Question: please help will give a thumbs up if correct Consider how Kyler Valey Waterfal Park Lodge could use capital budgeting to deoide whether the $11,000,000

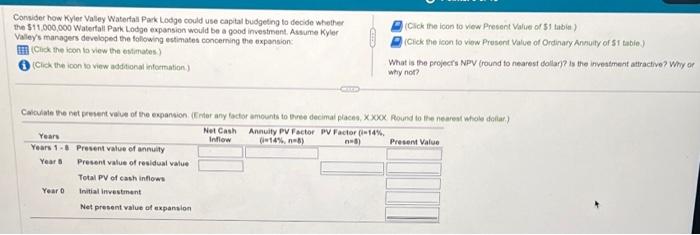

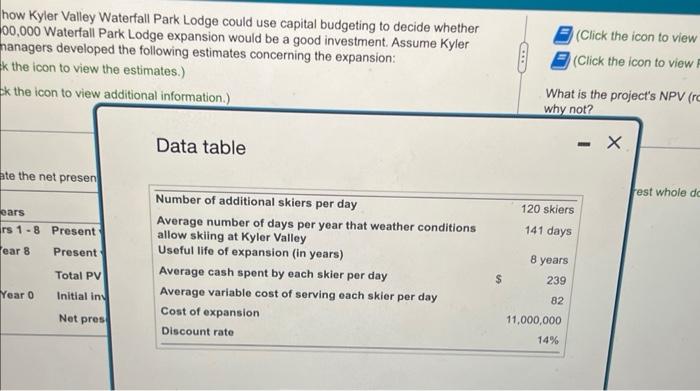

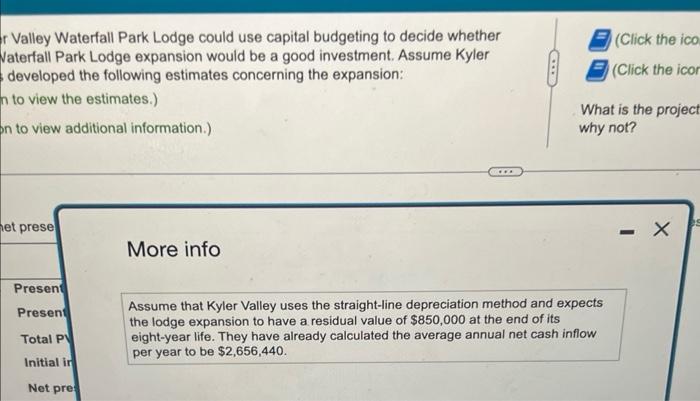

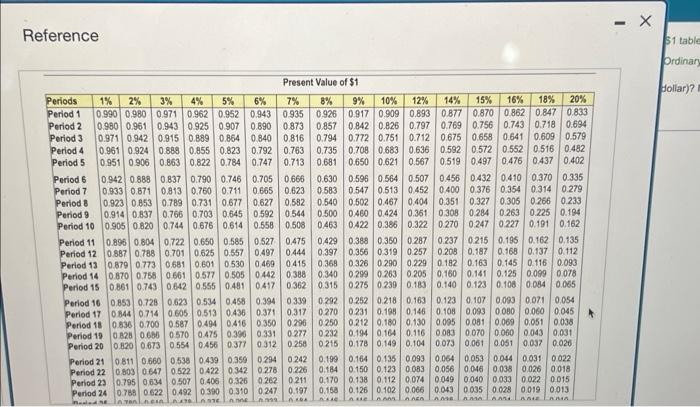

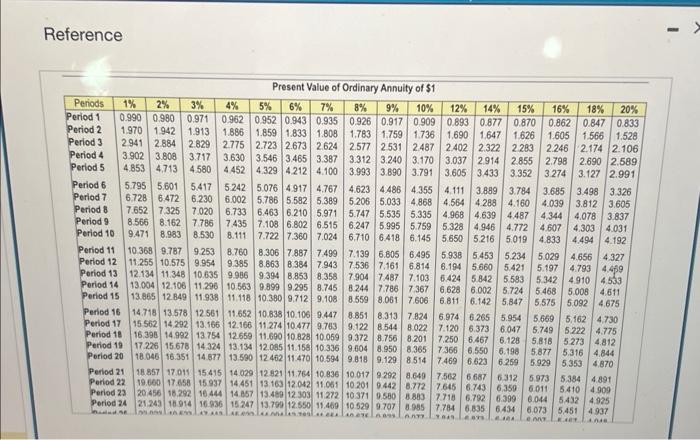

Consider how Kyler Valey Waterfal Park Lodge could use capital budgeting to deoide whether the \$11,000,000 Watertall Park Lodje expansion would be a good investment. Atsume Kyler Valey's marvagers developed the following estimates concerning the expension: (Cirk the kicon to view the estimates) (Click the icon lo view additional infermation) (Click ine icon to vew Present Value of 51 tabin) (Clek the ionn to view Present Value of Ordinary Annuity of 51 tabie). What is the projecrs NPV (round to nearest dollan? is the investment attractive? Why or why not? how Kyler Valley Waterfall Park Lodge could use capital budgeting to decide whether 00,000 Waterfall Park Lodge expansion would be a good investment. Assume Kyler nanagers developed the following estimates concerning the expansion: k the icon to view the estimates.) (Click the icon to view (Click the icon to view the icon to view additional information.) What is the project's NPV (r why not? Data table r Valley Waterfall Park Lodge could use capital budgeting to decide whether laterfall Park Lodge expansion would be a good investment. Assume Kyler developed the following estimates concerning the expansion: (Click the ico n to view the estimates.) (Click the icor What is the project why not? in to view additional information.) More info let prese \begin{tabular}{l|l|} \hline & More info \\ \hline Presen & \\ Presen & \begin{tabular}{l} Assume that Kyler Valley uses the straight-line depreciation method and expects \\ the lodge expansion to have a residual value of $850,000 at the end of its \\ eight-year life. They have already calculated the average annual net cash inflow \\ per year to be $2,656,440. \end{tabular} \\ \hline \end{tabular} Reference Reference

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts