Question: please help me with this business analytics case! i will give thumbs up! the questions are please use a build a decision tree model to

please help me with this business analytics case! i will give thumbs up!

the questions are

please use a build a decision tree model to provide analysis of the settlement decision. use the techniques of decision trees, risk profiles, sensitivity analysis, the value of information analysis, and utility theory to provide analysis into decisions and address the questions listed below at the end of the case.

1A. if you go to court, will you win or lose?

1B. if you do win or lose, what damages will be awarded?

1C. how will a legal victory or loss affect your future business?

1D. how much will it cost to litigate?

In August 2003, Gillette, the manufacturer of the popular Mach3 razor, filed a patent infringement suit against Energizer Holdings, Inc. claiming that their new Schick Quattro razor infringes on one of Gillette's patents. The patent in question was issued in April of 2001 and covers "progressive blade geometry," which means positioning multiple blades on a razor such that the blades are progressively closer to the skin. Gillette patented this technology and uses this progressive blade geometry in its Mach3 and Mach3Turbo razors for men and the Venus razor for women. This technology is widely credited with bolstering Gillette's share of the $1.7 billion American razor market (approximately 70 percent to Schick's 13 percent). Sales of Mach3 and Mach3Turbo blades total about $318 million annually. Gillette claims it spent $750 million to develop its Mach3 line of razors. In early 2004, the market value of Gillette was approximately $37 billion.

Energizer acquired Schick-Wilkinson Sword from Pfizer in March of 2003 for $930 million and introduced the Quattro razor with much fanfare in September of 2003. In its lawsuit, Gillette seeks an injunction to stop the sale of Quattro razors as well as damages for lost profits, legal expenses etc. Energizer argues that they have not infringed on Gillette's patent, claiming that the patent doesn't anticipate more than three blades and that the four blades in its Quattro razor do not have this progressive geometry: Quattro's first blade is farthest from the skin and its fourth blade is closest, but the middle two blades are at the same level. Energizer also argues that Gillette's patent is invalid because the technology was "obvious" and did not involve an inventive step.

In January of 2004, Judge Patti Saris of the U.S. District Court in Massachusetts denied Gillette's request for a preliminary injunction that would have halted sales of the Quattro razor. Saris concluded that Gillette had not established that it had a "reasonable likelihood of success on the claim of literal infringement." While this ruling clearly favors Energizer, this setback does not prevent Gillette from continuing its lawsuit or suggest that Gillette will lose the suit if they pursue it. As Saris noted in her decision, such a preliminary injunction would have been a "drastic and extraordinary remedy" and such injunctions "are not routinely granted." Moreover, Judge Saris considered only Gillette's claim of "literal infringement" which requires the device to have directly copied each element of the patent. A weaker "doctrine of equivalents" requires only that the patented invention is replicated in a product that works in substantially the same way and accomplishes substantially the same result. In a statement following Judge Saris' ruling, Gillette said: "We have been consistent in our rigorous defense of our intellectual property and we do not intend to abandon these claims based on this interim ruling. Therefore, Gillette intends to both contest this decision and to continue the related litigation, which includes additional claims.

In this analysis, we will consider Gillette's decision to pursue the patent infringement lawsuit or consider a settlement with Energizer, shortly after Judge Saris' ruling in January 2004. If they were to settle, how much should they settle for? There are three key sets of uncertainties to consider: the legal issues in the case, the damages that would be awarded if the jury finds infringement of a valid patent and the business impact of eliminating Quattro from the market if the injunction is granted.

Legal Uncertainties

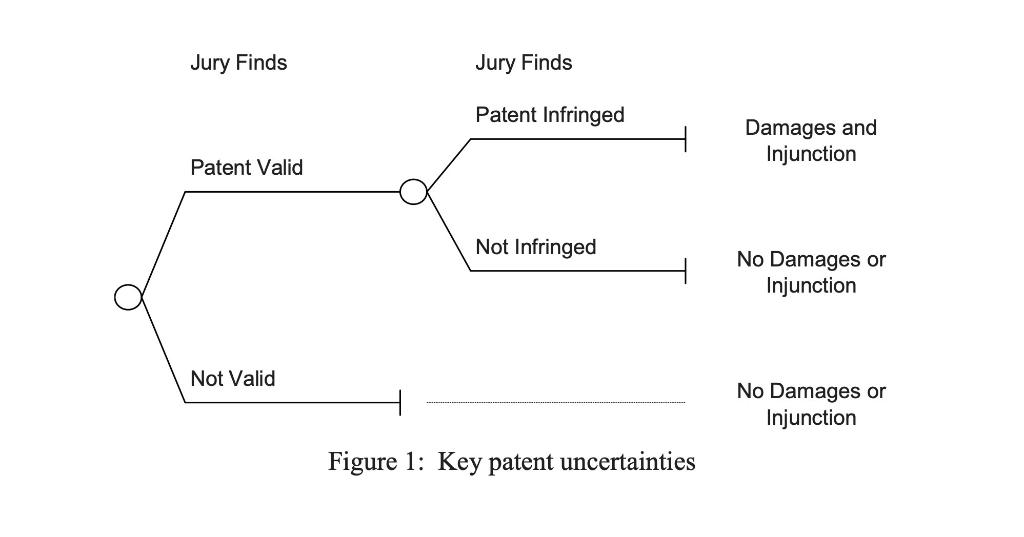

There are two key legal issues that would be decided in a jury trial: Was Gillette's patent valid? Did Energizer infringe on Gillette's patent? Both elements are required in order for damages to be awarded and the injunction granted, as shown in Figure 1.

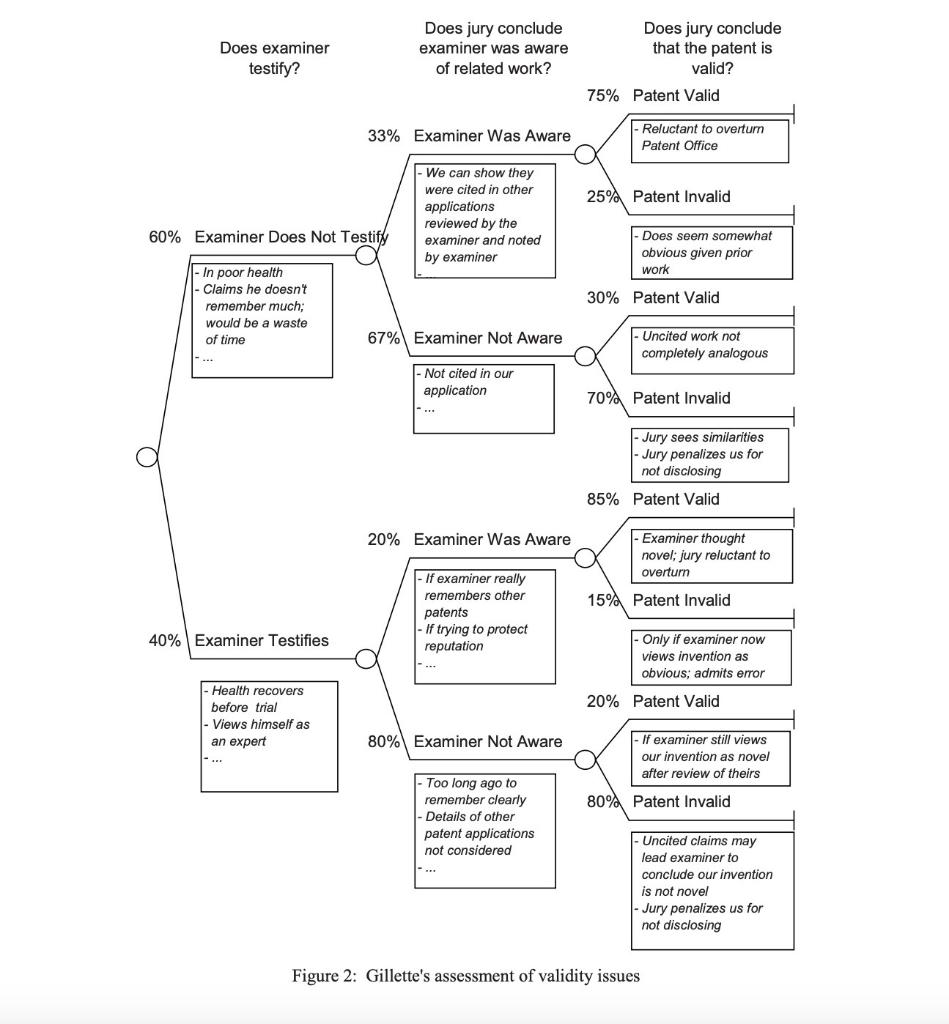

Rather than directly assess the probabilities for the events in Figure 1, Gillette's counsel found it easier to decompose these assessments and think about the key uncertainties underlying the validity and infringement issues. The key issue regarding validity is whether Gillette's progressive blade technology was novel and not obvious. In arguing that the technology is obvious and not novel, Energizer has cited the existence of other products and related patents that employ similar principles. They argue Gillette's patent application failed to call attention to these prior products and patents. Gillette disputes the relevance of these prior products and patents and further asserts that it was unnecessary to disclose them because they were cited in several other patent applications before the same patent examiner at about the same time. Energizer has suggested it may try to call this examiner to testify in the case. Gillette's counsel fears that his testimony could hurt their case. However, the patent examiner is now retired and in uncertain health and out of the jurisdiction of the court; it is unclear if he would be able to testify, even if Energizer were to seek his testimony. The probabilities for these events and the reasoning behind these probabilities are summarized in Figure 2.

As discussed earlier, if the patent is found to be valid, infringement can be established two different ways, either through "literal infringement" or the weaker "doctrine of equivalents." Either finding constitutes infringement and leads to damages. Gillette would make both arguments to the jury, hoping to convince the jury to accept one. Literal infringement would require the Quattro razor to have directly copied each element of the patent. Given that Gillette's patent specifically refers to a razor with three blades, Gillette's lawyers thought it was unlikely that the jury would find literal infringement. Judge Saris was quite critical of Gillette's arguments for literal infringement in her decision, though a jury might view this differently. Gillette's counsel assigned a 10% probability to the jury finding literal infringement.

The "doctrine of equivalents" requires only that the patented invention is replicated in a product that (a) works in substantially the same way and (b) accomplishes substantially the same result. Gillette thought it would be quite likely to successfully convince the jury that the two designs accomplish substantially the same result, as the two razors perform very similarly in tests; Gillette's counsel assigned a probability of .9 to convincing the jury of this. The "works in substantially the way" element would be more difficult to establish. Quattro's design clearly contains elements of Gillette's "progressive geometry" in that the four blades becoming progressively closer to the skin. But the facts that the Quattro has four blades rather than three (as indicated in Gillette's patent) and that the second and third blades are at the same height will make it harder to argue that they "work in substantially the same way." Gillette's counsel assigned a 50% probability to convincing the jury of the "works in substantially the way" element of the doctrine of equivalents argument.

Damage Award

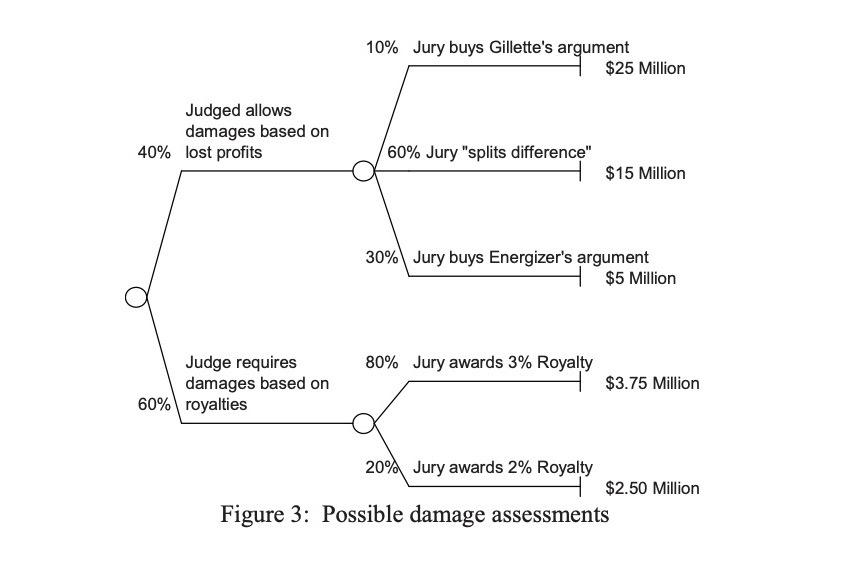

If the jury finds that the Quattro did indeed infringe on Gillette's patents, then Energizer will be required to remove the Quattro from the market and pay damages to compensate Gillette for lost profits while Quattro was on the market. Gillette argues that the sales of the Quattro razors have come at the expense of sales its Mach3 line of razors and that Quattro's gain in sales is entirely due to Quattro's use of Gillette's patented technology. Given an estimated 20% profit margin on disposable razors, Gillette argues that it should receive damages approximately equal to 20% of Quattro's sales to date. These sales are estimated at $125 million, suggesting a damage claim of $25 million by Gillette's argument. However, Energizer argues that the sales of the Quattro are entirely due to its increased advertising and otherwise superior product, rather than the specific positioning of the blades on its razors. After hearing these arguments, the jury will decide how much to award for lost profits. Rather than asking to estimate damages based on lost profits, the judge may view such arguments as too speculative and instead ask the jury to decide what would have been a reasonable royalty if the patent had been licensed to Energizer. Royalties on other features of disposable razors are typically 2-3% of sales, which would translate to a damage assessment in the $2.5 to $3.75 million range. Counsel's probabilities for the various damage assessments are illustrated in Figure 3.

Business Impacts of a Gillette Victory

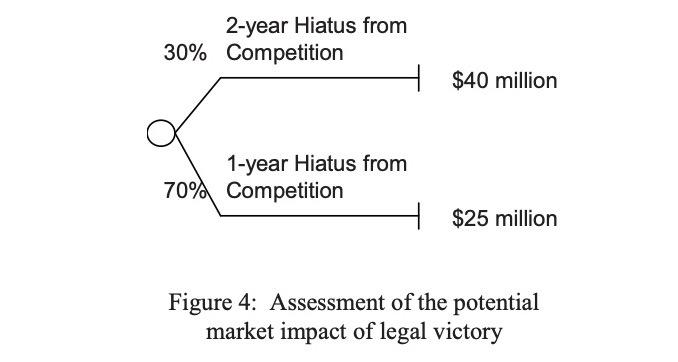

In addition to the damages awarded if Gillette wins the lawsuit, Gillette would benefit from the Quattro being removed from the market. In this scenario, Energizer would probably develop and market a different premium razor, either a modified ("new and improved") version of the Quattro that does not use the progressive blade geometry or some other razor with a new design. It would however take Energizer some time to develop a new razor and bring it to market. In the meantime, Gillette would benefit from the lack of competition. They should be able to recapture some of the market lost to the Quattro (or avoid future losses) and to avoid expensive promotions or discounting of its products.

It is not clear how far along Energizer is in developing alternative premium razor designs. Gillette's management believes that Energizer has probably already developed razors that it would bring to market if it loses the lawsuit. In this case, Gillette would enjoy a less than one year hiatus from competition that their marketing staff estimates would be worth about $25 million in present value to Gillette. On the other hand, if Energizer does not have a new non-infringing product ready, Gillette may enjoy a hiatus approaching two years, worth about $40 million in present value. The probabilities for these two scenarios are shown in Figure 4.

Settlement Decision

The legal proceedings associated with this case promise to be expensive and time consuming for both Gillette and Energizer. Gillette estimates that the cost of continuing this litigation to be approximately $2.5 million; this includes attorneys fees, expert fees, as well as the cost of the time of management and staff will have to spend on matters related to the lawsuit.

Shortly after Judge Saris' ruling in January of 2004, Energizer approached Gillette privately and offered to settle this lawsuit for $4.5 million. This offer would be a one-time cash offer that would require Gillette to drop the lawsuit and allow Energizer to continue market the Quattro razor with its current design. While Gillette's initial response to this offer was cool, privately Gillette senior management wondered whether they should accept this offer or continue to litigate. Is settling worth more than litigating? How risky would it be to litigate? What is the probability that they would be better off settling? A decision tree model should be able to help sort out these issues.

Before responding to the settlement offer, Gillette could perhaps gather additional information about some of the key issues in the case.

For example, it could:

Investigate the status of patent examiner who reviewed Gillette's patent application to see if he would be able to testify if called by Energizer

Review additional patent office documents to help determine whether the examiner was aware of the related patents and products at the time he reviewed Gillette's application

Hire a mock jury and test the validity and infringement arguments to better estimate the likelihood that a real jury would rule in Gillette's favor

Investigate Energizer's research and development efforts to see how far along they are in developing alternative razor designs that might be marketed if they lose the lawsuit

How much would such information be worth? Would it have a significant impact on the settlement decision or settlement value?

Jury Finds Jury Finds Figure 1: Key patent uncertainties Figure 2: Gillette's assessment of validity issues 10% Jury buys Gillette's argument Figure 3: Possible damage assessments Figure 4: Assessment of the potential market impact of legal victory

Step by Step Solution

There are 3 Steps involved in it

To address the problem and perform the required analysis we need to use the decision tree approach along with tools like risk profiles sensitivity analysis value of information and utility theory 1A I... View full answer

Get step-by-step solutions from verified subject matter experts