Question: Please show all equations and work as needed. If possible enter the work as text. Also make the answer clear. Thank you. Suppose Microsoft has

Please show all equations and work as needed. If possible enter the work as text. Also make the answer clear. Thank you.

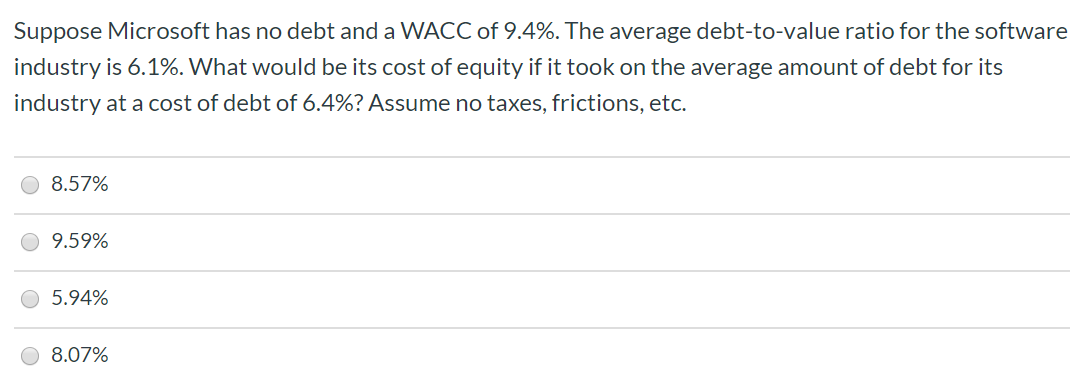

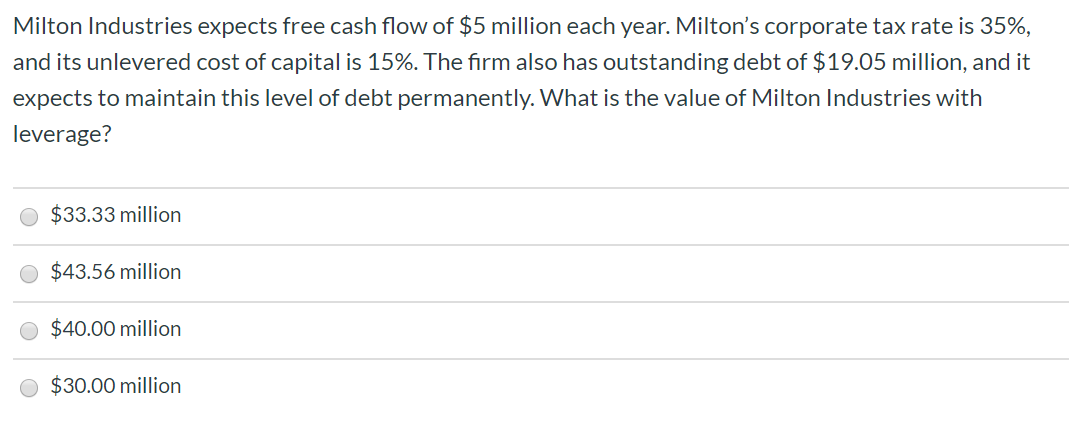

Suppose Microsoft has no debt and a WACC of 9.4%. The average debt-to-value ratio for the software industry is 6.1%. What would be its cost of equity if it took on the average amount of debt for its industry at a cost of debt of 6.4%? Assume no taxes, frictions, etc. 8.57% 09.59% 5.94% 08.07% Milton Industries expects free cash flow of $5 million each year. Milton's corporate tax rate is 35%, and its unlevered cost of capital is 15%. The firm also has outstanding debt of $19.05 million, and it expects to maintain this level of debt permanently. What is the value of Milton Industries with leverage? $33.33 million $43.56 million $40.00 million $30.00 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts