Question: Please show full working. TQ. Subject: Financial Management Formula Table is below. Please use the appropriate formula. QUESTION 3 1) Tuah Restaurant operates two branches

Please show full working. TQ.

Subject: Financial Management

Formula Table is below. Please use the appropriate formula.

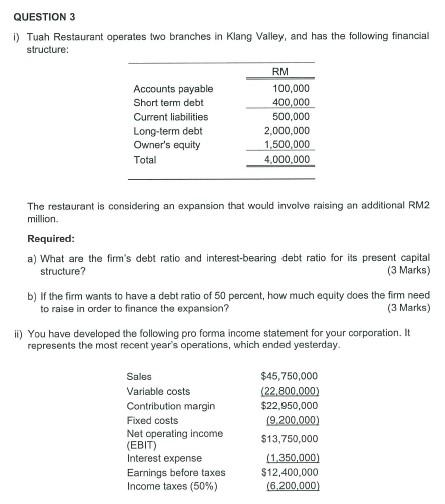

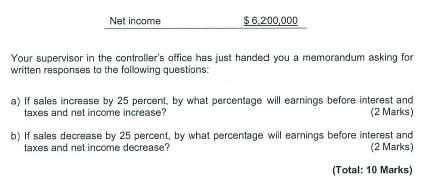

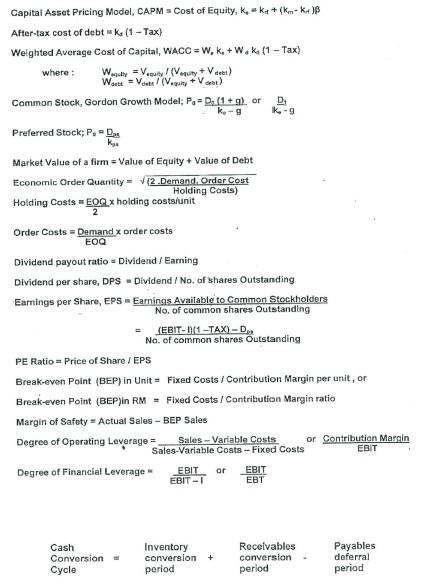

QUESTION 3 1) Tuah Restaurant operates two branches in Klang Valley, and has the following financial structure: Accounts payable Short term debt Current liabilities Long-term debt Owner's equity RM 100,000 400,000 500,000 2,000,000 1,500,000 4,000,000 Total The restaurant is considering an expansion that would involve raising an additional RM2 million Required: a) What are the firm's debt ratio and interest-bearing debt ratio for its present capital structure? (3 Marks) b) If the firm wants to have a debt ratio of 50 percent, how much equity does the firm need to raise in order to finance the expansion? (3 Marks) ) You have developed the following pro forma income statement for your corporation. It represents the most recent year's operations, which ended yesterday Sales Variable costs Contribution margin Fixed costs Net operating income (EBIT) Interest expense Earnings before taxes Income taxes (50%) $45,750,000 (22.800.000) $22.950,000 19200,000) $13,750,000 (1.350,000) $12,400.000 (6,200,000) Net income $6.200,000 Your supervisor in the controller's office has just handed you a memorandum asking for written responses to the following questions: a) If sales increase by 25 percent, by what percentage will earnings before interest and taxes and net income increase? (2 Marks) b) If sales decrease by 25 percent, by what percentage will earnings before interest and taxes and net income decrease? (2 Marks) (Total: 10 Marks) Capital Asset Pricing Model CAPM = Cost of Equity, kok++ (m+k+)B After-tax cost of debt = kx (1 - Tax) Weighted Average Cost of Capital, WACC = W. K+W.K. (1 - Tax) where : W = V(quhy + Vel) Watt + V (V... + V) Common Stock, Gordon Growth Model; P = D. (1+9) or D. ke-g K-9 Preferred Stock: P.-D. k. Market Value of a firm = Value of Equity + Value of Debt Economic Order Quantity (2.Demand Order Cost Holding Costs) Holding Costs =E0Qx holding costs unit = Order Costs - Demand x order costs EOQ Dividend payout ratio Dividend / Earning Dividend per share, DPS Dividend / No. of shares Outstanding Earnings per Share, EPS Earnings Available to Common Stockholders No. of common shares Outstanding (EBIT-11 -TAX)-D No. of common shares Outstanding PE Ratio - Price of Share / EPS Break-even Point (BEP) in Unit - Fixed Costs / Contribution Margin per unit, or Break-even Point (BEP)in RM - Fixed Costs / Contribution Margin ratio Margin of Safety - Actual Sales - BEP Sales Degree of Operating Leverage = Sales - Variable costs or Contribution Mannin Sales-Variable Costs - Fixed Costs EBIT Degree of Financial Leverage EBIT EBIT EBIT-1 EBT 1 or Cash Conversion - Cycle Inventory conversion period + Recolvables conversion - period Payables deferral period QUESTION 3 1) Tuah Restaurant operates two branches in Klang Valley, and has the following financial structure: Accounts payable Short term debt Current liabilities Long-term debt Owner's equity RM 100,000 400,000 500,000 2,000,000 1,500,000 4,000,000 Total The restaurant is considering an expansion that would involve raising an additional RM2 million Required: a) What are the firm's debt ratio and interest-bearing debt ratio for its present capital structure? (3 Marks) b) If the firm wants to have a debt ratio of 50 percent, how much equity does the firm need to raise in order to finance the expansion? (3 Marks) ) You have developed the following pro forma income statement for your corporation. It represents the most recent year's operations, which ended yesterday Sales Variable costs Contribution margin Fixed costs Net operating income (EBIT) Interest expense Earnings before taxes Income taxes (50%) $45,750,000 (22.800.000) $22.950,000 19200,000) $13,750,000 (1.350,000) $12,400.000 (6,200,000) Net income $6.200,000 Your supervisor in the controller's office has just handed you a memorandum asking for written responses to the following questions: a) If sales increase by 25 percent, by what percentage will earnings before interest and taxes and net income increase? (2 Marks) b) If sales decrease by 25 percent, by what percentage will earnings before interest and taxes and net income decrease? (2 Marks) (Total: 10 Marks) Capital Asset Pricing Model CAPM = Cost of Equity, kok++ (m+k+)B After-tax cost of debt = kx (1 - Tax) Weighted Average Cost of Capital, WACC = W. K+W.K. (1 - Tax) where : W = V(quhy + Vel) Watt + V (V... + V) Common Stock, Gordon Growth Model; P = D. (1+9) or D. ke-g K-9 Preferred Stock: P.-D. k. Market Value of a firm = Value of Equity + Value of Debt Economic Order Quantity (2.Demand Order Cost Holding Costs) Holding Costs =E0Qx holding costs unit = Order Costs - Demand x order costs EOQ Dividend payout ratio Dividend / Earning Dividend per share, DPS Dividend / No. of shares Outstanding Earnings per Share, EPS Earnings Available to Common Stockholders No. of common shares Outstanding (EBIT-11 -TAX)-D No. of common shares Outstanding PE Ratio - Price of Share / EPS Break-even Point (BEP) in Unit - Fixed Costs / Contribution Margin per unit, or Break-even Point (BEP)in RM - Fixed Costs / Contribution Margin ratio Margin of Safety - Actual Sales - BEP Sales Degree of Operating Leverage = Sales - Variable costs or Contribution Mannin Sales-Variable Costs - Fixed Costs EBIT Degree of Financial Leverage EBIT EBIT EBIT-1 EBT 1 or Cash Conversion - Cycle Inventory conversion period + Recolvables conversion - period Payables deferral period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts