Question: Please read the article titled A better way to outsource Download A better way to outsource . In one paragraph, describe what made Dells outsourcing

Please read the article titled A better way to outsource Download A better way to outsource . In one paragraph, describe what made Dells outsourcing agreement with Genco a success.

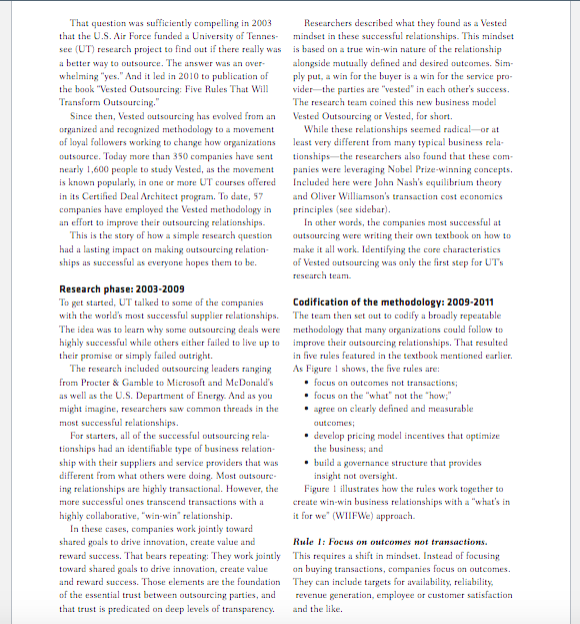

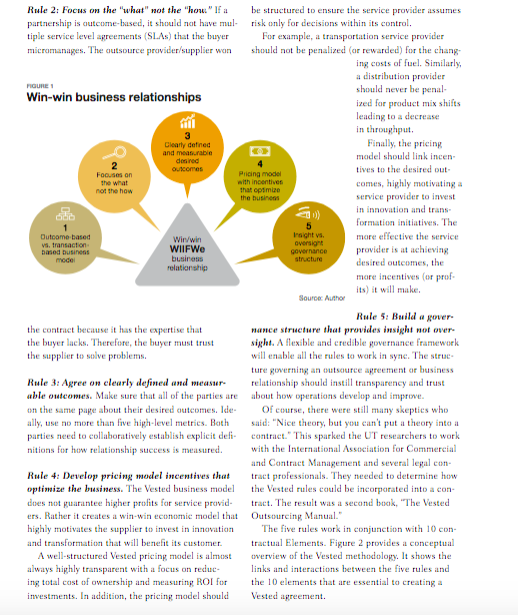

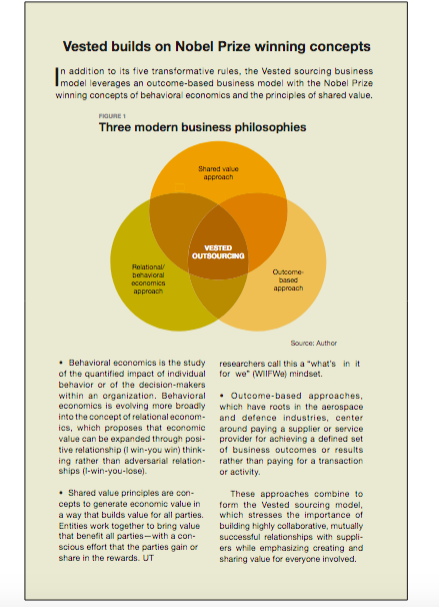

That question was sufficiently compelling in 2003 Researchers described what they found as a Vested that the U.S. Air Force funded a University of Tennes mindset in these successful relationships. This mindset see (UT) research project to find out if there really was is based on a true win-win nature of the relationship a better way to outsource. The answer was an over- alongside mutually defined and desired outcomes. Sim- whelming "yes." And it led in 2010 to publication of ply put, a win for the buyer is a win for the service pro the book "Vested Outsourcing: Five Rules That Will vider the parties are "vested in each other's success, Transform Outsourcing," The research team coined this new business model Since then, Vested outsourcing has evolved from an Vested Outsourcing or Vested, for short organized and recognized methodology to a movement While these relationships seemed radical or at of loyal followers working to change how organizations least very different from many typical business rela outsource. Today more than 350 companies have sent tionships--the researchers also found that these com nearly 1,600 people to study Vested, as the movement panies were leveraging Nobel Prize-winning concepts, is known popularly, in one or more UT courses offered Included here were John Nash's equilibrium theory in its Certified Deal Architect program. To date, 57 and Oliver Williamson's transaction cost economics companies have employed the Vested methodology in principles (ne sidebar) an effort to improve their outsourcing relationships. In other words, the companies most successful at This is the story of how a simple research question outsourcing were writing their own textbook on how to had a lasting impact on making outsourcing relation- make it all work. Identifying the core characteristics ships as successful as everyone hopes them to be. of Vested outsourcing was only the first step for UTS research team. Research phase: 2003-2009 To get started, UT talked to some of the companies Codification of the methodology: 2009-2011 with the world's most successful supplier relationships. The team then set out to codify a broadly repeatable The idea was to learn why some cutsourcing deals were methodology that many organizations could follow to highly successful while others either failed to live up to improve their outsourcing relationships. That resulted their promise or simply failed outright. in five rules featured in the textbook mentioned earlier. The research included outsourcing leaders ranging As Figure I shows, the five rules are: from Procter & Gamble to Microsoft and McDonald's . focus on outcomes not transactions as well as the U.S. Department of Energy. And as you focus on the "what" not the "how;" might imagine, researchers saw common threads in the . apree on clearly defined and measurable most successful relationships. outcomes For starters, all of the successful outsourcing rela . develop pricing model incentives that optimize tionships had an identifiable type of business relation the business, and ship with their suppliers and service providers that was build a governance structure that provides different from what others were doing. Most cutscure insight not twersight. ing relationships are highly transactional. However, the Figure 1 illustrates how the rules work together to more successful ones transcend transactions with a create win-win business relationships with a "What's in highly collaborative, "win-win" relationship. it for we" (WHIFWe approach. In these cases, companies work jointly toward shared goals to drive inntation, create value and Rule 1: Focus on outcomes not transactions. reward success. That hears repeating: They work jointly This requires a shift in mindset. Instead of focusing toward shared goals to drive innovation, create value on buying transactions, companies focus on outcomes. and reward success. Those elements are the foundation They can include targets for availability, reliability of the essential trust between outsourcing parties, and revenue generation, employee or customer satisfaction that trust is predicated on deep levels of transparency. and the like. the what vs. transaction Rule 2: Focus on the "what" not the "how" If a be structured to ensure the service provider assumes partnership is cutcome-based, it should not have muls risk only for decisions within its control. tiple service level agreements (SLA) that the buyer For example, i transportation service provider micromanages. The coutsource provider supplier wein should not be penalized (or rewarded) for the chang ing costs of fuel. Similarly, a distribution provider POUR should never be penal Win-win business relationships ized for product mix shifts leading to a decrease in throughput. Clearly defined Finally, the pricing and measurable desired model should link incen outcomes Focuses on Pricing model tives to the desired out with incentives not the how that optimize comes, highly motivating a the busine service provider to invest in innovation and trans formation initiatives. The Dutcome based Wirwin traight vs. more effective the service oversigt based business WIIFWe governance provider is at achieving model business structure desired outcomes, the relationship more incentives (or prof its) it will make Source: Author Rule 5: Build a gover the contract because it has the expertise that nance structure that provides insight not over the buyer lacks. Therefore, the buyer must trust sight. A flexible and credible governance framework the supplier to solve problems. will enable all the rules to work in syne. The struc ture governing an outsource agreement or business Rule 3: Agree on clearly defined and measur relationship should instill transparency and trust able outcomes. Make sure that all of the parties are about how operations develop and improve on the same page about their desired outcomes. Ide Of course, there were still many skepties who ally, use no more than five high-level metrics. Both said: "Nie theory, but you can't put a theory into a parties need to collaboratively establish explicit deli- contract." This sparked the UT researchers to work nitions for how relationship success is measured. with the International Association for Commercial and Contract Management and several legal con Rule 4: Develop pricing model incentives that tract professionals. They needed to determine how optimize the business. The Vested business model the Vested rules could be incorporated into a con does not guarantee higher profits for service provide tract. The result was a second book, "The Vested ers. Rather it creates a win-win economie model that Outsourcing Manual." highly motivates the supplier to invest in innovation The five rules work in conjunction with 10 con and transformation that will benefit its customer. tractual Elements. Figure 2 provides a conceptual A well-structured Vested pricing model is almost terview of the Vested methodology. It shows the always highly transparent with a focus on reduc. links and interactions between the five rules and ing total cost of ownership and measuring ROI for the 10 elements that are essential to creating a investments. In addition, the pricing model should Vested agreement FIGURE 10 elements of a Vested agreement The buyer outsourced to the expert and wants more insight, yet the buyer has an army of people RULE 1 Outcome-based vs. transaction-based business model on staff to provide oversight to manage the supplier. The buyer wants the supplier to implement efficiencies, yet its transactional pricing scheme inherently incentivizes the supplier to perform Element Business Element Shared vision statement more transactions 1 model map 2 and statement of intent . The buyer wants a partner, yet the contract has AULE 2 Focus on the what, not the how : 60-day termination for convenience clause. Ekomont Statement of objectives Proof of concept phase: 2011-2014 Workload location Eight years into the project, Vested was ready to be put to work. Dell was one of the first companies to RULE 3. Clearly defined and measurable desired outcomes pilot it, Intel was another one. These and other case studies are featured at Vestedway.com Dell and its strategic partner, the reverse logistics provider Gence (now a part of FedEx), had a Elorrent Clearly defined and Element Performance long-standing relationship. It was expanded in 4 measurable desired outcomes 5 management 2009 when Genco agreed to acquire Dell's build- RULE 4 Pricing model incentives that optimize the business ings, assets and people under a threeyear Outsourcing contract Element Pricing model The problem was that while it was a strategic and incentives relationship, the transactional structure of the agreement was far from strategie. Instead, it was a AULE 5 Insight vs. oversight governance structure typical transaction-based contract in which Genco assumed the risk of meeting a set "price per activ ity' while maintaining service levels The agreement worked reasonably well for a time, but Dell's leaders continued to face cost pres- Element Helationship Element Transformation management management sures. They insisted on an "every dollar, every year" procurement principle even though under the contract Genco assumed much of the risk under the contract terms. Element Exit Element Special concerns and 9 management 10 external requirements The seeds were sown for a difficult end Source: Author ing unless the companies could transform their relationship through trust, collaboration and the The five rules, working in conjunction with the 10 ele Vested mindset of "what's in it for we" (WIIFWe). ments, address and resolve the structural flaws that can Despite internal skepties at the computer maker, Dell emerge in transaction-based agreements. For example: and Genco structured a new strategie commercial . A buyer wants inntwation, yet the contract with the agreement that followed the five Rules. supplier has an 800-page statement of work with exact- ing details on how the supplier should perform each of Rule 1: Focus on outcomes not transactions. Instead the activities in scope. of buying transactions, Dell and Genco created a joint The buyer wants outcomes, yet the contract spells shared vision and six desired outcomes to set the tone for out hundreds of service level agreement metrics. what they would focus on for the relationship. This helped Vested builds on Nobel Prize winning concepts n addition to its five transformative rules, the Vested sourcing business winning concepts of behavioral economics and the principles of shared value, OURE Three modern business philosophies Shared value approach VESTED OUTSOURCING Relational behavioral economics approach Outcome based approach Source: Author researchers call this a "what's in it for we' (WIIF We) mindset. Behavioral economics is the study of the quantified impact of individual behavior or of the decision-makers within an organization. Behavioral economies is evolving more broadly into the concept of relational econom- ies, which proposes that economic value can be expanded through posi tive relationship (l win-you win) think- ing rather than adversarial relation- ships (l-win-you-lose). Shared value principles are con cepts to generate economic value in a way that builds value for all parties. Entities work together to bring value that benefit all parties-with a con- scious effort that the parties gain or share in the rewards. UT Outcome-based approaches, which have roots in the aerospace and defence industries, center around paying a supplier or service provider for achieving a defined set of business outcomes or results rather than paying for a transaction or activity These approaches combine to form the Vested sourcing model, which stresses the importance of building highly collaborative, mutually successful relationships with suppli- ers while emphasizing creating and sharing value for everyone involved. the parties avoid the activity trap in which suppliers are paid for performing a task or activity regardless of whether it was needed. Applying this rule enabled the parties to not only call it a strategic partnership, but craft a deal around true business outcomes. Rule 2: Focus on the "what not the "hen." A con ventional buyer-supplier relationship has a detailed statement of work (SOW) that dictates how the supplier should perform the work. Dell and Genco replaced their detailed SOW with a taxonomy and workload allocation that clearly showed how the parties would work together to achieve their shared vision and desired outcomes. Rule 3: Agree on clearly defined and measur able outcomes. Traditional outsourcing agreements have detailed SLAs. In a Vested agreement, all metries are clearly aligned to the desired outcomes. For Dell/ Gence this meant reducing the number of metrics from more than 100 to 20 clearly-defined metric aligned to six desired outcomes Rule 4: Develop pricing melel incentives that opti- mize the business. The Vested business model does not guarantee higher profits for suppliers. Rutber, suppliers take a calculated risk to link their profitability to perfor mance to mutually agreed desired outcomes. Dell's agreement incentivixed Gence to make stra tegic investments in processes that would help them achieve the desired outcomes. A pricing model with incentives enabled the parties to grow the pie and share the pie" when value was created. The more effective Genco was at achieving the desired out comes, the more incentives (prolits) they earned. A true win-win economie model. Rule 5: Build a governance structure that pro vides insight not oversight. Dell and Genco estab- lished a flexible and credible governance framework that enabled all the rules to work in syne. The focus shifted from managing the supplier to managing the business with the supplier. Together, the parties built a governance structure based on transparency about how operations are developing and improving. The results were transformational. In the first two years, Dell and Genco were able to reduce costs by 42%, scrap costs by 67% and drive defective parts per million down to record low levels. Both companies now consider the Vested contracting approach a best practice and have applied it in other relationships. Gence (now FedEx) also benefited with a tripling of its margins. John Coleman, FedEx's general manager of opera tions for Dell's reverse logistics business, explained the power of a collaborative win-win approach: "It's like we broke open a new innovation piata, FedEx employees now know that we will share in the reward for good ideas," says Columan Building a movement: 2014-2018 Today, Dell is one of more than 50 organizations that have applied the Vested methodolony to spend categories as diverse as facilities Management, reverse logistics, third party logistics, environmental services, fiber optic net work management and labor sirvices Meanwhile, the UT research library dedicated to Vested now includes six books, 18 white papers and 18 case studies that document the success stories of organizations such as Intel (third-party logistics), Dell (reverse logisties) Vancouver Coastal Health (environ mental services), Discovery Health insurance claims management), Telia (facilities management) and Island Health (labor services/union contract with doctors). Change takes time. History tells us new concepts often take a while to cross into the mainstream. Take for example the cell phone, which evolved from large, cumbersome and expensive gadgets to ones that have virtually replaced landlines and become handheld mul timedia computers. Or electric, self-driving cars. Once the momentum starts, it's impossible to go backward. The bottom line: Change is inevitable even change in how companies outsource. The tried and true buy sell, I-win-you-kose, non-tratsparent, power-based methods that became ingrained in the last century no longer work for today's complex and global sciurcing challenges. Oras Vested makes clear to all who give it a try: It is easier to maximize your success when you have a win-win deal. Con

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts