Question: Please show all equations and work as needed. Instant thumbs up if the work is able to be copied and pasted. Thank you. AAA Inc.

Please show all equations and work as needed. Instant thumbs up if the work is able to be copied and pasted. Thank you.

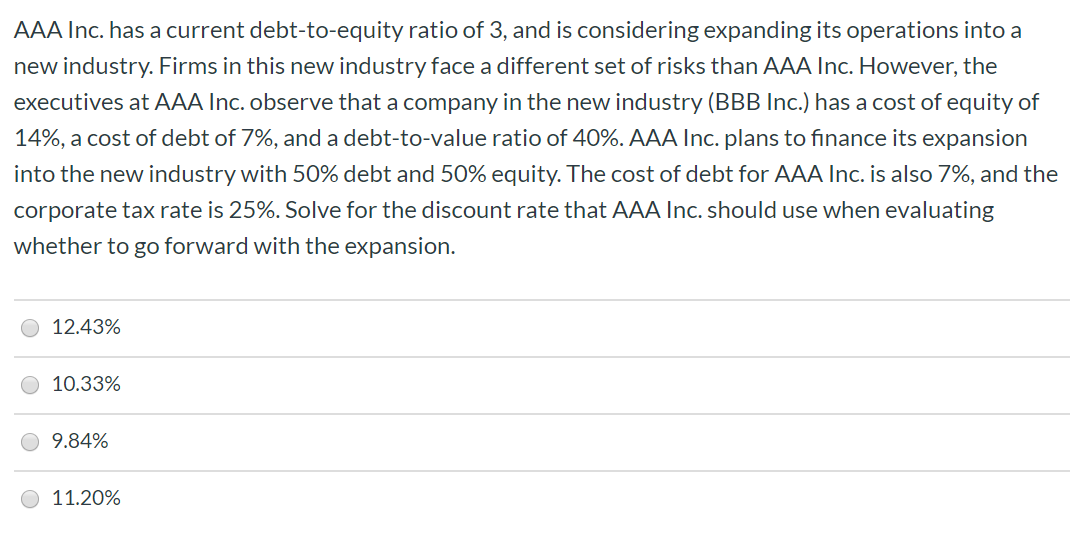

AAA Inc. has a current debt-to-equity ratio of 3, and is considering expanding its operations into a new industry. Firms in this new industry face a different set of risks than AAA Inc. However, the executives at AAA Inc. observe that a company in the new industry (BBB Inc.) has a cost of equity of 14%, a cost of debt of 7%, and a debt-to-value ratio of 40%. AAA Inc. plans to finance its expansion into the new industry with 50% debt and 50% equity. The cost of debt for AAA Inc. is also 7%, and the corporate taxrate is 25%. Solve for the discount rate that AAA Inc. should use when evaluating whether to go forward with the expansion. 12.43% 10.33% 9.84% 11.20% AAA Inc. has a current debt-to-equity ratio of 3, and is considering expanding its operations into a new industry. Firms in this new industry face a different set of risks than AAA Inc. However, the executives at AAA Inc. observe that a company in the new industry (BBB Inc.) has a cost of equity of 14%, a cost of debt of 7%, and a debt-to-value ratio of 40%. AAA Inc. plans to finance its expansion into the new industry with 50% debt and 50% equity. The cost of debt for AAA Inc. is also 7%, and the corporate taxrate is 25%. Solve for the discount rate that AAA Inc. should use when evaluating whether to go forward with the expansion. 12.43% 10.33% 9.84% 11.20%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts