Question: Please show all equations and work as needed. If possible, please type work so it can be copied. Thank you. Goliath Inc. is considering acquiring

Please show all equations and work as needed. If possible, please type work so it can be copied. Thank you.

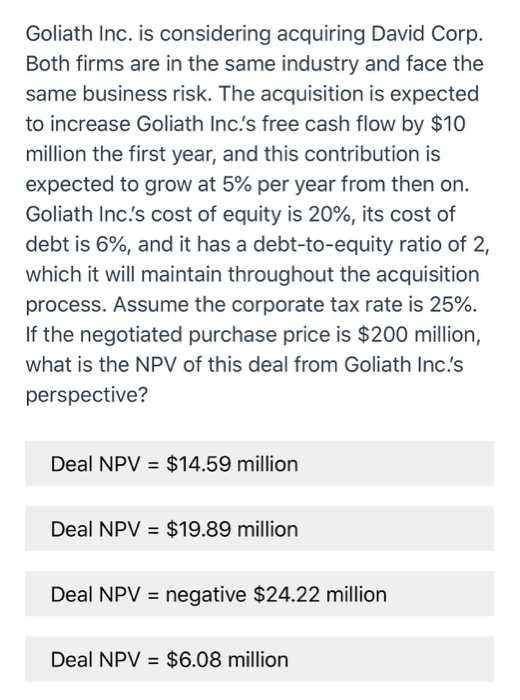

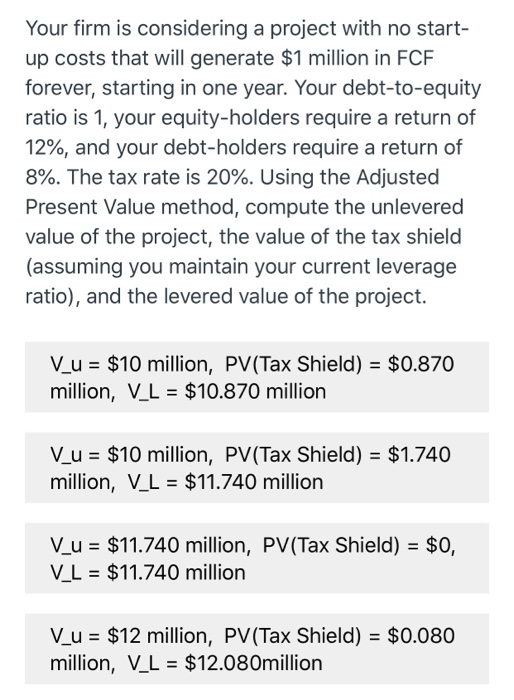

Goliath Inc. is considering acquiring David Corp. Both firms are in the same industry and face the same business risk. The acquisition is expected to increase Goliath Inc.'s free cash flow by $10 million the first year, and this contribution is expected to grow at 5% per year from then on. Goliath Inc.'s cost of equity is 20%, its cost of debt is 6%, and it has a debt-to-equity ratio of 2, which it will maintain throughout the acquisition process. Assume the corporate tax rate is 25% If the negotiated purchase price is $200 million, what is the NPV of this deal from Goliath Inc's perspective? Deal NPV $14.59 million Deal NPV = $19.89 million negative $24.22 milion Deal NPV $6.08 million Deal NPV Your firm is considering a project with no start- up costs that will generate $1 million in FCF forever, starting in one year. Your debt-to-equity ratio is 1, your equity-holders require a return of 12%, and your debt-holders require a return of 8%. The tax rate is 20%. Using the Adjusted Present Value method, compute the unlevered value of the project, the value of the tax shield (assuming you maintain your current leverage ratio), and the levered value of the project. V_u = $10 million, PV(Tax Shield) = $0.870 million, V_L $10.870 million V_u= $10 million, PV(Tax Shield) = $1.740 million, V L $11.740 million V_u $11.740 million, PV(Tax Shield) = $0, VL $11.740 million Vu = $12 million, PV(Tax Shield) = $0.080 million, V_L $12.080million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts