Question: Please show all equations and work as needed. For part a, you can solve for the risk-free rate of return and market return by using

Please show all equations and work as needed.

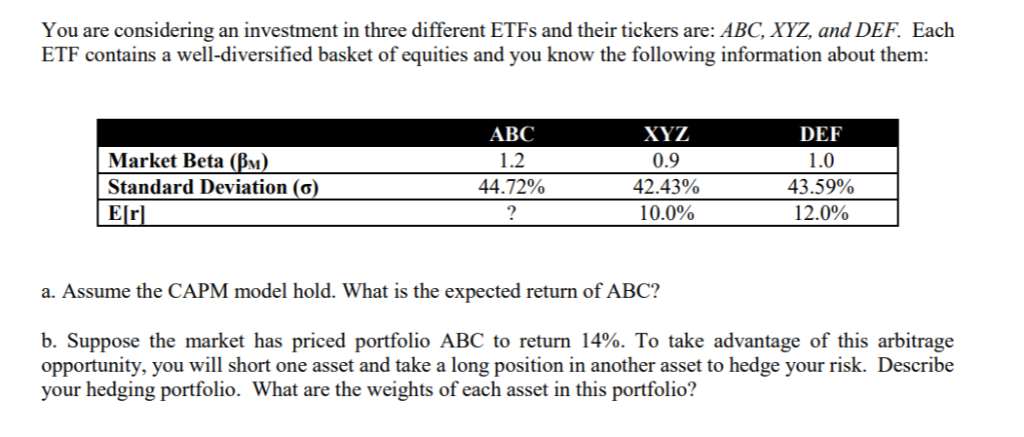

For part a, you can solve for the risk-free rate of return and market return by using stocks XYZ and DEF. The risk-free rate should be a negative number in this example. For b, you could design a long-short strategy to exploit the arbitrage opportunities by using either XYZ or DEF if we assume these two stocks are fairly priced.

You are considering an investment in three different ETFs and their tickers are: ABC, XYZ, and DEF. Each ETF contains a well-diversified basket of equities and you know the following information about them: XYZ 0.9) 42.43% 100% ABC 1.2 44.72% DEF 1.0 43.59% 12.0% Market Beta (PM) Standard Deviation (o) Erl a. Assume the CAPM model hold. What is the expected return of ABC? b. Suppose the market has priced portfolio ABC to return 14%. To take advantage of this arbitrage opportunity, you will short one asset and take a long position in another asset to hedge your risk. Describe your hedging portfolio. What are the weights of each asset in this portfolio? You are considering an investment in three different ETFs and their tickers are: ABC, XYZ, and DEF. Each ETF contains a well-diversified basket of equities and you know the following information about them: XYZ 0.9) 42.43% 100% ABC 1.2 44.72% DEF 1.0 43.59% 12.0% Market Beta (PM) Standard Deviation (o) Erl a. Assume the CAPM model hold. What is the expected return of ABC? b. Suppose the market has priced portfolio ABC to return 14%. To take advantage of this arbitrage opportunity, you will short one asset and take a long position in another asset to hedge your risk. Describe your hedging portfolio. What are the weights of each asset in this portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts