Question: please read all provided information, I posted this question prior and it was answered by an expert, who didn't seem to have any idea what

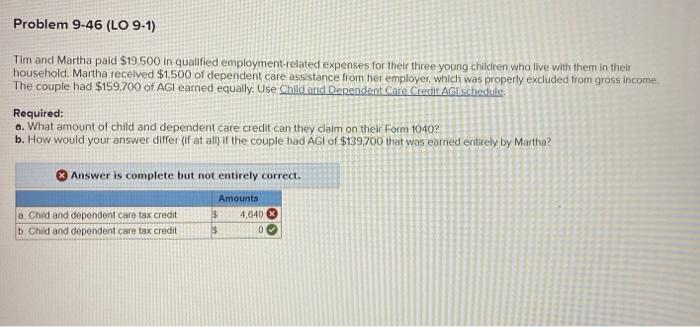

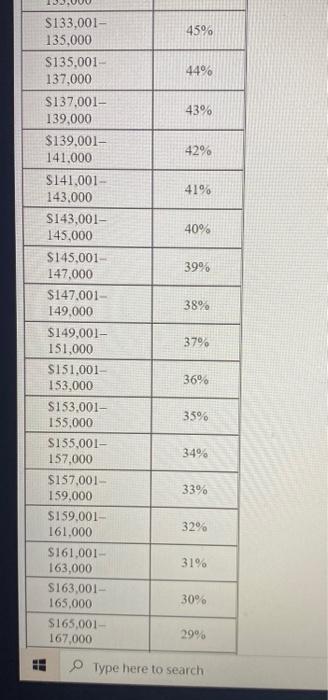

Problem 9-46 (LO 9-1) Tim and Martha paid $19.500 in qualified employment-related expenses for their three young children who live with them in their household. Martha received $1,500 of dependent care assistance from her employer, which was properly excluded from gross income The couple had $159.700 of AGI earned equally. Use Child and Dependent.Care Credit AGI schedule. Required: a. What amount of child and dependent care credit can they claim on their Form 1040? b. How would your answer differ (if at all) if the couple had AGI of $139,700 that was earned entirely by Martha? Answer is complete but not entirely correct. a Chid and dependent care tax credit b. Child and dependent care tax credit Amounts $ 4,040 0 45% 44% 43% 42% 41% 40% 39 38 S133,001- 135,000 $135,001- 137,000 $137,001- 139,000 $139.001- 141,000 S141,001- 143.000 $143,001- 145,000 $145,001 147.000 $147,001 - 149,000 $149,001- 151,000 S151,001- 153,000 $153,001- 155.000 $135,001- 157,000 $157,001- 159.000 $159.001- 161,000 S161,001- 163,000 S163,001- 165,000 $165,001- 167,000 37% 36% 35% 34% 33% 32% 31% 30% 29% Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts