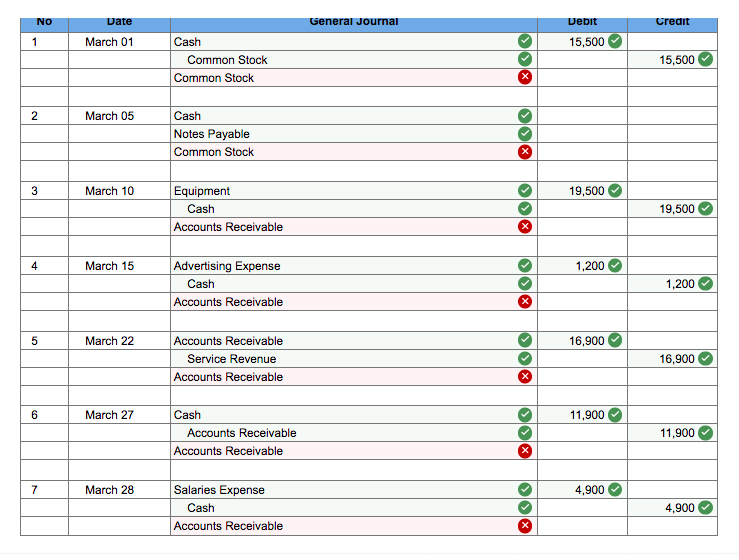

Question: PLEASE ONLY ANSWER THE LINE THAT IS IN RED THAT IS MARKED WITH AN X. ALL THE INFO IS ABOVE, PLEASE FILL IN IF IT

PLEASE ONLY ANSWER THE LINE THAT IS IN RED THAT IS MARKED WITH AN X. ALL THE INFO IS ABOVE, PLEASE FILL IN IF IT IS CASH, ACCOUNTS RECEIVABLE, EQUIPMENT, NOTES PAYABLE, COMMON STOCK, SERVICE REVENUE, ADVERTISING EXPENSE, OR SALARIES EXPENSE.

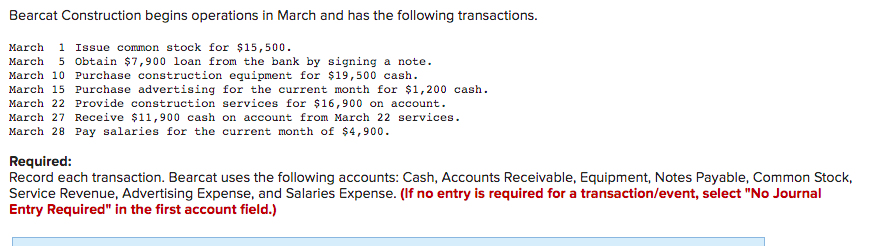

Bearcat Construction begins operations in March and has the following transactions. March 1 Issue common stock for $15,500. March 5 Obtain $7,900 loan from the bank by signing a note. March 10 Purchase construction equipment for $19,500 cash. March 15 Purchase advertising for the current month for $1,200 cash. March 22 Provide construction services for $16,900 on account. March 27 Receive $11,900 cash on account from March 22 services. March 28 Pay salaries for the current month of $4,900. Required: Record each transaction. Bearcat uses the following accounts: Cash, Accounts Receivable, Equipment, Notes Payable, Common Stock, Service Revenue, Advertising Expense, and Salaries Expense. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) NO 1 2 3 4 5 6 7 Date March 01 March 05 March 10 March 15 March 22 March 27 March 28 Cash Common Stock Cash Notes Payable Common Stock Equipment Cash Accounts Receivable Advertising Expense Cash Accounts Receivable Accounts Receivable Service Revenue Accounts Receivable Cash Accounts Receivable Salaries Expense Cash Accounts Receivable Common Stock Accounts Receivable General Journal *3 Debit 15,500 19,500 1,200 16,900 11,900 4,900 Credit 15,500 19,500 1,200 16,900 11,900 4,900 Bearcat Construction begins operations in March and has the following transactions. March 1 Issue common stock for $15,500. March 5 Obtain $7,900 loan from the bank by signing a note. March 10 Purchase construction equipment for $19,500 cash. March 15 Purchase advertising for the current month for $1,200 cash. March 22 Provide construction services for $16,900 on account. March 27 Receive $11,900 cash on account from March 22 services. March 28 Pay salaries for the current month of $4,900. Required: Record each transaction. Bearcat uses the following accounts: Cash, Accounts Receivable, Equipment, Notes Payable, Common Stock, Service Revenue, Advertising Expense, and Salaries Expense. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) NO 1 2 3 4 5 6 7 Date March 01 March 05 March 10 March 15 March 22 March 27 March 28 Cash Common Stock Cash Notes Payable Common Stock Equipment Cash Accounts Receivable Advertising Expense Cash Accounts Receivable Accounts Receivable Service Revenue Accounts Receivable Cash Accounts Receivable Salaries Expense Cash Accounts Receivable Common Stock Accounts Receivable General Journal *3 Debit 15,500 19,500 1,200 16,900 11,900 4,900 Credit 15,500 19,500 1,200 16,900 11,900 4,900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts