Question: Please show every step and no excel solutions... Three mutually exclusive alternatives are being considered as welding tools at a job shop. The estimated cash

Please show every step and no excel solutions...

Please show every step and no excel solutions...

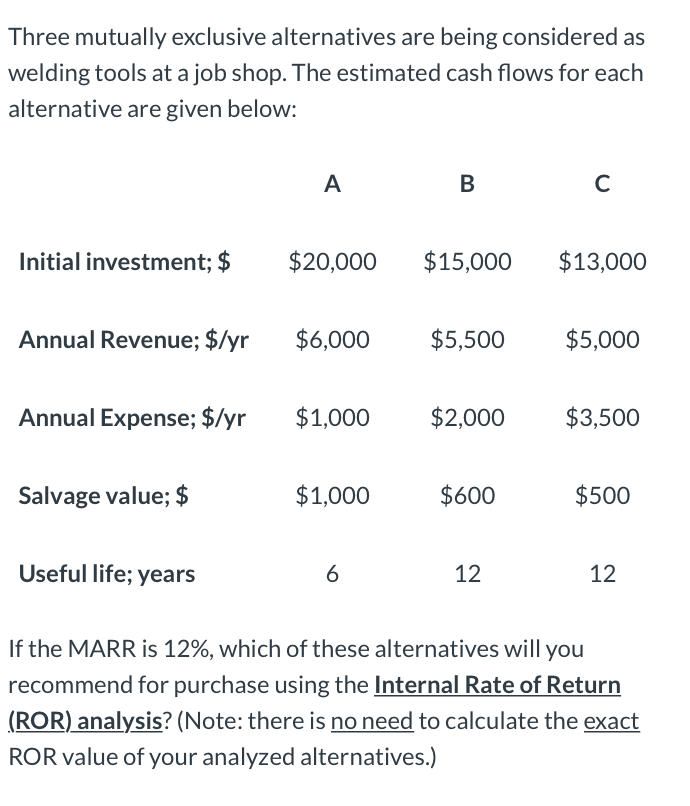

Three mutually exclusive alternatives are being considered as welding tools at a job shop. The estimated cash flows for each alternative are given below: A B C Initial investment; $ $20,000 $15,000 $13,000 Annual Revenue; $/yr $6,000 $5,500 $5,000 Annual Expense; $/yr $1,000 $2,000 $3,500 Salvage value; $ $1,000 $600 $500 Useful life; years 12 12 If the MARR is 12%, which of these alternatives will you recommend for purchase using the Internal Rate of Return (ROR) analysis? (Note: there is no need to calculate the exact ROR value of your analyzed alternatives.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts