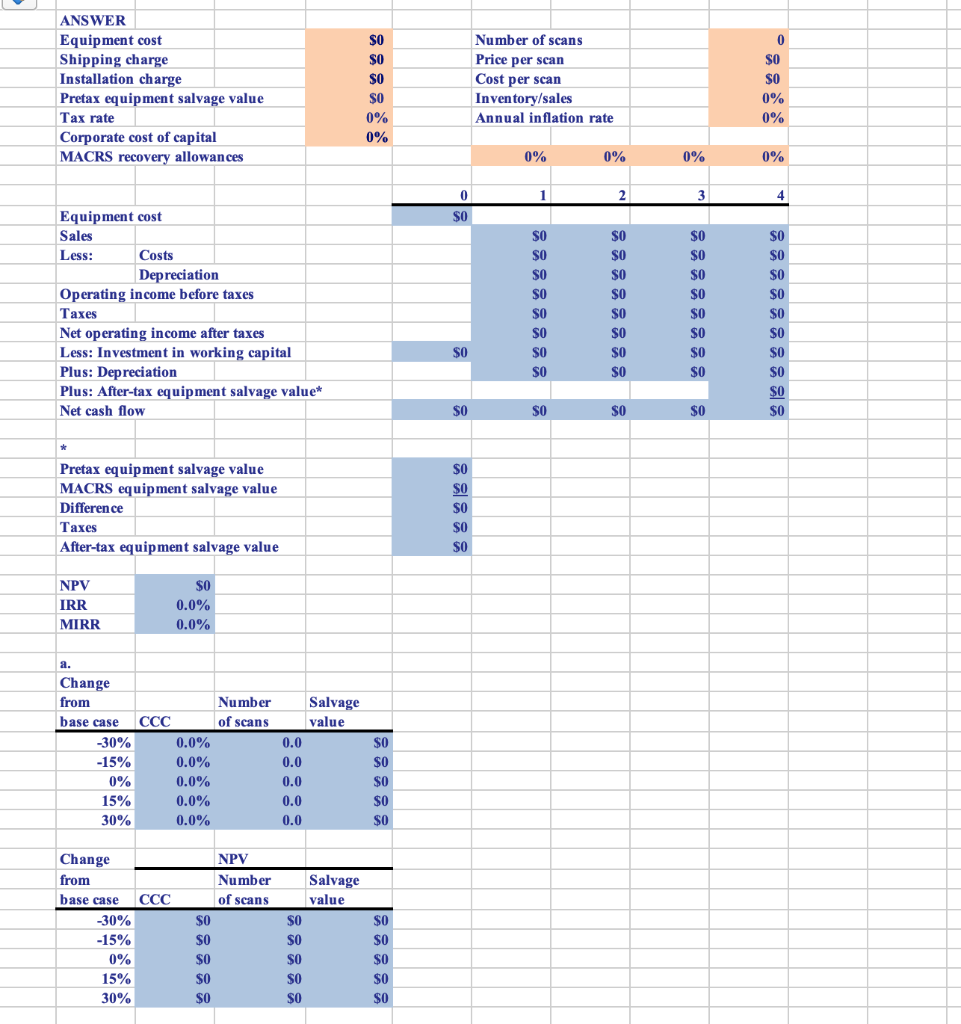

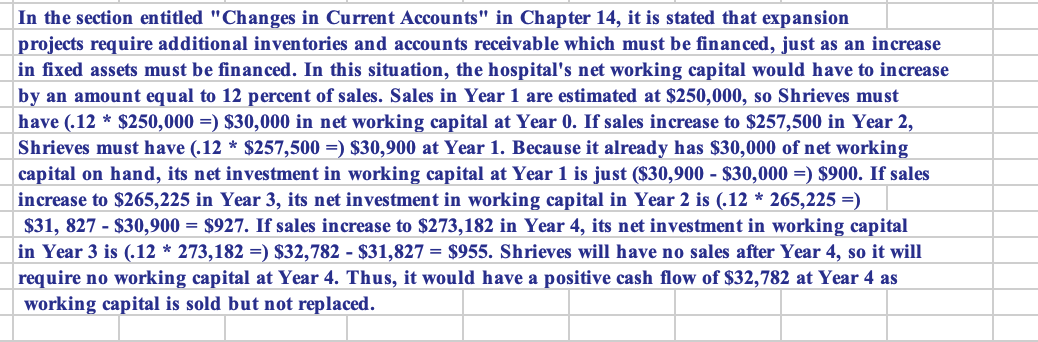

Shrieves Hospital Ltd. is considering adding a new line to its diagnostic product mix, and the capital budgeting analysis is being conducted by Sidney Johnson, a recently graduated MHA. A new bone density scanner would be set up in unused space in Shrieves's main clinic. The machinery's invoice price would be approximately $200,000; another $10,000 in shipping charges would be required; and it would cost an additional $30,000 to install the equipment. The machinery has an economic life of four years, and Shrieves has obtained a special tax ruling which places the equipment in the MACRS three-year class. The machinery is expected to have a salvage value of $25,000 after four years of use. The new line would generate incremental sales of 1,250 scans per year for four years at an incremental cost of $100 per scan in the first year, excluding depreciation. Each scan would generate revenue of $200 in the first year. The price and cost of each scan are expected to increase by 3 percent per year due to inflation. Further, to handle the new line, the hospital's net operating working capital would have to increase by an amount equal to 12 percent of sales revenues*. The hospital's tax rate is 20 percent, and its corporate cost of capital is 10 percent. a. Perform a sensitivity analysis on the corporate cost of capital, number of scans, and salvage value. Assume that each of these variables can vary from its base case by plus and minus 15 and 30 percent. ANSWER In the section entitled "Changes in Current Accounts" in Chapter 14, it is stated that expansion projects require additional inventories and accounts receivable which must be financed, just as an increase in fixed assets must be financed. In this situation, the hospital's net working capital would have to increase by an amount equal to 12 percent of sales. Sales in Year 1 are estimated at $250,000, so Shrieves must have (.12$250,000=)$30,000 in net working capital at Year 0 . If sales increase to $257,500 in Year 2 , Shrieves must have (.12$257,500=)$30,900 at Year 1 . Because it already has $30,000 of net working capital on hand, its net investment in working capital at Year 1 is just ($30,900$30,000=)$900. If sales increase to $265,225 in Year 3, its net investment in working capital in Year 2 is (.12265,225= ) $31,827$30,900=$927. If sales increase to $273,182 in Year 4 , its net investment in working capital in Year 3 is (.12273,182=)$32,782$31,827=$955. Shrieves will have no sales after Year 4 , so it will require no working capital at Year 4. Thus, it would have a positive cash flow of $32,782 at Year 4 as working capital is sold but not replaced. Shrieves Hospital Ltd. is considering adding a new line to its diagnostic product mix, and the capital budgeting analysis is being conducted by Sidney Johnson, a recently graduated MHA. A new bone density scanner would be set up in unused space in Shrieves's main clinic. The machinery's invoice price would be approximately $200,000; another $10,000 in shipping charges would be required; and it would cost an additional $30,000 to install the equipment. The machinery has an economic life of four years, and Shrieves has obtained a special tax ruling which places the equipment in the MACRS three-year class. The machinery is expected to have a salvage value of $25,000 after four years of use. The new line would generate incremental sales of 1,250 scans per year for four years at an incremental cost of $100 per scan in the first year, excluding depreciation. Each scan would generate revenue of $200 in the first year. The price and cost of each scan are expected to increase by 3 percent per year due to inflation. Further, to handle the new line, the hospital's net operating working capital would have to increase by an amount equal to 12 percent of sales revenues*. The hospital's tax rate is 20 percent, and its corporate cost of capital is 10 percent. a. Perform a sensitivity analysis on the corporate cost of capital, number of scans, and salvage value. Assume that each of these variables can vary from its base case by plus and minus 15 and 30 percent. ANSWER In the section entitled "Changes in Current Accounts" in Chapter 14, it is stated that expansion projects require additional inventories and accounts receivable which must be financed, just as an increase in fixed assets must be financed. In this situation, the hospital's net working capital would have to increase by an amount equal to 12 percent of sales. Sales in Year 1 are estimated at $250,000, so Shrieves must have (.12$250,000=)$30,000 in net working capital at Year 0 . If sales increase to $257,500 in Year 2 , Shrieves must have (.12$257,500=)$30,900 at Year 1 . Because it already has $30,000 of net working capital on hand, its net investment in working capital at Year 1 is just ($30,900$30,000=)$900. If sales increase to $265,225 in Year 3, its net investment in working capital in Year 2 is (.12265,225= ) $31,827$30,900=$927. If sales increase to $273,182 in Year 4 , its net investment in working capital in Year 3 is (.12273,182=)$32,782$31,827=$955. Shrieves will have no sales after Year 4 , so it will require no working capital at Year 4. Thus, it would have a positive cash flow of $32,782 at Year 4 as working capital is sold but not replaced

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts