Question: *PLEASE SHOW FORMULAS* Your division is considering two projects. Its WACC is 12%, and the projects' after-tax cash flows (in millions of dollars) would be

*PLEASE SHOW FORMULAS*

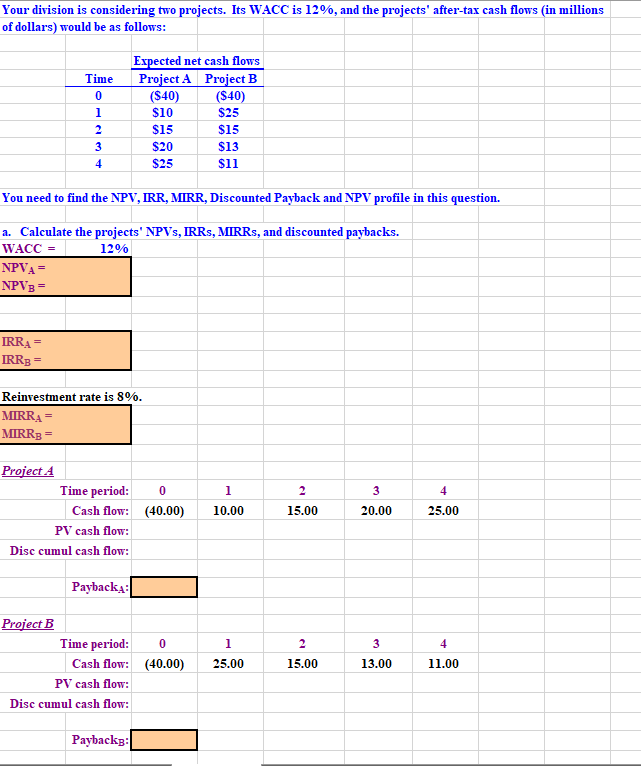

Your division is considering two projects. Its WACC is 12%, and the projects' after-tax cash flows (in millions of dollars) would be as follows: Time 0 1 Expected net cash flows Project A Project B ($40) ($40) $10 $25 $15 $15 $20 $25 $11 2 $13 3 4 You need to find the NPV, IRR, MIRR, Discounted Payback and NPV profile in this question. . ounted paybacks. a. Calculate the projects' NPVS, IRRS, MIRRs, and dis WACC = 12% NPVA= NPVB = IRRA IRRB = Reinvestment rate is 8%. MIRRA MIRR3 = 1 2 3 4 Project 4 Time period: 0 Cash flow: (40.00) PV cash flow: Disc cumul cash flow: 10.00 15.00 20.00 25.00 Paybacka 3 4 Project B Time period: 0 Cash flow: (40.00) PV cash flow: Disc cumul cash flow: 1 25.00 15.00 13.00 11.00 PaybackB

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts