Question: Please show full working. TQ. Subject: Financial Management Formula Table is below. Please use the appropriate formula. QUESTION 4 Megah Corporation's projected sales for the

Please show full working. TQ.

Subject: Financial Management

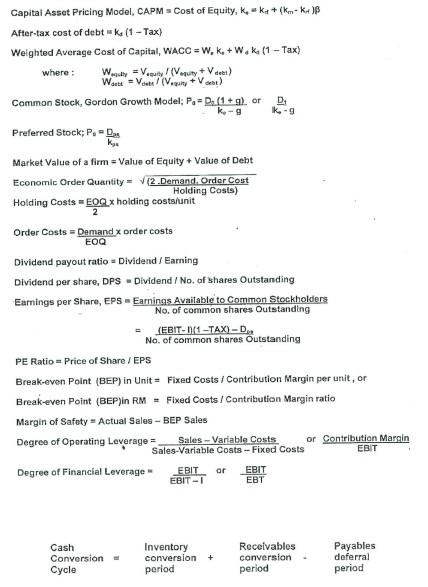

Formula Table is below. Please use the appropriate formula.

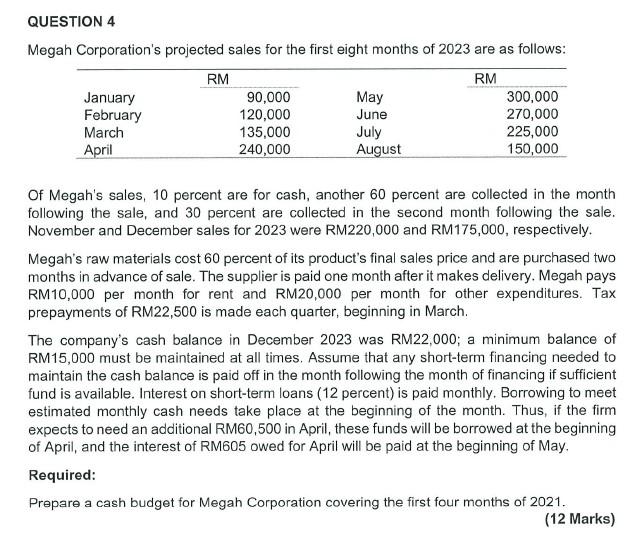

QUESTION 4 Megah Corporation's projected sales for the first eight months of 2023 are as follows: RM RM January 90,000 May 300,000 February 120,000 June 270,000 March 135,000 July 225,000 240,000 August 150,000 April Of Megah's sales, 10 percent are for cash, another 60 percent are collected in the month following the sale, and 30 percent are collected in the second month following the sale. November and December sales for 2023 were RM220,000 and RM175,000, respectively. Megan's raw materials cost 60 percent of its product's final sales price and are purchased two months in advance of sale. The supplier is paid one month after it makes delivery. Megah pays RM10,000 per month for rent and RM20,000 per month for other expenditures. Tax prepayments of RM22,500 is made each quarter, beginning in March. The company's cash balance in December 2023 was RM22,000; a minimum balance of RM15,000 must be maintained at all times. Assume that any short-term financing needed to maintain the cash balance is paid off in the month following the month of financing if sufficient fund is available. Interest on short-term loans (12 percent) is paid monthly, Borrowing to meet estimated monthly cash needs take place at the beginning of the month. Thus, if the firm expects to need an additional RM60,500 in April, these funds will be borrowed at the beginning of April, and the interest of RM605 owed for April will be paid at the beginning of May, Required: Prepare a cash budget for Megah Corporation covering the first four months of 2021. (12 Marks) Capital Asset Pricing Model CAPM = Cost of Equity, kok++ (m+k+)B After-tax cost of debt = kx (1 - Tax) Weighted Average Cost of Capital, WACC = W. K+W.K. (1 - Tax) where : W = V(quhy + Vel) Watt + V (V... + V) Common Stock, Gordon Growth Model; P = D. (1+9) or D. ke-g K-9 Preferred Stock: P.-D. k. Market Value of a firm = Value of Equity + Value of Debt Economic Order Quantity (2.Demand Order Cost Holding Costs) Holding Costs =E0Qx holding costs unit = Order Costs - Demand x order costs EOQ Dividend payout ratio Dividend / Earning Dividend per share, DPS Dividend / No. of shares Outstanding Earnings per Share, EPS Earnings Available to Common Stockholders No. of common shares Outstanding (EBIT-11 -TAX)-D No. of common shares Outstanding PE Ratio - Price of Share / EPS Break-even Point (BEP) in Unit - Fixed Costs / Contribution Margin per unit, or Break-even Point (BEP)in RM - Fixed Costs / Contribution Margin ratio Margin of Safety - Actual Sales - BEP Sales Degree of Operating Leverage = Sales - Variable costs or Contribution Mannin Sales-Variable Costs - Fixed Costs EBIT Degree of Financial Leverage EBIT EBIT EBIT-1 EBT 1 or Cash Conversion - Cycle Inventory conversion period + Recolvables conversion - period Payables deferral period QUESTION 4 Megah Corporation's projected sales for the first eight months of 2023 are as follows: RM RM January 90,000 May 300,000 February 120,000 June 270,000 March 135,000 July 225,000 240,000 August 150,000 April Of Megah's sales, 10 percent are for cash, another 60 percent are collected in the month following the sale, and 30 percent are collected in the second month following the sale. November and December sales for 2023 were RM220,000 and RM175,000, respectively. Megan's raw materials cost 60 percent of its product's final sales price and are purchased two months in advance of sale. The supplier is paid one month after it makes delivery. Megah pays RM10,000 per month for rent and RM20,000 per month for other expenditures. Tax prepayments of RM22,500 is made each quarter, beginning in March. The company's cash balance in December 2023 was RM22,000; a minimum balance of RM15,000 must be maintained at all times. Assume that any short-term financing needed to maintain the cash balance is paid off in the month following the month of financing if sufficient fund is available. Interest on short-term loans (12 percent) is paid monthly, Borrowing to meet estimated monthly cash needs take place at the beginning of the month. Thus, if the firm expects to need an additional RM60,500 in April, these funds will be borrowed at the beginning of April, and the interest of RM605 owed for April will be paid at the beginning of May, Required: Prepare a cash budget for Megah Corporation covering the first four months of 2021. (12 Marks) Capital Asset Pricing Model CAPM = Cost of Equity, kok++ (m+k+)B After-tax cost of debt = kx (1 - Tax) Weighted Average Cost of Capital, WACC = W. K+W.K. (1 - Tax) where : W = V(quhy + Vel) Watt + V (V... + V) Common Stock, Gordon Growth Model; P = D. (1+9) or D. ke-g K-9 Preferred Stock: P.-D. k. Market Value of a firm = Value of Equity + Value of Debt Economic Order Quantity (2.Demand Order Cost Holding Costs) Holding Costs =E0Qx holding costs unit = Order Costs - Demand x order costs EOQ Dividend payout ratio Dividend / Earning Dividend per share, DPS Dividend / No. of shares Outstanding Earnings per Share, EPS Earnings Available to Common Stockholders No. of common shares Outstanding (EBIT-11 -TAX)-D No. of common shares Outstanding PE Ratio - Price of Share / EPS Break-even Point (BEP) in Unit - Fixed Costs / Contribution Margin per unit, or Break-even Point (BEP)in RM - Fixed Costs / Contribution Margin ratio Margin of Safety - Actual Sales - BEP Sales Degree of Operating Leverage = Sales - Variable costs or Contribution Mannin Sales-Variable Costs - Fixed Costs EBIT Degree of Financial Leverage EBIT EBIT EBIT-1 EBT 1 or Cash Conversion - Cycle Inventory conversion period + Recolvables conversion - period Payables deferral period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts