Question: please help! timed! Question 31 6 pts A bond will maturity of smaller than 10 years has a YTM of 8.ON and a coupon rate

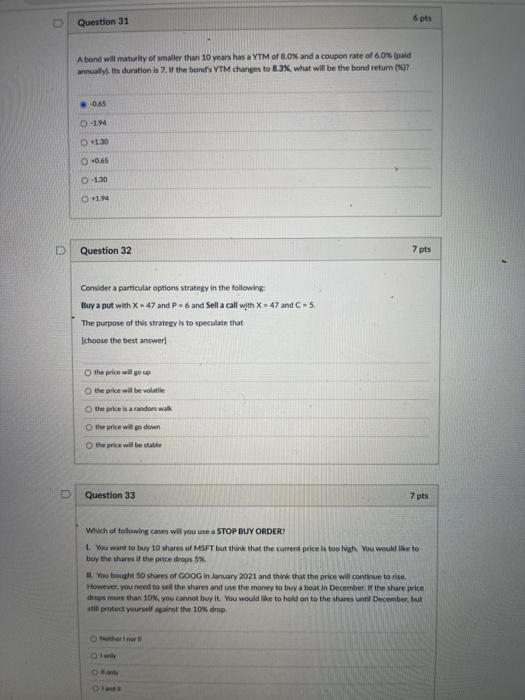

Question 31 6 pts A bond will maturity of smaller than 10 years has a YTM of 8.ON and a coupon rate of 60% (nald annually. Its duration is 7. If the band's YTM changes to 8.3% what will be the bond return -0.45 0-194 O +1.30 O 065 130 O +1. Question 32 7 pts Consider a particular options strategy in the following Buy a put with X-47 and p-6 and Sell a call with X-47 and C -5. The purpose of this strategy is to speculate that Ichoose the best answer] O the price will go up the price will be able the price is a random walk the price will go down the price will be stato Question 33 7 pts Which of following cases will you use a STOP BUY ORDER? You want to buy 10 shares of MSFT but think that the current price is too high you would like to buy the share if the price drops 5 You bought 50 shares of GOOG in January 2021 and think that the price will continue to rise. However, you need to sell the shares and use the money to buy a boat in December if the share price drops more than 10%, you cannot buy it you would like to hold on to the shares in December, but si protect yourself against the 10% drop OB

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts