Question: Please show full working. TQ. Subject: Financial Management Formula Table is below. Please use the appropriate formula. QUESTION 2 i) Mikasa Technology is considering whether

Please show full working. TQ.

Subject: Financial Management

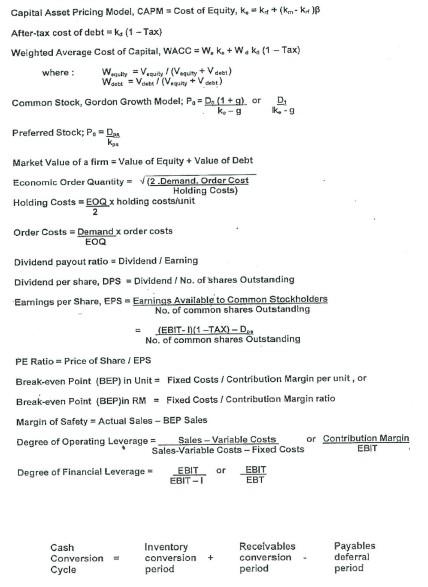

Formula Table is below. Please use the appropriate formula.

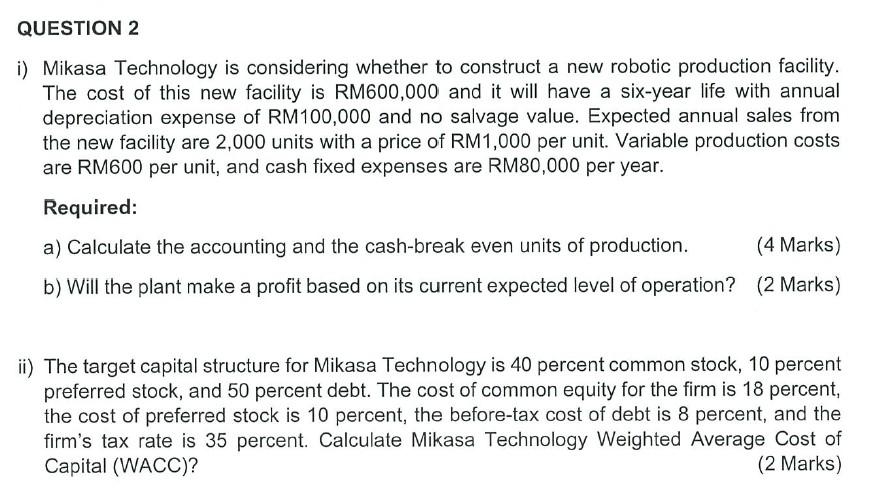

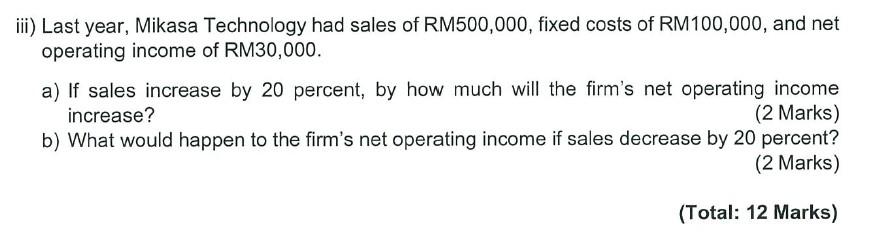

QUESTION 2 i) Mikasa Technology is considering whether to construct a new robotic production facility. The cost of this new facility is RM600,000 and it will have a six-year life with annual depreciation expense of RM100,000 and no salvage value. Expected annual sales from the new facility are 2,000 units with a price of RM1,000 per unit. Variable production costs are RM600 per unit, and cash fixed expenses are RM80,000 per year. Required: a) Calculate the accounting and the cash-break even units of production. (4 Marks) b) Will the plant make a profit based on its current expected level of operation? (2 Marks) ii) The target capital structure for Mikasa Technology is 40 percent common stock, 10 percent preferred stock, and 50 percent debt. The cost of common equity for the firm is 18 percent, the cost of preferred stock is 10 percent, the before-tax cost of debt is 8 percent, and the firm's tax rate is 35 percent. Calculate Mikasa Technology Weighted Average Cost of Capital (WACC)? (2 Marks) iii) Last year, Mikasa Technology had sales of RM500,000, fixed costs of RM100,000, and net operating income of RM30,000. a) If sales increase by 20 percent, by how much will the firm's net operating income increase? (2 Marks) b) What would happen to the firm's net operating income if sales decrease by 20 percent? (2 Marks) (Total: 12 Marks) Capital Asset Pricing Model CAPM = Cost of Equity, kok++ (m+k+)B After-tax cost of debt = kx (1 - Tax) Weighted Average Cost of Capital, WACC = W. K+W.K. (1 - Tax) where : W = V(quhy + Vel) Watt + V (V... + V) Common Stock, Gordon Growth Model; P = D. (1+9) or D. ke-g K-9 Preferred Stock: P.-D. k. Market Value of a firm = Value of Equity + Value of Debt Economic Order Quantity (2.Demand Order Cost Holding Costs) Holding Costs =E0Qx holding costs unit = Order Costs - Demand x order costs EOQ Dividend payout ratio Dividend / Earning Dividend per share, DPS Dividend / No. of shares Outstanding Earnings per Share, EPS Earnings Available to Common Stockholders No. of common shares Outstanding (EBIT-11 -TAX)-D No. of common shares Outstanding PE Ratio - Price of Share / EPS Break-even Point (BEP) in Unit - Fixed Costs / Contribution Margin per unit, or Break-even Point (BEP)in RM - Fixed Costs / Contribution Margin ratio Margin of Safety - Actual Sales - BEP Sales Degree of Operating Leverage = Sales - Variable costs or Contribution Mannin Sales-Variable Costs - Fixed Costs EBIT Degree of Financial Leverage EBIT EBIT EBIT-1 EBT 1 or Cash Conversion - Cycle Inventory conversion period + Recolvables conversion - period Payables deferral period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts