Question: Please provide answer with the formulas used A B D E F G . L M N o P 1 Part II (20 points) 2

Please provide answer with the formulas used

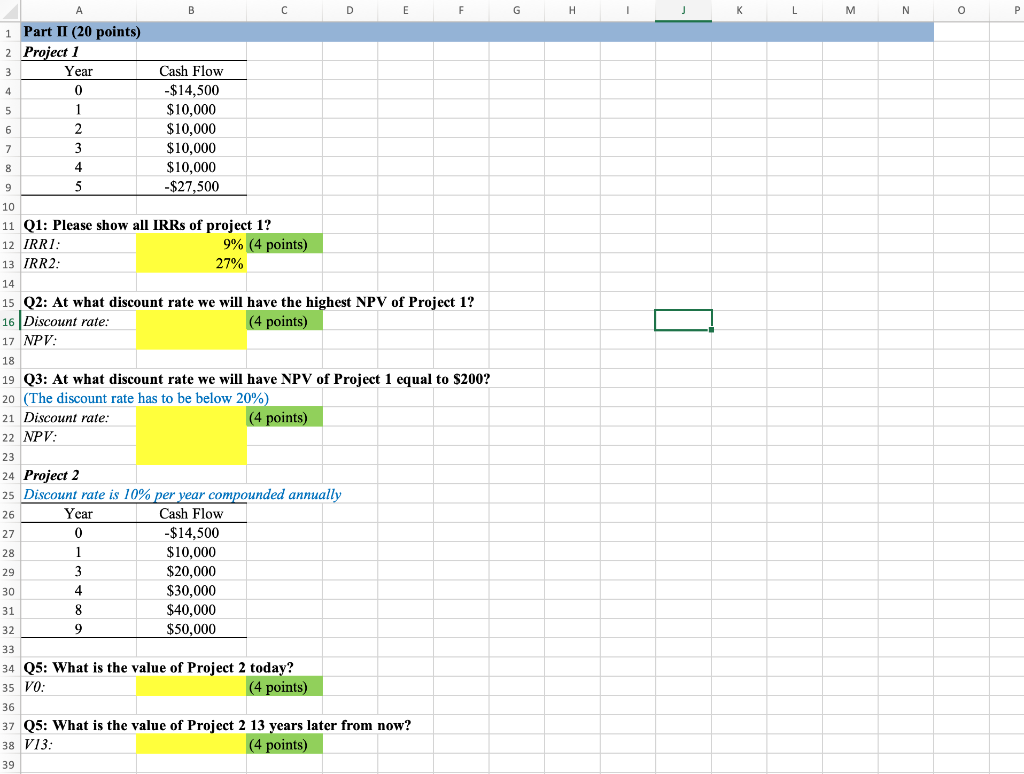

A B D E F G . L M N o P 1 Part II (20 points) 2 Project 1 Year 3 4 0 5 1 6 2 Cash Flow -$14,500 $10,000 $10,000 $10,000 $10,000 -$27,500 7 3 8 4 9 5 10 11 Q1: Please show all IRRs of project 1? 12 IRRI: 9% (4 points) 13 IRR2: 27% 14 15 Q2: At what discount rate we will have the highest NPV of Project 1? 16 Discount rate: (4 points) 17 NPV: - 18 19 Q3: At what discount rate we will have NPV of Project 1 equal to $200? 20 (The discount rate has to be below 20%) 21 Discount rate: (4 points) 22 NPV: 23 26 27 24 Project 2 25 Discount rate is 10% per year compounded annually Year Cash Flow 0 -$14,500 1 $10,000 3 $20,000 4 $30,000 8 $40,000 9 $50,000 28 29 30 31 32 33 34 Q5: What is the value of Project 2 today? 35 VO: (4 points) 36 37 Q5: What is the value of Project 2 13 years later from now? 38 V13: (4 points) 39 A B D E F G . L M N o P 1 Part II (20 points) 2 Project 1 Year 3 4 0 5 1 6 2 Cash Flow -$14,500 $10,000 $10,000 $10,000 $10,000 -$27,500 7 3 8 4 9 5 10 11 Q1: Please show all IRRs of project 1? 12 IRRI: 9% (4 points) 13 IRR2: 27% 14 15 Q2: At what discount rate we will have the highest NPV of Project 1? 16 Discount rate: (4 points) 17 NPV: - 18 19 Q3: At what discount rate we will have NPV of Project 1 equal to $200? 20 (The discount rate has to be below 20%) 21 Discount rate: (4 points) 22 NPV: 23 26 27 24 Project 2 25 Discount rate is 10% per year compounded annually Year Cash Flow 0 -$14,500 1 $10,000 3 $20,000 4 $30,000 8 $40,000 9 $50,000 28 29 30 31 32 33 34 Q5: What is the value of Project 2 today? 35 VO: (4 points) 36 37 Q5: What is the value of Project 2 13 years later from now? 38 V13: (4 points) 39

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts