Question: please need this case study answer faster i really appreciate it i will like your answer thank you so much Year 1 Year 2 Year

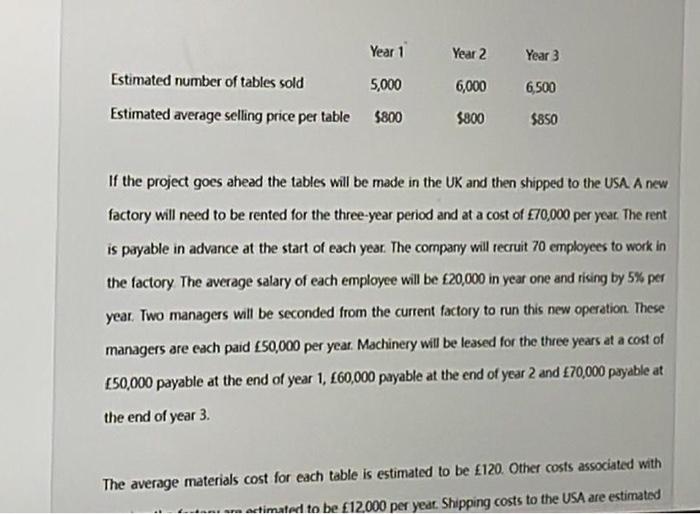

Year 1 Year 2 Year 3 6,000 6,500 Estimated number of tables sold 5,000 Estimated average selling price per table 5800 $800 $850 If the project goes ahead the tables will be made in the UK and then shipped to the USA. A new factory will need to be rented for the three-year period and at a cost of 70,000 per year. The rent is payable in advance at the start of each year. The company will recruit 70 employees to work in the factory The average salary of each employee will be 20,000 in year one and rising by 5% per year. Two managers will be seconded from the current factory to run this new operation. These managers are each paid 150,000 per year. Machinery will be leased for the three years at a cost of 50,000 payable at the end of year 1, 60,000 payable at the end of year 2 and 70,000 payable at the end of year 3. The average materials cost for each table is estimated to be 120. Other costs associated with - actimated to be 12.000 per year. Shipping costs to the USA are estimated the end of year 3 The average materials cost for each table is estimated to be 120. Other costs associated with running the tactory ate estimated to be 12,000 per year. Shipping costs to the USA are estimated to be 1,500 per 50 tables. Sales personnel will be employed for the three-year period. These sales personnel will be people who are from the UK but currently based in the USA The directors of Gorforth pic believe this will be an advantage as the sales personnel will understand the requirements of both Gorforth plc and potential USA customers. The total cost of their salaries and associated expenses are estimated to be $300,000 per year. The directors of Gorforth ple will oversee the project The current spot rate is $1.75 to the L. It is expected that the exchange rate will change in the future, and it has been estimated that the inflation rate in the UK will be 2% per year and the inflation rate in the USA will be 1% per year Tax would be payable for the business 1 year in arrears and at a rate of 20% of the net cash low for any year is negative then you should assume that zero tax will be paid on this cashflow, and that the negative cashflow will be used to reduce the next available positive cashflow when calculating Tax would be payable for the business 1 year in arrears and at a rate of 20% I the net cashflow for any year is negative then you should assume that zero tax will be paid on this cashflow, and that the negative cashflow will be used to reduce the next available positive cashflow when calculating tax on that positive cashflow. Gorforth plc believes it has a cost of capital of 11%. This figure is based on calculations the finance team made approximately five years ago. The capital structure of Gorforth pk has changed since then Required a) Prepare calculations to evaluate whether it is worthwhile for Gorforth plc to go ahead with the new venture. State any assumptions you have made in your cakulations (15) b) Advise the directors of any potential risks that may be associated with this new venture (5) Year 1 Year 2 Year 3 6,000 6,500 Estimated number of tables sold 5,000 Estimated average selling price per table 5800 $800 $850 If the project goes ahead the tables will be made in the UK and then shipped to the USA. A new factory will need to be rented for the three-year period and at a cost of 70,000 per year. The rent is payable in advance at the start of each year. The company will recruit 70 employees to work in the factory The average salary of each employee will be 20,000 in year one and rising by 5% per year. Two managers will be seconded from the current factory to run this new operation. These managers are each paid 150,000 per year. Machinery will be leased for the three years at a cost of 50,000 payable at the end of year 1, 60,000 payable at the end of year 2 and 70,000 payable at the end of year 3. The average materials cost for each table is estimated to be 120. Other costs associated with - actimated to be 12.000 per year. Shipping costs to the USA are estimated the end of year 3 The average materials cost for each table is estimated to be 120. Other costs associated with running the tactory ate estimated to be 12,000 per year. Shipping costs to the USA are estimated to be 1,500 per 50 tables. Sales personnel will be employed for the three-year period. These sales personnel will be people who are from the UK but currently based in the USA The directors of Gorforth pic believe this will be an advantage as the sales personnel will understand the requirements of both Gorforth plc and potential USA customers. The total cost of their salaries and associated expenses are estimated to be $300,000 per year. The directors of Gorforth ple will oversee the project The current spot rate is $1.75 to the L. It is expected that the exchange rate will change in the future, and it has been estimated that the inflation rate in the UK will be 2% per year and the inflation rate in the USA will be 1% per year Tax would be payable for the business 1 year in arrears and at a rate of 20% of the net cash low for any year is negative then you should assume that zero tax will be paid on this cashflow, and that the negative cashflow will be used to reduce the next available positive cashflow when calculating Tax would be payable for the business 1 year in arrears and at a rate of 20% I the net cashflow for any year is negative then you should assume that zero tax will be paid on this cashflow, and that the negative cashflow will be used to reduce the next available positive cashflow when calculating tax on that positive cashflow. Gorforth plc believes it has a cost of capital of 11%. This figure is based on calculations the finance team made approximately five years ago. The capital structure of Gorforth pk has changed since then Required a) Prepare calculations to evaluate whether it is worthwhile for Gorforth plc to go ahead with the new venture. State any assumptions you have made in your cakulations (15) b) Advise the directors of any potential risks that may be associated with this new venture

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts