Question: Please help to analysis these data Analysis the trend of following 1. Deseasonalized Forecasts 2. Seasonalized Forecasts 3. MAD 4. Recommended forcasts. 3 periods 5.3.1

Please help to analysis these data

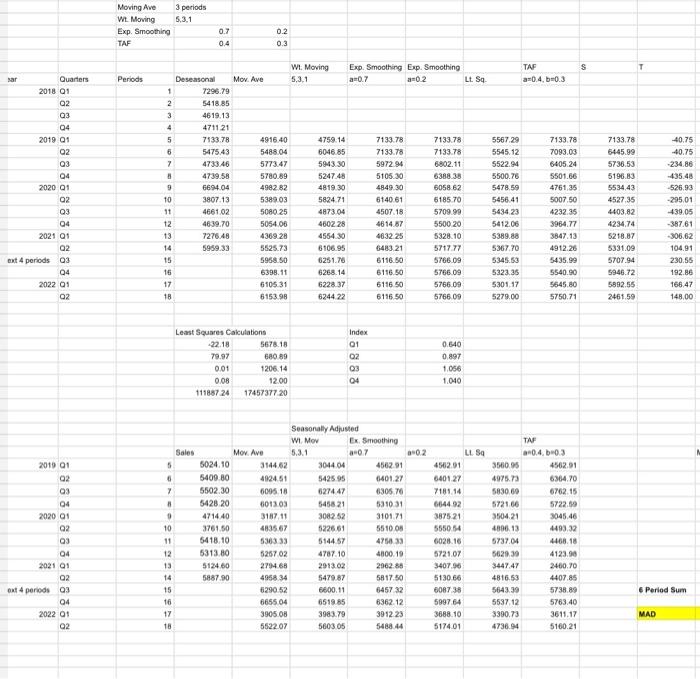

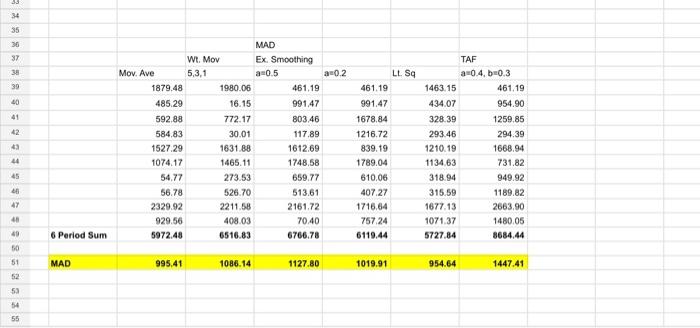

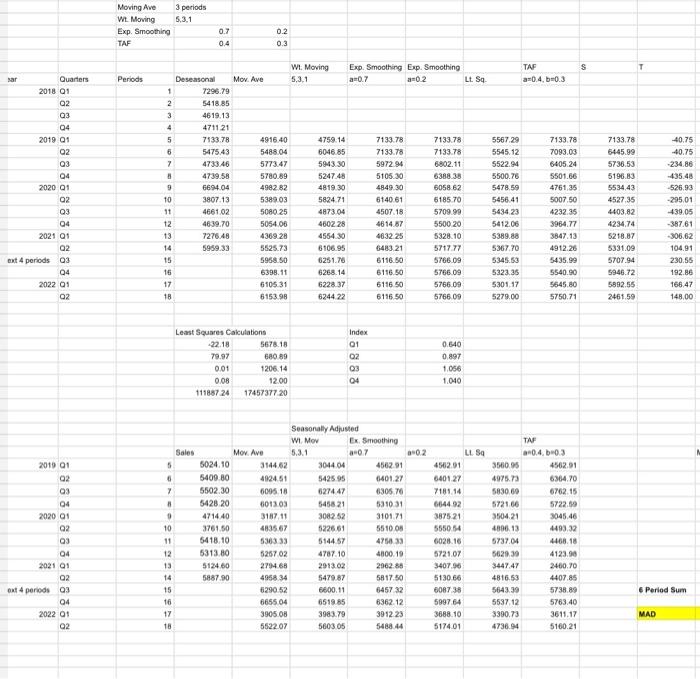

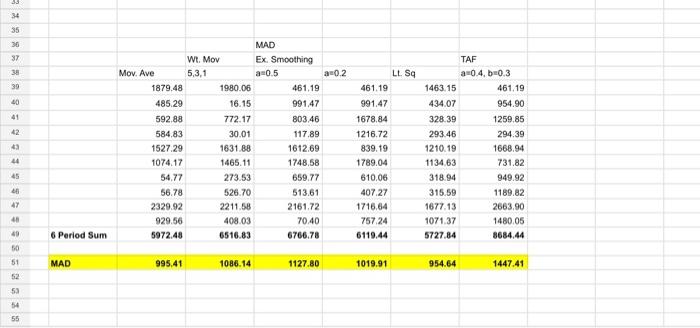

3 periods 5.3.1 Moving Ave Wt. Moving Exp. Smoothing TAF 0.7 0.4 0.2 0.3 S T Exp. Smoothing Exp. Smoothing 0.7 a02 Lt. Sa TAF 30.4.0.3 sar Periods Quarters 2018 01 Q2 a3 04 2019 01 Q3 04 2020 01 Q2 99999999999999 W. Moving Deseasonal Mov. Ave 5.3.1 1 7296.79 2 5418.85 3 4619.13 4 471121 5 7133.78 4916.40 4759.14 6 5475.43 5488.04 6046.85 7 4733.46 5773.47 5943.30 8 4739.58 5780.89 5247.48 9 669404 498282 4819.30 10 3807.13 5389.03 5824.71 11 466102 5080 25 4873.04 12 4639.70 5054.00 460228 13 7276.48 4369 28 4564.30 14 5959.33 5525.73 6106.95 15 5958.50 6251.78 16 6398.11 6268.14 17 6105.31 6228.37 18 6153.98 624422 Q3 7133.78 7133.78 5972.94 5105.30 4849 30 614061 4507,18 4614.87 4632 25 6483 21 6116.50 6116.50 6116.50 6116.50 7133.78 7133.78 6802.11 6388.38 6058 62 6185.70 5709.99 5500 20 5328.10 571777 576609 5766.09 5766.09 5766.00 5567.29 5545.12 5522.94 5500.78 5478,59 5456.41 5434 23 5412.05 5389.88 5367.70 5345.53 5323.35 5301.17 5279.00 713378 7093.03 6405.24 5501.66 4761,35 5007 50 423235 3964.77 3847.13 4912.26 5435.99 5540.90 5645.80 5750.71 7133.78 6445.99 5736.53 5196.83 553443 452735 4403.82 4234.74 5218.87 5331.09 5707.94 5946.72 5892.55 2461.59 40.75 40.75 234.86 -435.48 -526.93 -295,01 -439.05 -387.61 306.62 104.91 230.55 192.86 166.47 148.00 04 2021 05 Q2 ext 4 periods 03 04 2022 01 02 Least Squares Calculations 22.18 5678.18 79.97 680.89 0.01 1206.14 0.08 12.00 111887 24 1745737720 Index 01 OZ 03 04 0.640 0.897 1,056 1.040 Sales 5 5 2020 2019 01 02 Q3 04 2020 21 02 Q3 04 2021 21 02 out 4 periods 03 04 2022 01 Q2 89999999999999 7 8 9 10 11 12 13 14 15 16 17 18 Seasonally Adjusted W Mov Ex Smoothing Mov. Ave 5.3.1 -0.7 502410 3144.62 3044 04 4562.91 5409 80 492451 542595 6401.27 5502.30 6095.18 627447 630570 5428 20 601303 545821 5310 31 4714 40 318711 308252 310171 3761.50 4835.67 5226,61 551008 5418.10 536333 514457 475833 5313.80 5267 02 4787. 10 4800.19 5124.60 2768 2913.02 2962.88 5887.90 4958 34 5479.87 5817.50 6290.52 6600.11 6457 32 665504 6519.85 6362.12 3905 08 3983.79 3912 23 552207 560305 5488 44 LL S 4562.01 6401.27 7181.14 664492 387521 5550.54 6028.16 5721.07 3407.96 5130.66 608738 599764 3688.10 517401 TA 10.4-03 3560.95 4562.91 4975.73 6364.70 5830 60 6762.15 572166 5722.59 350421 3045.46 4896.13 4493.32 5737.04 4468.18 5629.30 4123.90 3447.47 2460.70 4816.53 4407.85 5643.39 5738.89 553712 5763.40 3390.73 3611.17 4736.94 5160.21 6 Period Sum MAD 34 35 36 38 39 40 42 MAD Wt. Mov Ex Smoothing Mov. Ave 5,3,1 a 0.5 a0.2 1879.48 1980.06 461,19 485.29 16.15 991,47 592.88 772.17 803.46 584.83 30.01 117.89 1527.29 1631.88 1612.69 1074.17 1465.11 1748,58 54.77 273.53 659.77 56.78 526.70 513,61 2329.92 2211.58 2161.72 929.56 408.03 70.40 5972.48 6516.83 6766.78 33938589&B B&%**** LL S 461,19 991.47 1678.84 1216.72 839.19 1789.04 610.06 407.27 1716.64 757.24 6119.44 TAF 0.4, b0.3 1463.15 461.19 434.07 954.90 328.39 1259.85 293.46 294.39 1210.19 1668.94 1134 63 731.82 318.94 949.92 315,59 1189.82 1677.13 2663,90 1071.37 1480.05 5727.84 8684.44 44 48 6 Period Sum 51 MAD 995.41 1086.14 1127.80 1019.91 954.64 1447.41 55

Analysis the trend of following

1. Deseasonalized Forecasts 2. Seasonalized Forecasts 3. MAD 4. Recommended forcasts.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock