Question: please help me understand with some short written explanations, question 1 AND 16 only please 1. Why are trusts used in estate planning? 2. What

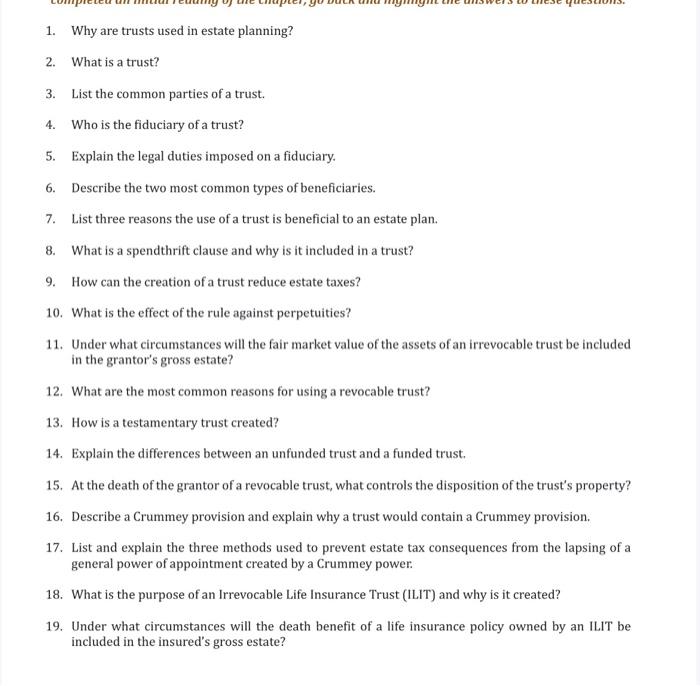

1. Why are trusts used in estate planning? 2. What is a trust? 3. List the common parties of a trust. 4. Who is the fiduciary of a trust? 5. Explain the legal duties imposed on a fiduciary. 6. Describe the two most common types of beneficiaries. 7. List three reasons the use of a trust is beneficial to an estate plan. 8. What is a spendthrift clause and why is it included in a trust? 9. How can the creation of a trust reduce estate taxes? 10. What is the effect of the rule against perpetuities? 11. Under what circumstances will the fair market value of the assets of an irrevocable trust be included in the grantor's gross estate? 12. What are the most common reasons for using a revocable trust? 13. How is a testamentary trust created? 14. Explain the differences between an unfunded trust and a funded trust. 15. At the death of the grantor of a revocable trust, what controls the disposition of the trust's property? 16. Describe a Crummey provision and explain why a trust would contain a Crummey provision. 17. List and explain the three methods used to prevent estate tax consequences from the lapsing of a general power of appointment created by a Crummey power. 18. What is the purpose of an Irrevocable Life Insurance Trust (ILIT) and why is it created? 19. Under what circumstances will the death benefit of a life insurance policy owned by an ILIT be included in the insured's gross estate? 1. Why are trusts used in estate planning? 2. What is a trust? 3. List the common parties of a trust. 4. Who is the fiduciary of a trust? 5. Explain the legal duties imposed on a fiduciary. 6. Describe the two most common types of beneficiaries. 7. List three reasons the use of a trust is beneficial to an estate plan. 8. What is a spendthrift clause and why is it included in a trust? 9. How can the creation of a trust reduce estate taxes? 10. What is the effect of the rule against perpetuities? 11. Under what circumstances will the fair market value of the assets of an irrevocable trust be included in the grantor's gross estate? 12. What are the most common reasons for using a revocable trust? 13. How is a testamentary trust created? 14. Explain the differences between an unfunded trust and a funded trust. 15. At the death of the grantor of a revocable trust, what controls the disposition of the trust's property? 16. Describe a Crummey provision and explain why a trust would contain a Crummey provision. 17. List and explain the three methods used to prevent estate tax consequences from the lapsing of a general power of appointment created by a Crummey power. 18. What is the purpose of an Irrevocable Life Insurance Trust (ILIT) and why is it created? 19. Under what circumstances will the death benefit of a life insurance policy owned by an ILIT be included in the insured's gross estate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts