Question: Please help me! Show the formulas too so I know where I am going wrong! PROBLEM 2.4 Note: The text incorrectly labeled the column headings

Please help me!

Show the formulas too so I know where I am going wrong!

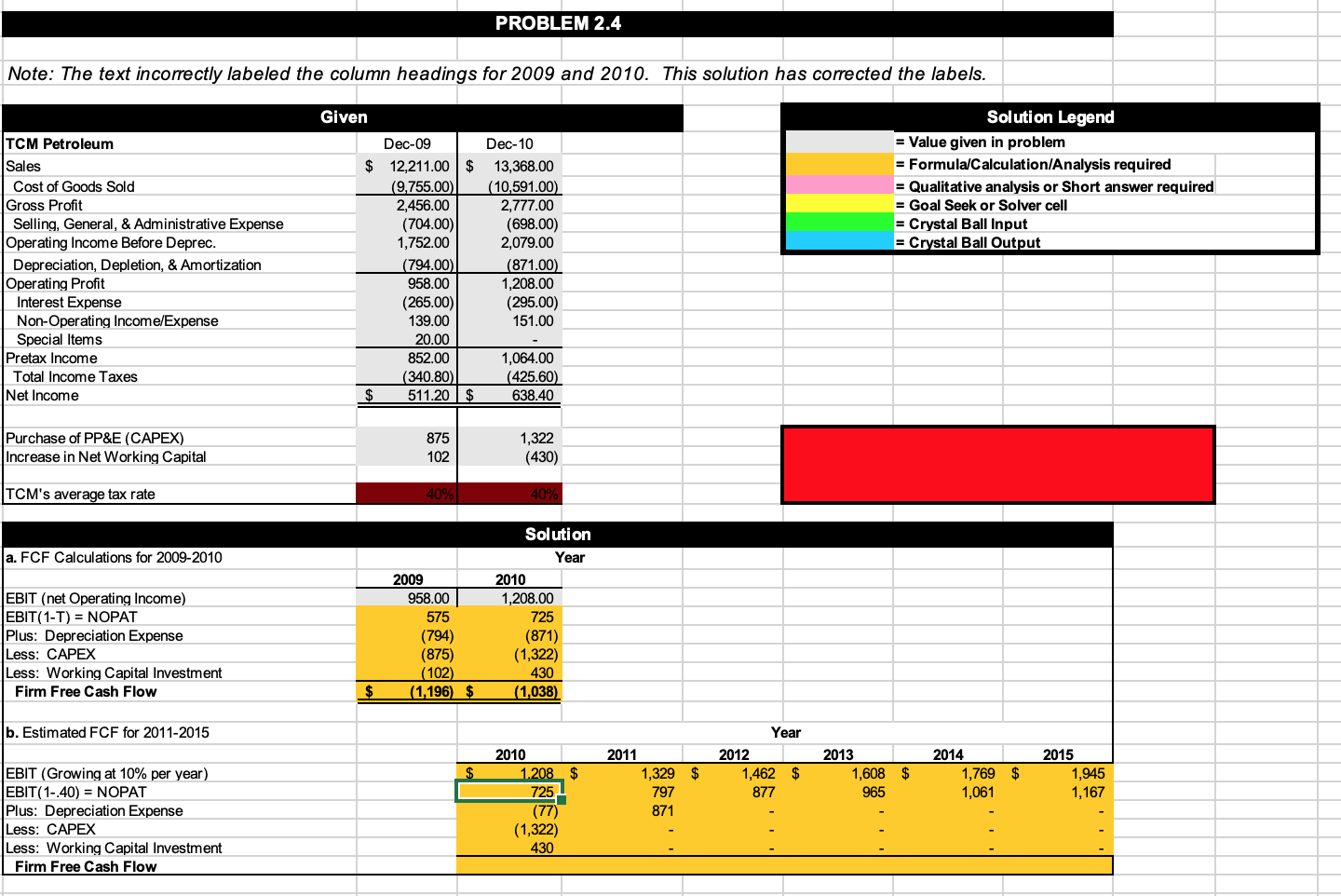

PROBLEM 2.4 Note: The text incorrectly labeled the column headings for 2009 and 2010. This solution has corrected the labels. Given TCM Petroleum Solution Legend = Value given in problem = Formula/Calculation Analysis required = Qualitative analysis or Short answer required = Goal Seek or Solver cell = Crystal Ball Input = Crystal Ball Output Sales Cost of Goods Sold Gross Profit Selling, General, & Administrative Expense Operating Income Before Deprec. Depreciation, Depletion, & Amortization Operating Profit Interest Expense Non-Operating Income/Expense Special Items Pretax Income Total Income Taxes Net Income Dec-09 $ 12,211.00 $ (9,755.00) 2,456.00 (704.00) 1,752.00 (794.00) 958.00 (265.00) 139.00 20.00 852.00 (340.80) $ 511.20 $ Dec-10 13,368.00 (10,591.00 2,777.00 (698.00) 2,079.00 (871.00) 1,208.00 (295.00) 151.00 1,064.00 (425.60) 638.40 Purchase of PP&E (CAPEX) Increase in Net Working Capital 875 102 1,322 (430) TCM's average tax rate 40% 40% a. FCF Calculations for 2009-2010 EBIT (net Operating Income) EBIT(1-T) = NOPAT Plus: Depreciation Expense Less: CAPEX Less: Working Capital Investment Firm Free Cash Flow 2009 958.00 575 (794) (875) (102) (1,196) $ Solution Year 2010 1,208.00 725 (871) (1,322) 430 (1,038) $ b. Estimated FCF for 2011-2015 2011 Year 2012 1,462 $ 877 $ 2013 1,608 $ 965 1,329 $ 797 871 2014 1,769 $ 1,061 2015 1,945 1,167 2010 1.208_ $ 725 (77) (1,322) 430 EBIT (Growing at 10% per year) EBIT(1-.40) = NOPAT Plus: Depreciation Expense Less: CAPEX Less: Working Capital Investment Firm Free Cash Flow PROBLEM 2.4 Note: The text incorrectly labeled the column headings for 2009 and 2010. This solution has corrected the labels. Given TCM Petroleum Solution Legend = Value given in problem = Formula/Calculation Analysis required = Qualitative analysis or Short answer required = Goal Seek or Solver cell = Crystal Ball Input = Crystal Ball Output Sales Cost of Goods Sold Gross Profit Selling, General, & Administrative Expense Operating Income Before Deprec. Depreciation, Depletion, & Amortization Operating Profit Interest Expense Non-Operating Income/Expense Special Items Pretax Income Total Income Taxes Net Income Dec-09 $ 12,211.00 $ (9,755.00) 2,456.00 (704.00) 1,752.00 (794.00) 958.00 (265.00) 139.00 20.00 852.00 (340.80) $ 511.20 $ Dec-10 13,368.00 (10,591.00 2,777.00 (698.00) 2,079.00 (871.00) 1,208.00 (295.00) 151.00 1,064.00 (425.60) 638.40 Purchase of PP&E (CAPEX) Increase in Net Working Capital 875 102 1,322 (430) TCM's average tax rate 40% 40% a. FCF Calculations for 2009-2010 EBIT (net Operating Income) EBIT(1-T) = NOPAT Plus: Depreciation Expense Less: CAPEX Less: Working Capital Investment Firm Free Cash Flow 2009 958.00 575 (794) (875) (102) (1,196) $ Solution Year 2010 1,208.00 725 (871) (1,322) 430 (1,038) $ b. Estimated FCF for 2011-2015 2011 Year 2012 1,462 $ 877 $ 2013 1,608 $ 965 1,329 $ 797 871 2014 1,769 $ 1,061 2015 1,945 1,167 2010 1.208_ $ 725 (77) (1,322) 430 EBIT (Growing at 10% per year) EBIT(1-.40) = NOPAT Plus: Depreciation Expense Less: CAPEX Less: Working Capital Investment Firm Free Cash Flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts