Question: Please show all equations and work as needed. Instant thumbs up if the work is able to be copied and pasted. Thank you. Assume BigData

Please show all equations and work as needed. Instant thumbs up if the work is able to be copied and pasted. Thank you.

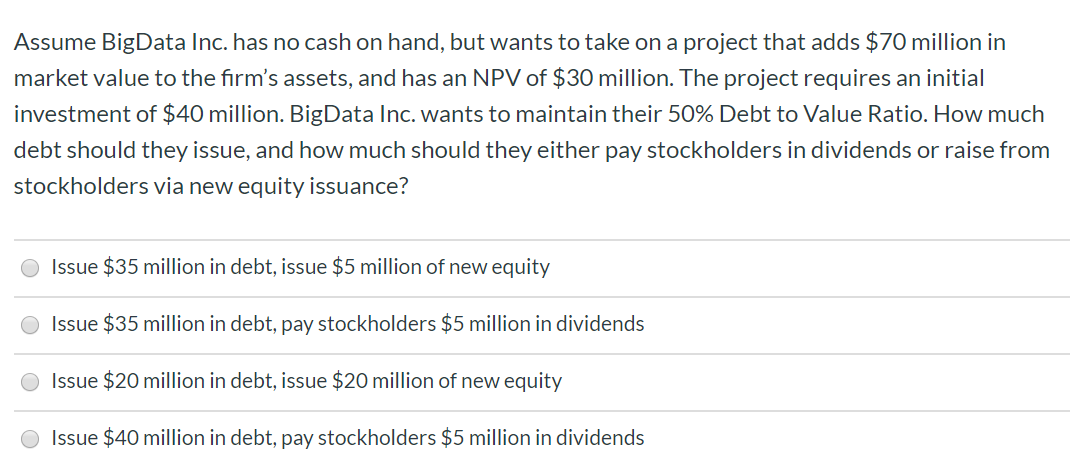

Assume BigData Inc. has no cash on hand, but wants to take on a project that adds $70 million in market value to the firm's assets, and has an NPV of $30 million. The project requires an initial investment of $40 million. BigData Inc. wants to maintain their 50% Debt to Value Ratio. How much debt should they issue, and how much should they either pay stockholders in dividends or raise from stockholders via new equity issuance? Issue $35 million in debt, issue $5 million of new equity O Issue $35 million in debt, pay stockholders $5 million in dividends Issue $20 million in debt, issue $20 million of new equity Issue $40 million in debt, pay stockholders $5 million in dividends

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts