Question: Please show full working. TQ. Subject: Financial Management Formula Table is below. Please use the appropriate formula. QUESTION 1 You are considering adding new robotic

Please show full working. TQ.

Subject: Financial Management

Formula Table is below. Please use the appropriate formula.

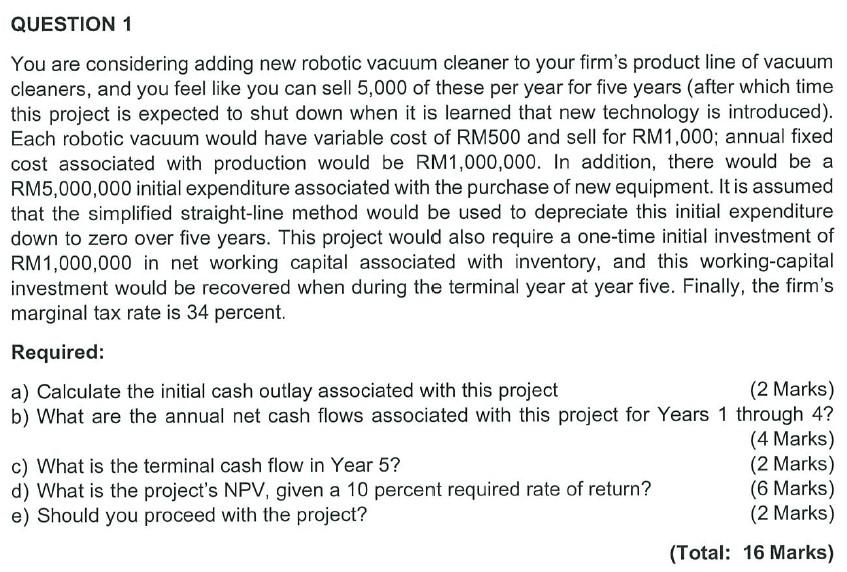

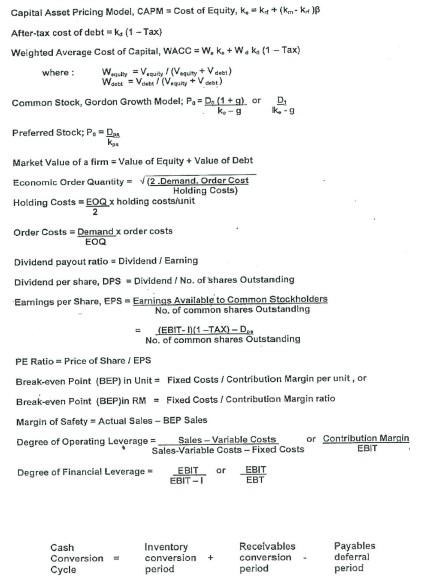

QUESTION 1 You are considering adding new robotic vacuum cleaner to your firm's product line of vacuum cleaners, and you feel like you can sell 5,000 of these per year for five years (after which time this project is expected to shut down when it is learned that new technology is introduced). Each robotic vacuum would have variable cost of RM500 and sell for RM1,000; annual fixed cost associated with production would be RM1,000,000. In addition, there would be a RM5,000,000 initial expenditure associated with the purchase of new equipment. It is assumed that the simplified straight-line method would be used to depreciate this initial expenditure down to zero over five years. This project would also require a one-time initial investment of RM1,000,000 in net working capital associated with inventory, and this working-capital investment would be recovered when during the terminal year at year five. Finally, the firm's marginal tax rate is 34 percent. Required: a) Calculate the initial cash outlay associated with this project (2 Marks) b) What are the annual net cash flows associated with this project for Years 1 through 4? (4 Marks) c) What is the terminal cash flow in Year 5? (2 Marks) d) What is the project's NPV, given a 10 percent required rate of return? (6 Marks) e) Should you proceed with the project? (2 Marks) (Total: 16 Marks) Capital Asset Pricing Model CAPM = Cost of Equity, kok++ (m+k+)B After-tax cost of debt = kx (1 - Tax) Weighted Average Cost of Capital, WACC = W. K+W.K. (1 - Tax) where : W = V(quhy + Vel) Watt + V (V... + V) Common Stock, Gordon Growth Model; P = D. (1+9) or D. ke-g K-9 Preferred Stock: P.-D. k. Market Value of a firm = Value of Equity + Value of Debt Economic Order Quantity (2.Demand Order Cost Holding Costs) Holding Costs =E0Qx holding costs unit = Order Costs - Demand x order costs EOQ Dividend payout ratio Dividend / Earning Dividend per share, DPS Dividend / No. of shares Outstanding Earnings per Share, EPS Earnings Available to Common Stockholders No. of common shares Outstanding (EBIT-11 -TAX)-D No. of common shares Outstanding PE Ratio - Price of Share / EPS Break-even Point (BEP) in Unit - Fixed Costs / Contribution Margin per unit, or Break-even Point (BEP)in RM - Fixed Costs / Contribution Margin ratio Margin of Safety - Actual Sales - BEP Sales Degree of Operating Leverage = Sales - Variable costs or Contribution Mannin Sales-Variable Costs - Fixed Costs EBIT Degree of Financial Leverage EBIT EBIT EBIT-1 EBT 1 or Cash Conversion - Cycle Inventory conversion period + Recolvables conversion - period Payables deferral period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts