Question: Please show all equations and work as needed. Make the correct answer clear. If possible, please type work so it can be copied. Thank you.

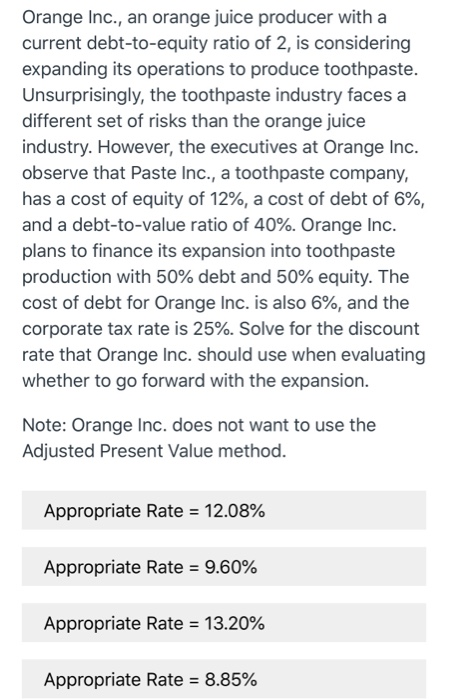

Orange Inc., an orange juice producer with a current debt-to-equity ratio of 2, is considering expanding its operations to produce toothpaste. Unsurprisingly, the toothpaste industry faces a different set of risks than the orange juice industry. However, the executives at Orange Inc. observe that Paste Inc., a toothpaste company, has a cost of equity of 12%, a cost of debt of 6%, and a debt-to-value ratio of 40%. Orange Inc. plans to finance its expansion into toothpaste production with 50% debt and 50 % equity. The cost of debt for Orange Inc. is also 6%, and the corporate tax rate is 25%. Solve for the discount rate that Orange Inc. should use when evaluating whether to go forward with the expansion. Note: Orange Inc. does not want to use the Adjusted Present Value method. Appropriate Rate 12.08% Appropriate Rate = 9.60% Appropriate Rate = 13.20% Appropriate Rate = 8.85%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts