Question: Please show all equations and work as needed. If possible enter the work as text. Also make the answer clear. Thank you. Assume it's an

Please show all equations and work as needed. If possible enter the work as text. Also make the answer clear. Thank you.

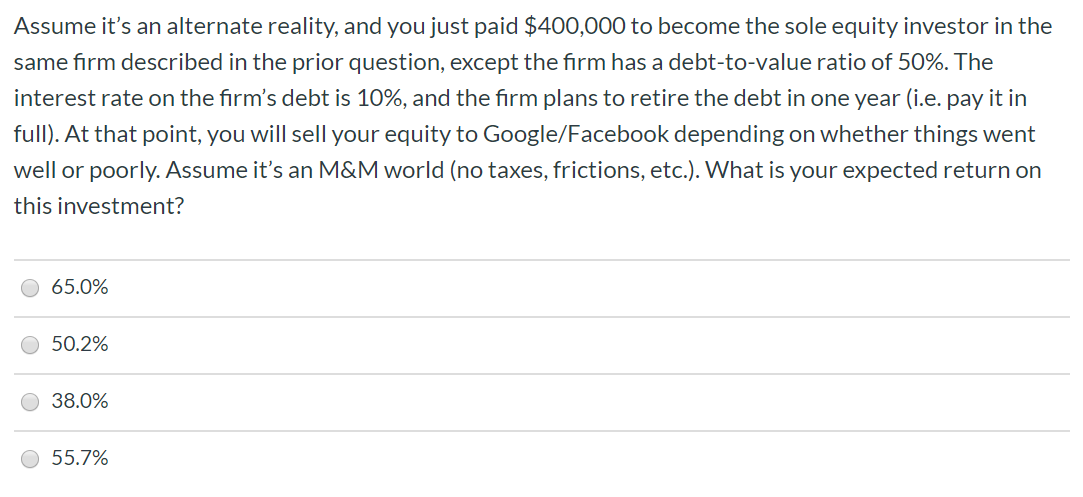

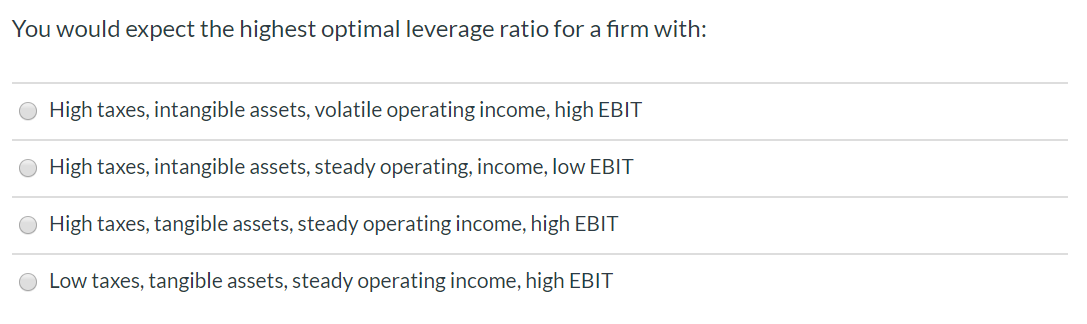

Assume it's an alternate reality, and you just paid $400,000 to become the sole equity investor in the same firm described in the prior question, except the firm has a debt-to-value ratio of 50%. The interest rate on the firm's debt is 10%, and the firm plans to retire the debt in one year (i.e. pay it in full). At that point, you will sell your equity to Google/Facebook depending on whether things went well or poorly. Assume it's an M&M world (no taxes, frictions, etc.). What is your expected return on this investment? O 65.0% O 50.2% 38.0% O 55.7% You would expect the highest optimal leverage ratio for a firm with: O High taxes, intangible assets, volatile operating income, high EBIT High taxes, intangible assets, steady operating, income, low EBIT O High taxes, tangible assets, steady operating income, high EBIT O Low taxes, tangible assets, steady operating income, high EBIT Assume it's an alternate reality, and you just paid $400,000 to become the sole equity investor in the same firm described in the prior question, except the firm has a debt-to-value ratio of 50%. The interest rate on the firm's debt is 10%, and the firm plans to retire the debt in one year (i.e. pay it in full). At that point, you will sell your equity to Google/Facebook depending on whether things went well or poorly. Assume it's an M&M world (no taxes, frictions, etc.). What is your expected return on this investment? O 65.0% O 50.2% 38.0% O 55.7% You would expect the highest optimal leverage ratio for a firm with: O High taxes, intangible assets, volatile operating income, high EBIT High taxes, intangible assets, steady operating, income, low EBIT O High taxes, tangible assets, steady operating income, high EBIT O Low taxes, tangible assets, steady operating income, high EBIT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts