Question: Please help with this question I'm really confused. Lee went to great lengths to make sure that Heard was considered an independent contractor and it

Please help with this question I'm really confused.

Lee went to great lengths to make sure that Heard was considered an independent contractor and it didn't work. Since Lee made it so clear that Heard was an independent contractor, why did the court find employee status?

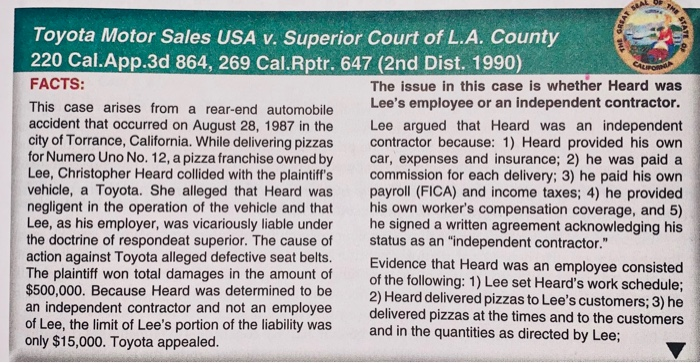

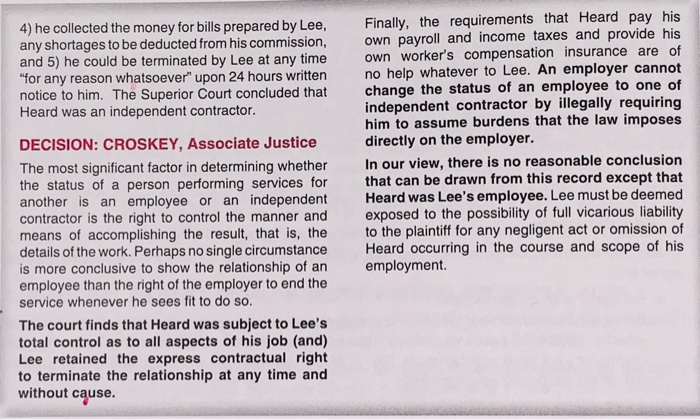

Toyota Motor Sales USA v. Superior Court of L.A. County 220 Cal. App.3d 864, 269 Cal.Rptr. 647 (2nd Dist. 1990) FACTS: The issue in this case is whether Heard was This case arises from a rear-end automobile Lee's employee or an independent contractor. accident that occurred on August 28, 1987 in the Lee argued that Heard was an independent city of Torrance, California. While delivering pizzas contractor because: 1) Heard provided his own for Numero Uno No. 12, a pizza franchise owned by car, expenses and insurance; 2) he was paid a Lee, Christopher Heard collided with the plaintiff's commission for each delivery; 3) he paid his own vehicle, a Toyota. She alleged that Heard was payroll (FICA) and income taxes; 4) he provided negligent in the operation of the vehicle and that his own worker's compensation coverage, and 5) Lee, as his employer, was vicariously liable under he signed a written agreement acknowledging his the doctrine of respondeat superior. The cause of status as an "independent contractor." action against Toyota alleged defective seat belts. Evidence that Heard was an employee consisted The plaintiff won total damages in the amount of of the following: 1) Lee set Heard's work schedule: $500,000. Because Heard was determined to be 2) Heard delivered pizzas to Lee's customers; 3) he an independent contractor and not an employee delivered pizzas at the times and to the customers of Lee, the limit of Lee's portion of the liability was and in the quantities as directed by Lee; only $15,000. Toyota appealed. 4) he collected the money for bills prepared by Lee, any shortages to be deducted from his commission, and 5) he could be terminated by Lee at any time "for any reason whatsoever" upon 24 hours written notice to him. The Superior Court concluded that Heard was an independent contractor. DECISION: CROSKEY, Associate Justice The most significant factor in determining whether the status of a person performing services for another is an employee or an independent contractor is the right to control the manner and means of accomplishing the result, that is, the details of the work. Perhaps no single circumstance is more conclusive to show the relationship of an employee than the right of the employer to end the service whenever he sees fit to do so. The court finds that Heard was subject to Lee's total control as to all aspects of his job (and) Lee retained the express contractual right to terminate the relationship at any time and without cause. Finally, the requirements that Heard pay his own payroll and income taxes and provide his own worker's compensation insurance are of no help whatever to Lee. An employer cannot change the status of an employee to one of independent contractor by illegally requiring him to assume burdens that the law imposes directly on the employer. In our view, there is no reasonable conclusion that can be drawn from this record except that Heard was Lee's employee. Lee must be deemed exposed to the possibility of full vicarious liability to the plaintiff for any negligent act or omission of Heard occurring in the course and scope of his employment