Question: PLEASE READ THE INSTRUCTIONS Complete the steps below using cell references to given data or previous calculations. in some cases, a simple cell reference is

PLEASE READ THE INSTRUCTIONS

Complete the steps below using cell references to given data or previous calculations. in some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mired cell reference may be preferred.

If a specific Excel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computatious only in the blue cells highlighted below. In all cases, unless otherwise directed, use the cartiest appearance of

the data in your formulas, usually the Given Data section.

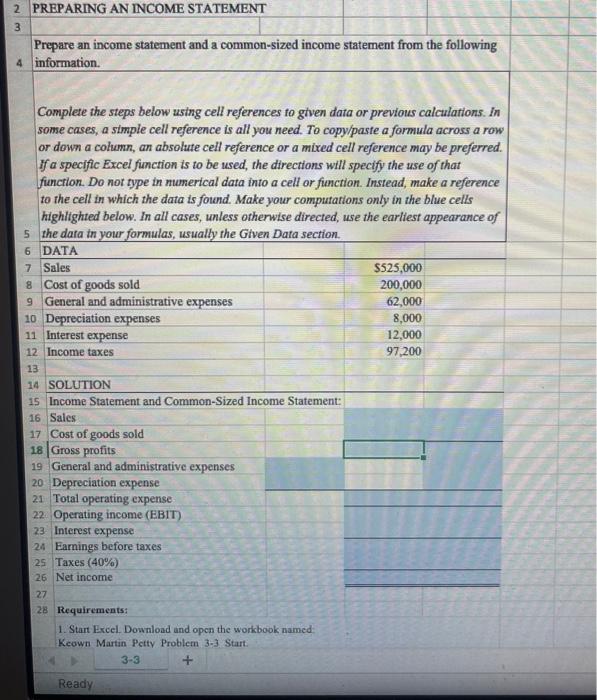

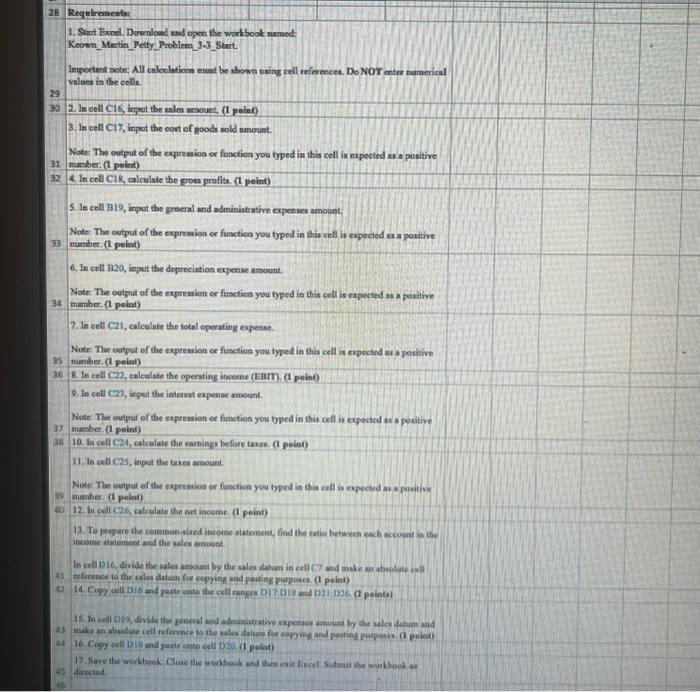

2 PREPARING AN INCOME STATEMENT 3 Prepare an income statement and a common-sized income statement from the following 4 information. Complete the steps below using cell references fo given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that function. Do not type in mumerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of 5 the data in your formulas, usually the Given Data section. \begin{tabular}{|l|l|r|} \hline 6 & DATA & \\ \hline 7 & Sales & $525,000 \\ \hline 8 & Cost of goods sold & 200,000 \\ \hline 9 & General and administrative expenses & 62,000 \\ \hline 10 & Depreciation expenses & 8,000 \\ \hline 11 & Interest expense & 12,000 \\ \hline 12 & Income taxes & 97,200 \\ \hline 13 & & \\ \hline 14 & SOLUTHON & \\ \hline 15 & Income Statement and Common-Sized Income Statement: & \\ \hline 16 & Sales & \\ \hline 17 & Cost of goods sold & \\ \hline 18 & Gross profits & \\ \hline 19 & General and administrative expenses & \\ \hline 20 & Depreciation expense & \\ \hline 21 & Total operating expense & \\ \hline 22 & Operating income (EBIT) \\ \hline 23 & Interest expense & \\ \hline 24 & Earnings before taxes & \\ \hline 25 & Taxes (40\%) & \\ \hline 26 & Net income & \\ \hline 27 & \end{tabular} 28 Requirements: 1. Stant Excel. Download and open the workbook named: Keown Martin Pctty Problem 3-3. Start. Ready 28 Requirements: 1. Stant Fricel. Downlowd nod open the workbook named: Koown_Mintin_Petly,Problizen_3.3_Start. limportat aote: All emleclations eleat be shown tixing cell references. Do NOT mter namerical values in the coll. 29 39 2. In eell Cl6, inpet the sales armount ( 1 pelet) 3. In eell Cl7, inprot the cort of goods nold amount. Note: The output of the expresion of function you typed in this cell is expected as a positive 31 mumber. ( 1 pelint) 32. 4. In coll CI8, calcelate the gross profits. (t peint) 5. le cell B19, inpet the groeral and adminiatrativo expenses amount. Note: The output of the expremion or function you fyped in this cell is expecied an a pasitive 33 number. (1. peint) 6. If cell 1320, inpet the deprociation expense amount. Note: The output of the cepretsion of functicn you typed in this cell is cxpected as a ponitive number. ( peint) 34 number. ( 1 peint ). 7. In cell C21, calculate the fotal eperating expense. Note: The output of the expresion or funstion you typed in this cell is expected as a positive 35 number (1 peint) 9. In cell C2, irpol the interest expense armount. Note: The ouput of the expression of functien you fyped in this cell in expecicd as a postive 37 zumber. (1 peiet) 38 10. In oell C24, calcelaie the carnings ixfore thece. (1 peint) 11. In cell C25, itiput the taxes arnount. Note. The oulput of the eqresion of fanction you typed is this cell is espected a a pastive (4) taumer (t paint) 4i0 12. In cell 1206 , calculate the net incerne. (1 peint) 11. To perare the comrnoesized income siatement, find the ratia betweea each accouat in the incouns stalement and thie shles amount. In cell Dik, divide the sales amouat by the sules datias in cell C and make an abolute celf 4. refcresce to the sales detuan for copying and pasting purposick. (t peint) 15. In well D19 divide tie general and admusiutrative expenses umopat by the ales daham and 43. make en absilule cell reference to the wales daium for copyisg acol patiogs purpose. (t peint) as directed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts